Solana Smashes $150 Barrier—But Whale Dumping Threatens the Rally

Solana's bull run hits a speed bump as big players cash out.

Just as SOL breaches the $150 milestone—a psychological victory for traders—on-chain data reveals heavy profit-taking by early holders. The blockchain's speed and low fees aren't enough to stop human greed.

Whale watching turns into whale hunting

Addresses holding 1M+ SOL tokens have been quietly offloading stacks since the $140 breakout. Typical 'buy the rumor, sell the news' behavior—except this time they're selling the rumor too.

Retail FOMO meets institutional skepticism

While retail traders pile in, derivatives markets show hedge funds building short positions. Someone's betting this rally won't last—and with Fed rate decisions looming, they might be right.

Another 'decentralized' asset controlled by a handful of insiders. How revolutionary.

Solana Holders Are Selling

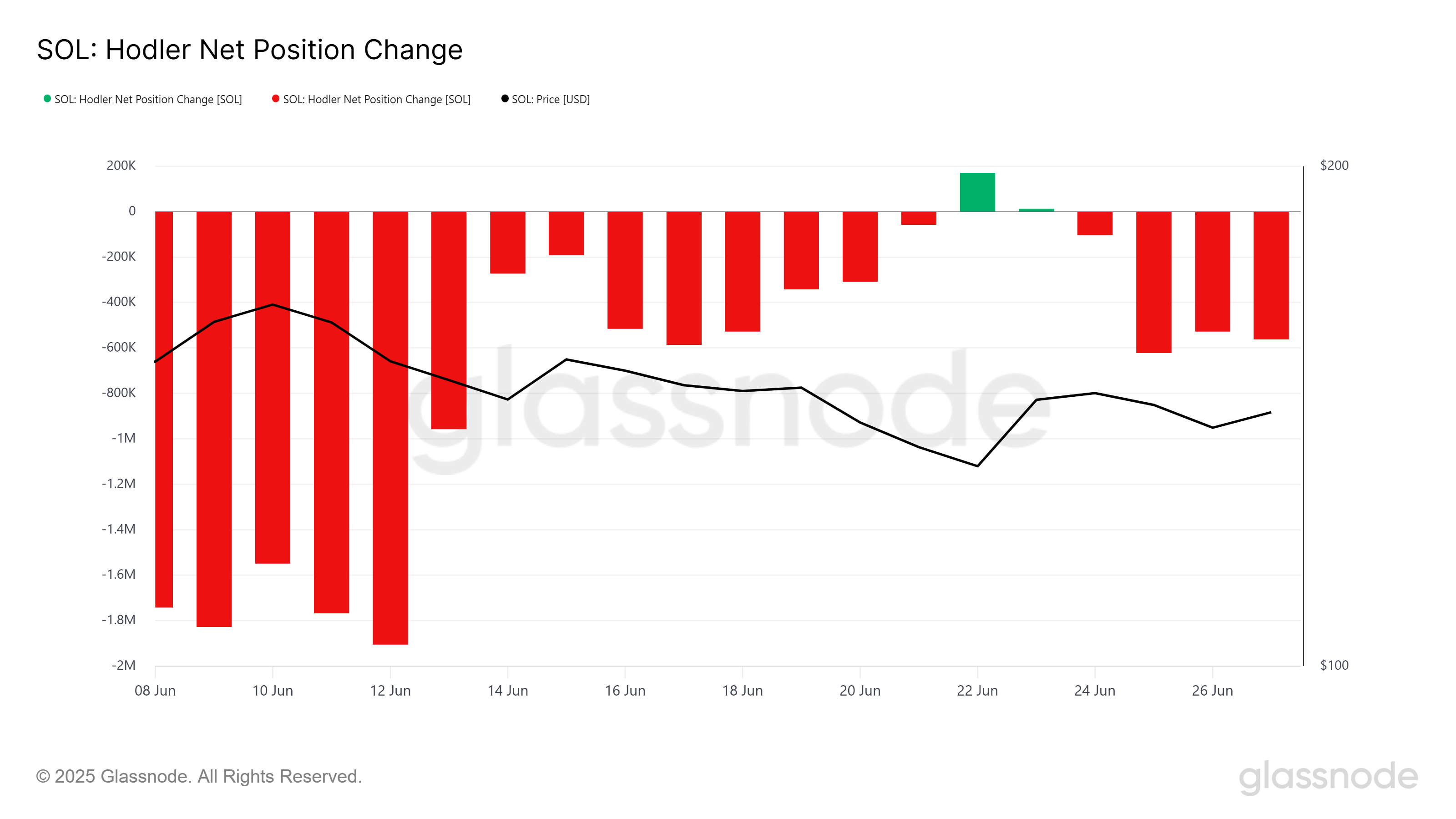

Last week, Solana’s long-term holders (LTHs) shifted from selling to accumulation, offering hope for a price recovery. Unfortunately, this shift was short-lived, as the HODLer net position change has since dropped back below the zero line.

This indicates that LTHs are back to selling, which could exert downward pressure on the price.

Given that LTHs control a large portion of the market’s supply, their selling activity significantly influences Solana’s price action.

This selling trend could lead to further declines, especially if the momentum continues in the coming days.

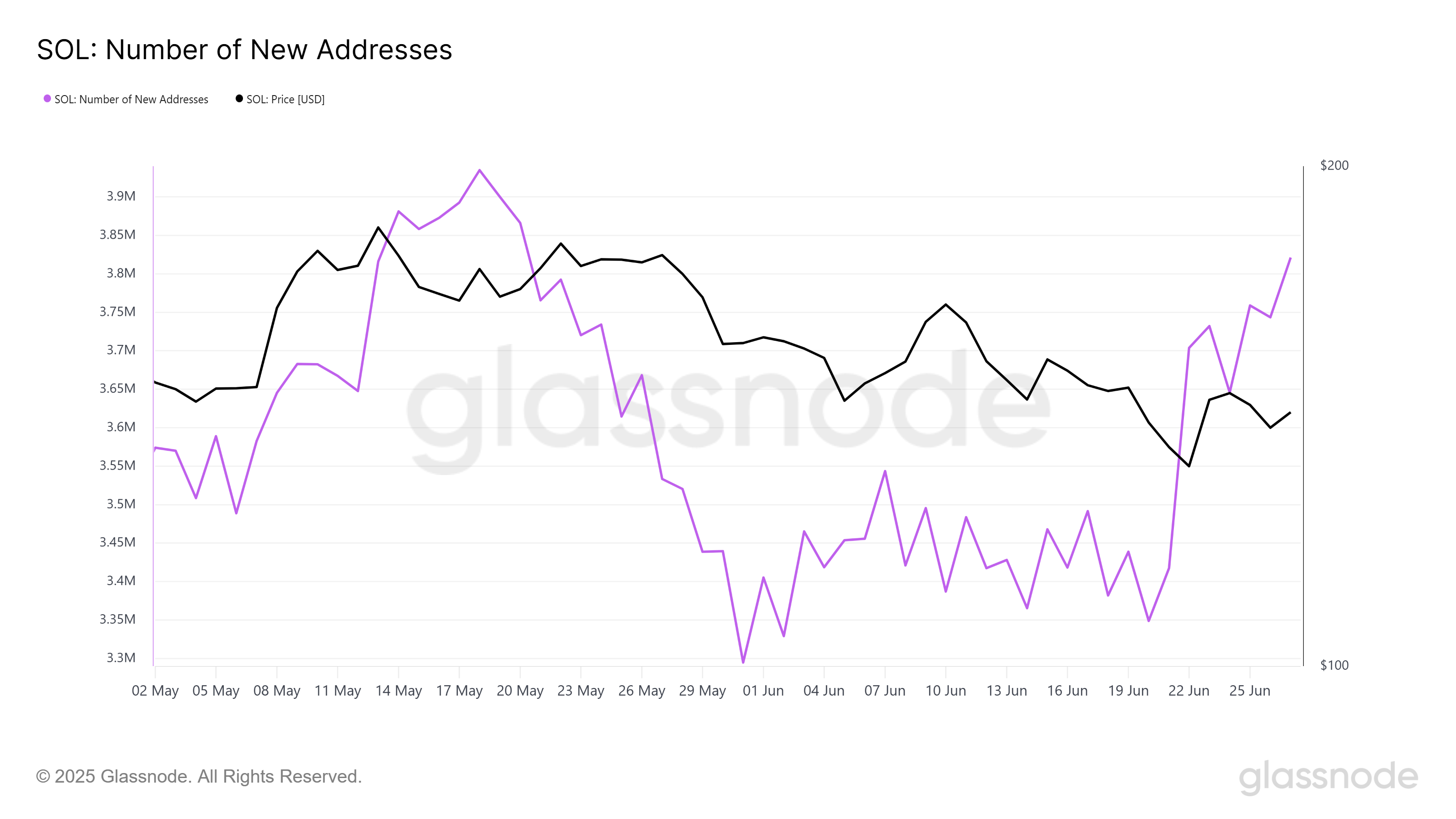

On a more positive note, solana is experiencing a sharp uptick in new addresses, signaling growing interest in the altcoin. This trend highlights that, despite volatility, new investors are optimistic about Solana’s potential.

The increase in new addresses suggests that Solana is gaining traction, particularly among those looking to capitalize on potential price gains.

The influx of new investors indicates that there is still substantial confidence in Solana’s future. This optimism could play a critical role in helping the cryptocurrency weather its recent volatility.

SOL Price May Suffer

At the time of writing, Solana is trading at $146, reflecting a 5.6% increase over the last 24 hours. The altcoin is currently facing resistance at $150, a crucial barrier for the price to surpass.

However, unless stronger bullish signals emerge, Solana may struggle to break through $150 before Q3 begins.

The altcoin could hover around the $144 mark or even dip to $136. This could result in a consolidation period as investors await clearer cues from the broader market.

On the other hand, if the broader market turns bullish, Solana’s price could surpass the $150 resistance level.

A break above this price, followed by flipping $152 into support, WOULD invalidate the bearish outlook and signal a strong upward move for the altcoin.