2025 Crypto Wake-Up Call: Why Altcoin Traders Need to Dump Buy-and-Hold for Smart Trading Now

The altcoin casino is open—but the rules have changed. Forget diamond hands; 2025 belongs to algorithmic agility and mercenary trading tactics.

HODLing? That’s so 2021.

Here’s why your portfolio bleeds alpha without these shifts:

1. Liquidity Vampires Are Draining Your Gains

Market makers now front-run retail with AI that predicts your buys before you do. Static positions get picked apart like a carcass in a bear market.

2. Regulatory Roulette Just Got Faster

Three words: surprise stablecoin audits. Overnight policy shifts—courtesy of overzealous regulators—can vaporize passive positions. Adapt or get rekt.

3. The 100x Plays Are Now Microduration Trades

That ‘next Ethereum’ you’re bagging? Its entire lifecycle—pump, hype, dump—now compresses into 72 hours. Miss the exit, and you’re left holding vaporware.

The Bottom Line

Institutional sharks circle these waters with machine guns while retail clings to wooden swords. Either upgrade your arsenal… or become another ‘I believed in the tech’ sob story.

(Bonus jab: Congrats—your ‘long-term hold’ now qualifies as a tax loss harvesting strategy.)

Why Shifting From Buy-and-Hold to Disciplined Trading

Facing widespread losses among altcoin traders, Stockmoney Lizards, a well-known investor on X, shared a straightforward strategy designed for those with limited experience. Named the “Low-IQ Altcoin Strategy,” it consists of four main steps.

- Choose reputable altcoins: Focus on coins that have proven resilient over multiple market cycles, such as SOL, ADA, or ETH. These coins usually have stronger foundations and lower risk than new, smaller projects.

- Allocate capital carefully: Divide trading capital into five equal parts to spread risk across different buying points.

- Define clear entry points: Enter positions when the daily RSI drops below 30 (an oversold signal). Continue adding after each further 10% price drop from the last purchase.

- Set strict exit points: Exit the entire position once profits reach 30–50%. Avoid hesitation or waiting for even higher gains, as altcoin markets remain highly volatile and vulnerable to sudden moves by whales.

Stockmoney Lizards emphasized that this method does not promise quick wealth but aims to help traders avoid losing everything, like most altcoin investors. The recommendation includes reinvesting half of the profits into stablecoins and the other half into bitcoin for long-term accumulation.

“You won’t get rich quick. But you also won’t lose everything like 99% of altcoin traders do…This boring strategy is exactly how I survived my early trading days,” Stockmoney Lizards noted.

Michaël van de Poppe, CIO and founder of MNFund, also highlighted a common mistake: many investors rush in to buy only when prices have already soared, which raises the risk of losses.

The disciplined method suggested by Stockmoney Lizards helps lower risk and reduce the FOMO mindset described by Michaël van de Poppe.

However, maintaining discipline can be challenging, as many traders still hope for rapid and large profits.

“Not the strategy most people in crypto believe in, but need to. They want that Lambo yesterday,” another investor on X commented.

Will Altcoin Season Arrive in H2 2025?

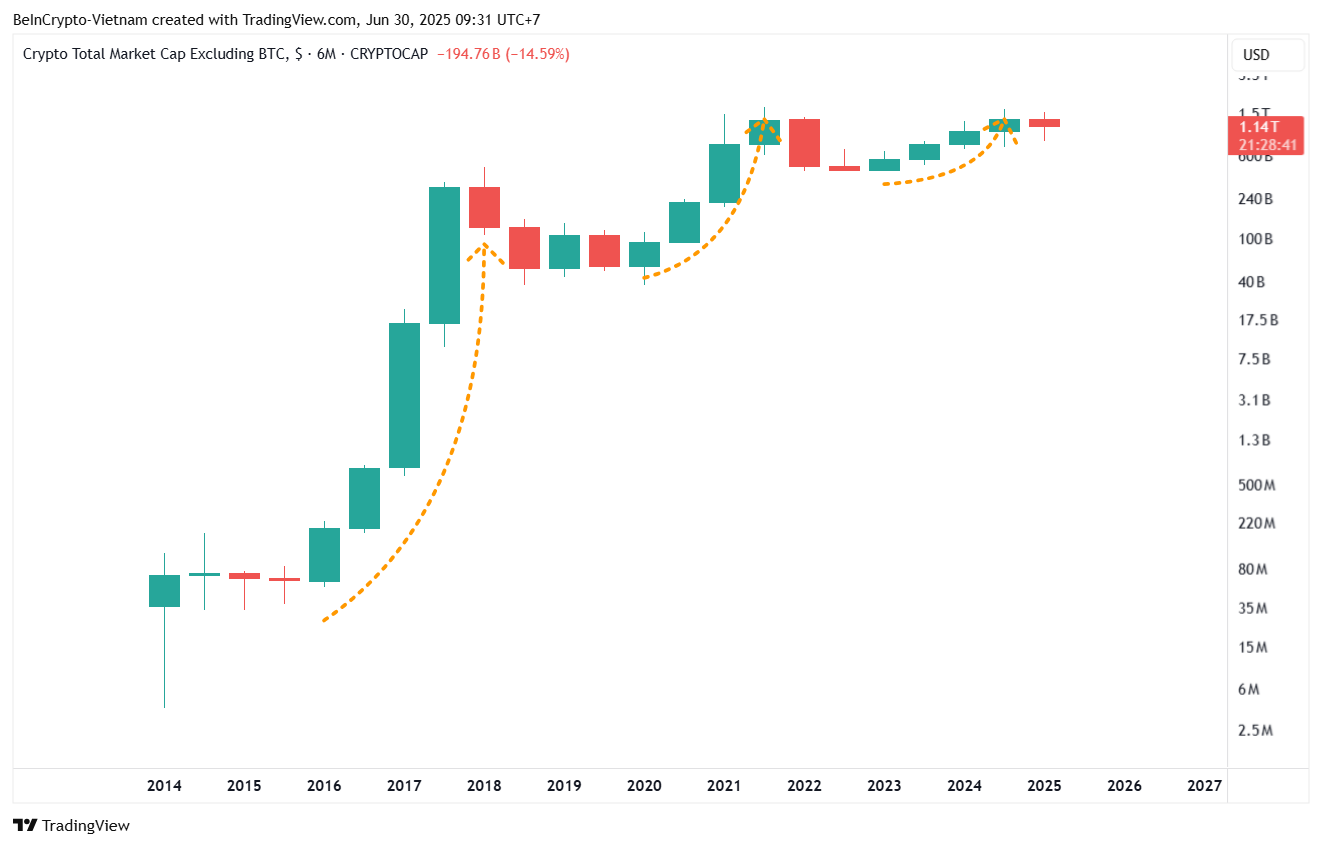

A recent BeInCrypto report identified signs that the altcoin winter may continue. Analysis of the altcoin market cap (TOTAL2) on a six-month chart shows that TOTAL2 has completed four consecutive green candles and now appears to be entering a red candle phase.

In previous cycles, four green six-month candles typically ended with two red candles, suggesting that the second half of 2025 could remain challenging for altcoins.

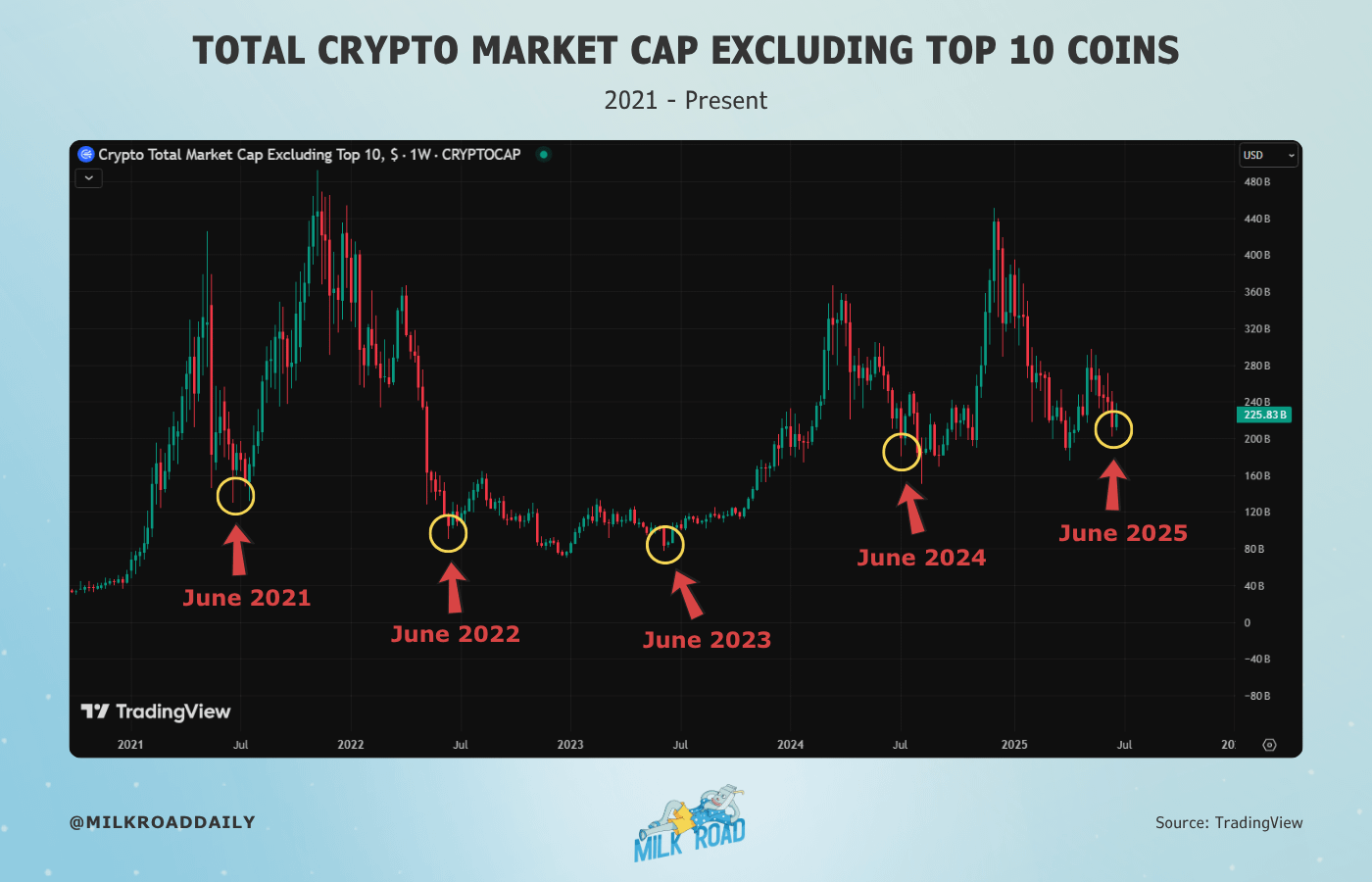

However, investor Milk Road observed a more optimistic historical pattern: the market cap bottom for altcoins excluding the top 10 often forms in June each year.

“Every June since 2021 has marked a key turning point in the altcoin market… And June 2025 could be following the same script,” Milk Road observed.

This perspective is supported by other investors who hope the altcoin market cap could reach new highs in late 2025.

Conflicting signals from different data models add uncertainty to forecasts for H2 2025. At the same time, Bitcoin Dominance (BTC.D), which typically needs to decline to signal an altcoin season, remains above 65%, its highest level since February 2021, with no signs of retreat.

Altcoin investors remain divided. Some try to adjust expectations and strategies after previous losses, while others continue to wait for significant returns to justify years of holding.