BREAKING: Lummis Pushes Game-Changing Tax Breaks for Crypto Miners in Trump’s ’Big Beautiful Bill’

Crypto miners just hit the policy jackpot—Senator Cynthia Lummis is slashing their tax burden in a move that could supercharge U.S. blockchain infrastructure. The provision, tucked into Trump’s newly unveiled 'Big Beautiful Bill,' aims to keep mining ops onshore while critics groan about another handout to 'digital gold rushers.'

Key Details:

-

Tax Cut Mechanics

: The bill proposes reclassifying mining rewards as capital gains rather than income—a 20-37% swing in favor of operators.

-

Geopolitical Play

: Comes as China’s renewed crypto crackdown leaves $4B in mining gear gathering dust.

-

Energy Angle

: No mention of addressing Bitcoin’s notorious power appetite—because who needs ESG when you’ve got lobbyists?

Wall Street’s already salivating over the arbitrage: 'Finally, a tax loophole that doesn’t require yacht-based accounting,' quipped one hedge fund manager. The bill now faces a Senate showdown—where even crypto’s critics might hold their noses for a shot at those sweet, sweet campaign donations.

Trump’s Big Beautiful Bill and Crypto Implications

It’s a tough time for crypto miners, with firms exiting the business and geopolitical disruptions bringing the global hashrate to an 8-month low.

Additionally, Senator Cynthia Lummis identified some apparent inconsistencies in these firms’ tax obligations. Aiming to fix this, Lummis is working to add some last-minute amendments to Trump’s Big Beautiful Bill:

For years, miners and stakers have been taxed TWICE. Once when they receive block rewards, and again when they sell it.

It’s time to stop this unfair tax treatment and ensure America is the world’s Bitcoin and Crypto Superpower.![]()

The Big Beautiful Bill is a controversial budget reconciliation effort that’s growing to cover a huge range of topics. It passed the House of Representatives, and the Senate is in a flurry of activity to deliver on a workable version.

Amendments and backroom deals are going back and forth around the clock, leaving Lummis an opportunity to squeeze in mining tax reform.

Congressional reporters claimed that the White House supports Lummis’ effort, especially since she’s a firm TRUMP ally.

Strictly speaking, her proposed reform seems fairly straightforward: remove one tax on US miners, either when they receive block rewards or sell them. The Big Beautiful Bill might be her best chance to pass them quickly.

However, the Big Beautiful Bill is becoming a convoluted mess. As the name suggests, it covers a huge range of topics, including tax policy, social issues, AI regulations, and more.

Prominent crypto advocates like Elon Musk staunchly oppose it, for one thing. Much like Lummis, several anti-crypto Senators are hoping to pass their own amendments at the last minute.

In other words, Senator Lummis can’t make the bill uniformly pro-crypto with a single amendment. Furthermore, even if Trump supports her effort, he has many other priorities.

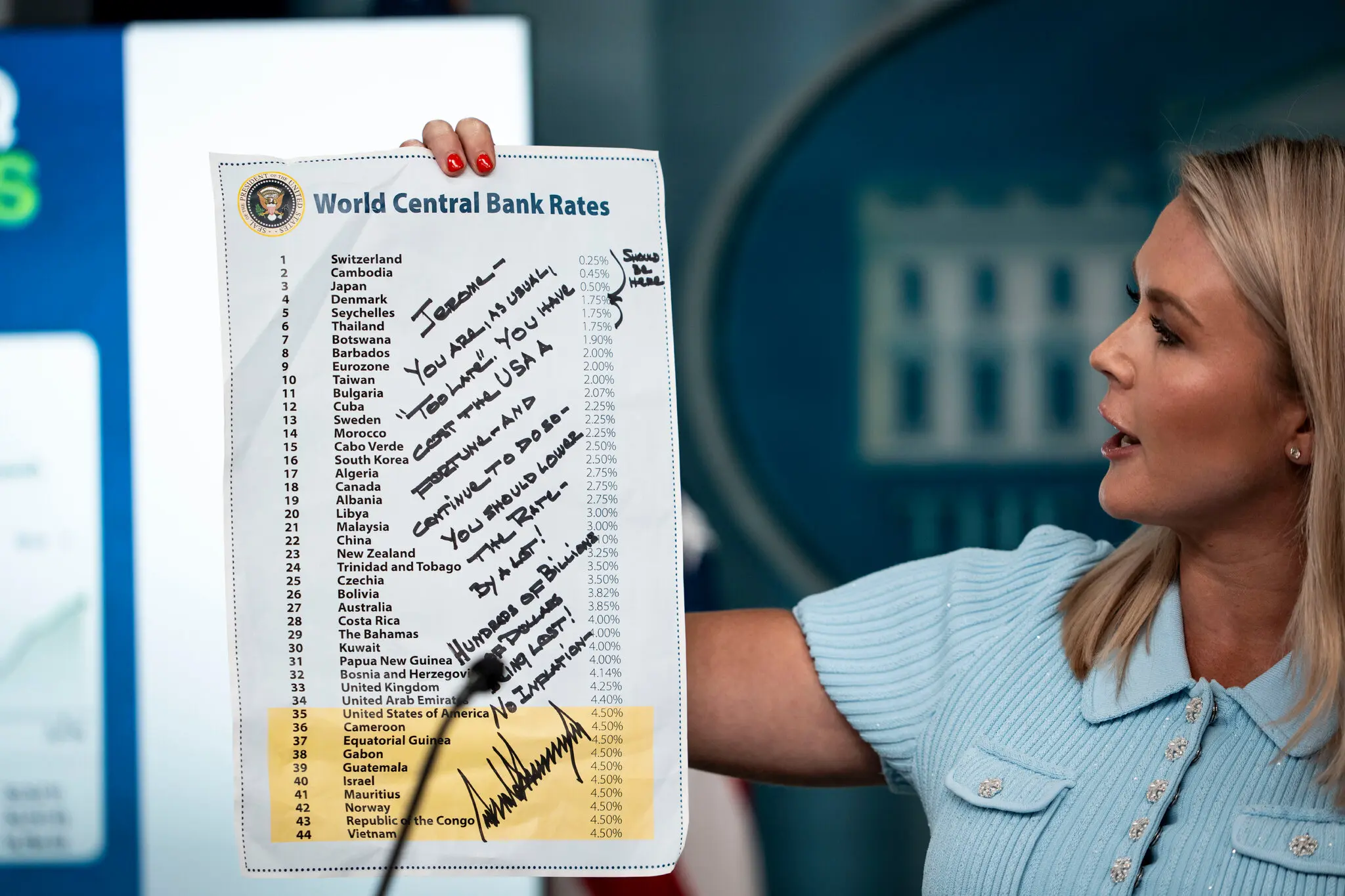

For example, WHITE House Press Secretary Karoline Leavitt discussed the Big Beautiful Bill in a press conference today, relaying Trump’s message that he is dissatisfied with Jerome Powell as Fed Chair.

This is just one of the many fights that may take the President’s attention away from mining tax reform.

All that is to say, it’s currently more or less impossible to say whether Lummis’ tax cuts will survive the negotiations. Indeed, the Big Beautiful Bill might even hurt crypto miners, depending on the successful amendments.

One proposal WOULD de-incentivize green energy, which the mining industry relies on.