Bitcoin’s Institutional Surge: Smart Money or Bubble Set to Pop? Analysts Sound Bear Market Alarms

Wall Street's latest crypto crush faces a reality check as Bitcoin's institutional adoption hits fever pitch. The smart money's piling in—but are they building a rocket or a house of cards?

Bullish or delusional? Institutional FOMO reaches critical mass

Hedge funds and corporate treasuries can't get enough of digital gold, with Bitcoin ETFs sucking up supply like a financial black hole. Yet trading desks whisper about leverage ratios that'd make 2008 blush.

The bears are circling

Veteran traders spot familiar patterns: overleveraged positions, frothy derivatives markets, and that telltale glow of irrational exuberance. 'This isn't your grandma's store of value anymore,' quips one fund manager while adjusting his gold-plated moon lambo order.

Crypto's institutional moment meets Wall Street's amnesia

As pension funds dive into BTC futures (because nothing says 'prudent investing' like 100x leverage), the smart money's making the same old mistakes—just with fancier jargon. DeFi protocols now offer 'risk-managed' yield farming, which is Wall Street-speak for 'we swear this Ponzi's different.'

One thing's certain: when the music stops, the suits will be left holding bags heavier than their bonus checks.

Bitcoin’s Institutional Boom: A Bubble in the Making?

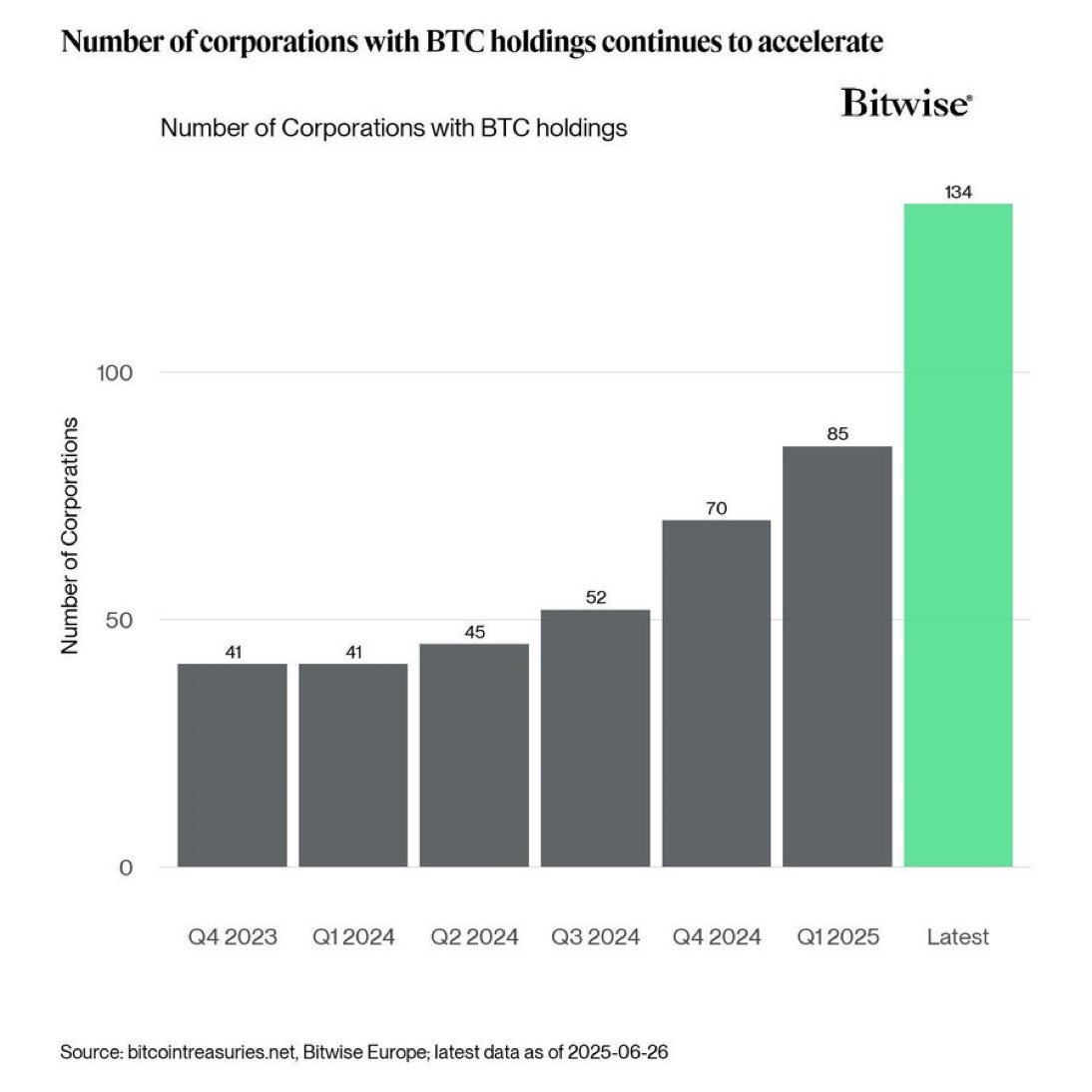

In the latest X (formerly Twitter), crypto analyst and educator Heidi flagged this trend. She cited Bitwise data to highlight a steady rise in corporate bitcoin adoption.

After remaining consistent in early 2024, the number of corporations holding Bitcoin grew gradually throughout the year. In 2025, the adoption surged, reflecting a significant uptick in institutional interest.

Towards the close of Q2 2025, the number of corporations holding Bitcoin has reached 134. This marked a 57.6% increase from Q1 2025.

This includes giants like Strategy (formerly MicroStrategy) and Metaplanet and new firms like ProCap BTC and Twenty-One Capital, which are focused on building large-scale Bitcoin treasuries.

With institutional players increasingly pouring capital into the digital asset, concerns are mounting about the potential for an unwinding of these positions when market conditions shift.

“The institutional bubble is forming? The next bear market is going to be brutal,” Heidi posted.

Furthermore, Versan Aljarrah, co-founder of Black Swan Capitalist, shared the concerns. He argued that corporations may be encouraging retail investors to buy now to serve as ‘exit liquidity.’

“They will all dump. That’s why they want people buying in now instead of BTC lows in 2022. Exit liquidity. Nothing moves in a straight line,” he wrote.

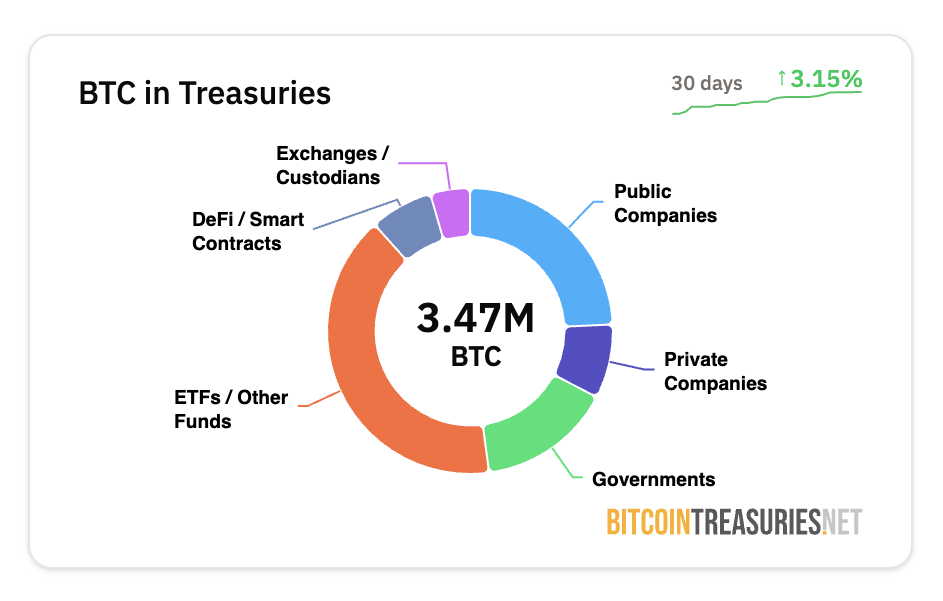

The latest data from Bitcoin Treasuries showed that institutions have a total of 1,132,913 BTC, divided between 842,035 BTC (public) and 290,878 BTC (private). This amounts to approximately 5.39% of the total supply. Strategy alone holds around 2.8% of the total BTC supply.

If these institutions were to offload their holdings, the market could face serious repercussions. Theoretically, it could increase selling pressure, negative sentiment, heightened volatility, and a prolonged bear market. This, in turn, could signal instability, causing further institutional retreat and diminishing Bitcoin’s position as a stable asset.

Sygnum had previously warned that if the market becomes oversaturated with demand and a bear market emerges, the resulting selling pressure from institutions could not only drive the price of Bitcoin lower but also worsen overall market sentiment, leading to a more significant downturn.

“Michael Saylor selling Bitcoin” would be a difficult headline for the crypto market to face,” Sygnum stated.

From Trend to Standard: Bitcoin’s Growing Influence in Institutional Finance

Nonetheless, not all perspectives align with the bubble narrative. A pseudonymous user, FiatHawk, countered that labeling this a bubble is misguided.

“How is this a bubble? More people and companies are saving in money others can’t print. Hardly a bubble when money printer keeps printing. In 5 and 10+ years far more companies and people will do the same (i.e. save in Bitcoin),” the post read.

Several experts agree with this. Joe Burnett, former director of market research at Unchained and now director of Bitcoin Strategy at Semler Scientific, told BeInCrypto that more firms will adopt Bitcoin. He added that it will become the foundational element of corporate capital structures in the next 10 years.

Meanwhile, many firms have committed to holding Bitcoin as a long-term treasury asset. In fact, Michael Saylor, co-founder of Strategy, has consistently advocated for never selling Bitcoin.

Never sell your Bitcoin.

— Michael Saylor (@saylor) February 2, 2025He even hinted that he plans to burn his BTC keys after his death. Thus, while firms remain confident in Bitcoin and more are joining the trend, the future cannot be predicted.

Whether this institutional surge leads to a bubble or solidifies Bitcoin’s role as a cornerstone of corporate capital structures will depend on market dynamics and the long-term stability of the asset.