Bitcoin Whale Holdings Plummet to 6-Year Low – Is a Massive BTC Price Surge Imminent?

Whales are fleeing Bitcoin – and that might be the best news bulls have heard in years.

The big players' exodus could trigger the mother of all squeezes.

Supply shock incoming?

When whales dump, retail traders typically panic. But this time, the math works in favor of the little guy. With fewer mega-holders controlling the float, even modest demand could send prices parabolic.

Wall Street analysts are already spinning this as 'healthy distribution' – which is banker-speak for 'we missed the boat again.'

Bitcoin Whales Sell Heavily

Whale activity has been notable in recent days, with addresses holding between 1,000 BTC and 10,000 BTC, selling off significant portions of their holdings.

In the past week alone, these whales have sold over 40,000 BTC, valued at more than $4.3 billion. This selling pressure is likely a response to Bitcoin’s recent price rise, as these large holders may be uncertain about the sustainability of the rally.

This type of selling by whales can be detrimental to Bitcoin’s price, as it creates bearish pressure when such large volumes are sold at once. The impact of whale selling could prevent Bitcoin from maintaining its upward momentum.

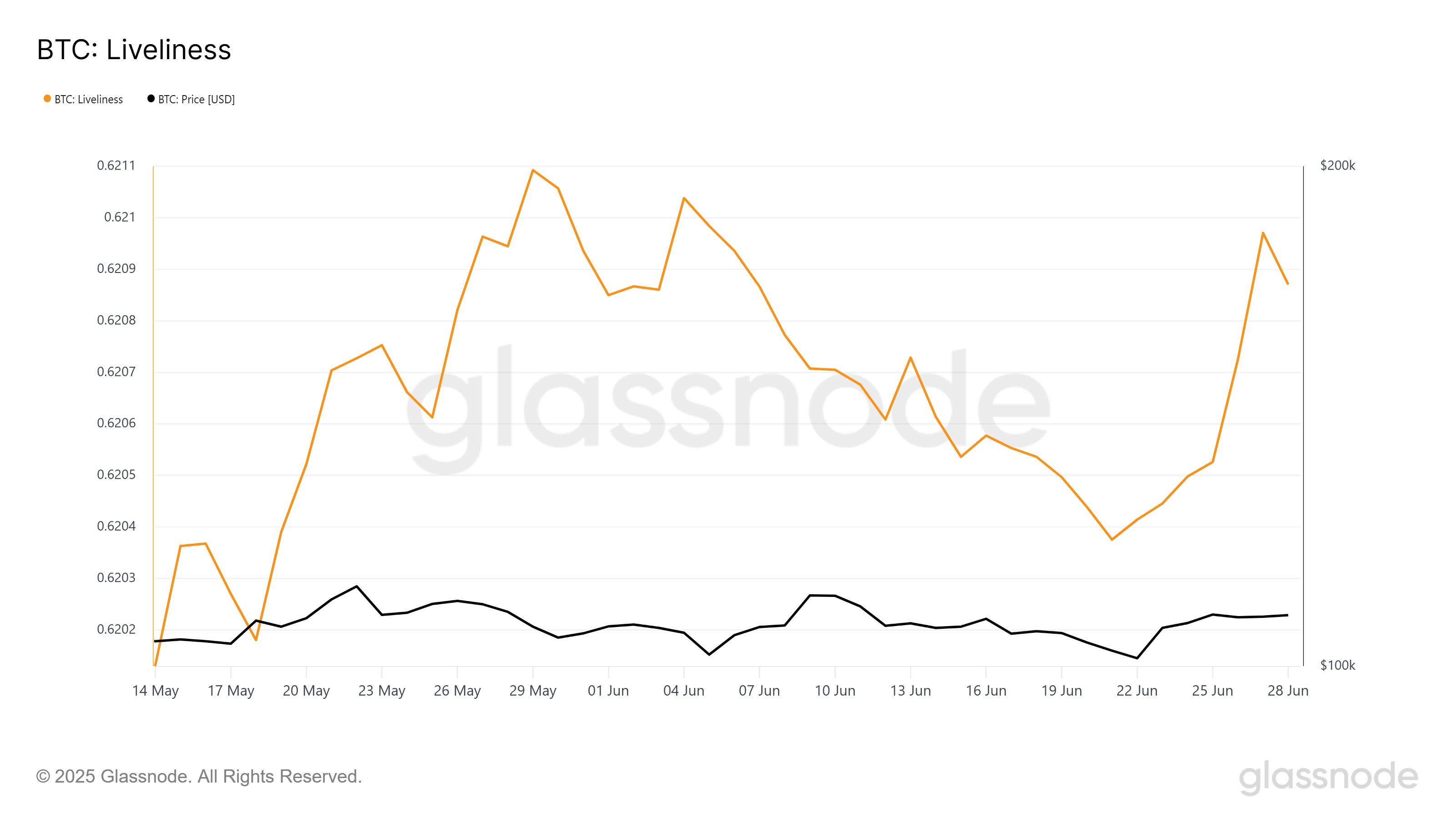

In addition to whale selling, the Liveliness metric, which tracks the frequency of bitcoin transactions, has seen a sharp uptick this week.

A rising Liveliness typically signals that long-term holders (LTHs) are moving their assets instead of holding them. This shift suggests that LTHs are opting to sell their holdings rather than accumulate, which mirrors the actions of the whales.

LTHs, with their significant influence over Bitcoin’s market, are likely to have a pronounced effect on price movements. If they continue to sell, it could lead to further volatility and potentially limit Bitcoin’s price recovery.

Can BTC Price Make It Past $110,000?

Bitcoin’s price has risen by 7% in the last 24 hours, reaching $108,145 at the time of writing. The cryptocurrency is currently attempting to establish $108,000 as a solid support level.

However, the ongoing selling by whales and the shift in LTH behavior make it susceptible to falling back below this level.

If Bitcoin fails to secure $108,000 as support, the next support level could be around $105,622, with a further decline potentially pushing the price down to $102,734.

The impact of whale selling and LTH behavior may drive this downward movement if the market sentiment turns more bearish.

On the other hand, if institutional demand continues to rise and outpaces the selling pressure from whales and LTHs, Bitcoin could break through the $109,476 resistance.

A strong push past this level WOULD pave the way for Bitcoin to reach $110,000, which would invalidate the current bearish thesis and continue the upward momentum.