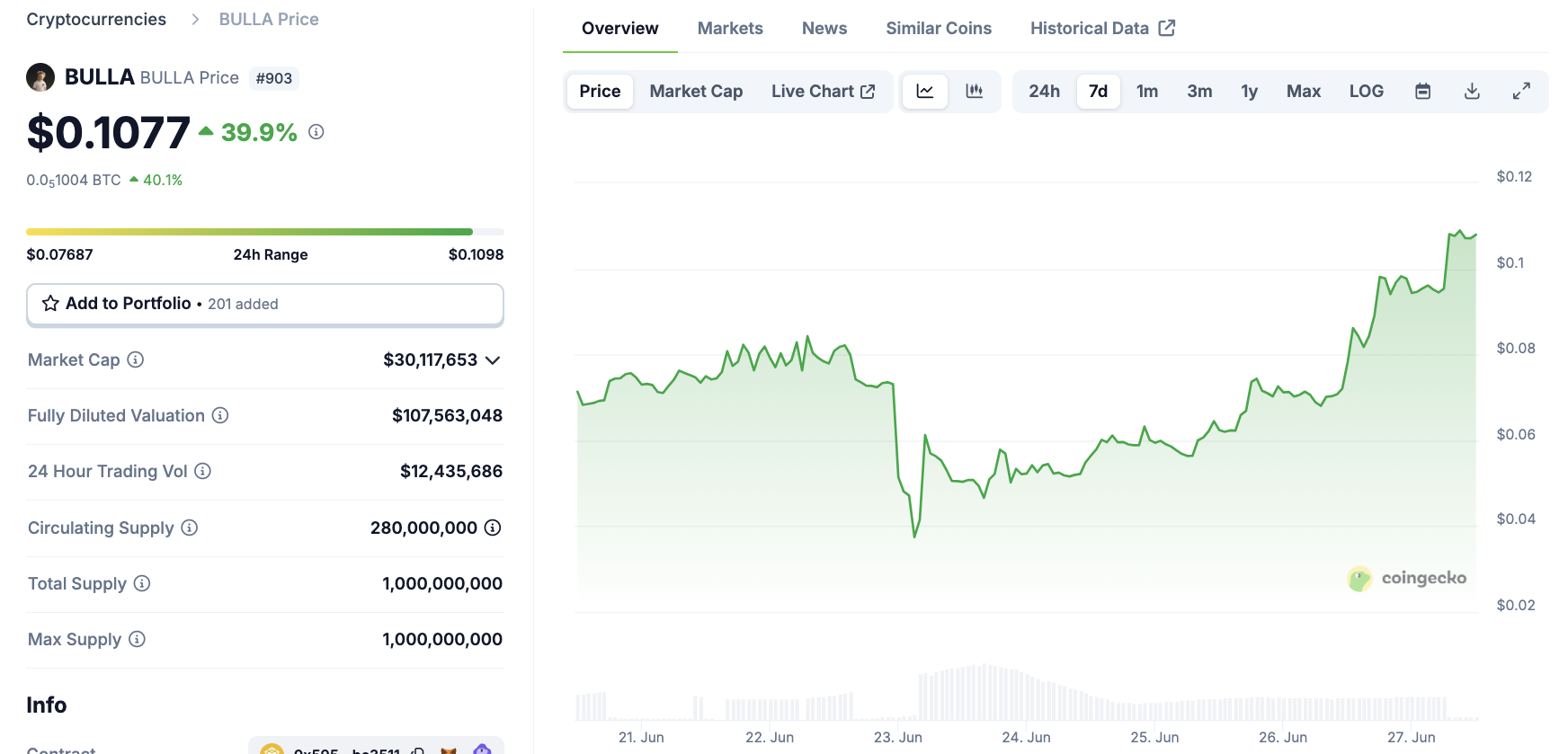

Hasbulla’s BULLA Meme Coin Skyrockets 40% in a Day—Is This Pump & Dump’s Final Act?

Another day, another meme coin defying gravity—until it doesn’t. Hasbulla’s BULLA token just ripped a 40% gain in 24 hours, leaving traders torn between FOMO and exit strategies.

The Pump Before the Plunge?

No whitepaper. No utility. Just pure viral hype fueling the rally. Sound familiar? *Cough* Dogecoin clones *cough*. Retail’s piling in—because nothing screams 'sound investment' like a token named after an internet personality.

Rug Pull Radar Blinking Red

Liquidity pools thinner than a crypto influencer’s patience. Dev wallets still loaded. History suggests this ends one way: a chart that looks like a cliff diver mid-leap. But hey, maybe 'this time is different'—said every bagholder before the drop.

Bonus jab: If you’re trading this, your risk management strategy probably involves praying to a laminated photo of Michael Saylor.

Hasbulla and BULLA Explained

Hasbulla, a Russian crypto influencer, has a long track record of launching meme coins, most of which ended in scam allegations.

Therefore, when he first began a presale for the new BULLA token, the community was very skeptical of a rug pull. Hasbulla’s BULLA token has been trading for most of the last month, yet everything remains ambiguous.

To be clear, the asset’s whole history has been punctuated by massive drops. When Hasbulla launched BULLA on June 8, it had a $100 million market cap. Five days later, $70 million evaporated.

For the most part, BULLA exhibited a constant downward trend, but a few events kept bumping it back up.

On June 22, Binance Alpha announced that it was featuring Hasbulla’s newest asset, increasing BULLA’s prominence. This included a massive airdrop, which the exchange is particularly notable for.

This immediately attracted heavy criticism, with analysts fearing a rug pull. Shortly after, the token’s price dropped 50%:

The token $BULLA (from @hasbulla_main) is down ~50% since announcing a partnership with Binance Alpha.

The whole scam narrative relies on claiming endorsement from Binance.

Then it got endorsed, and the only thing it's doing is dumping.

Guess who's selling. pic.twitter.com/KEqk6txci7

And yet, this drop doesn’t seem to fully match with the rug pull theory. Rather, if there is a scam, it hasn’t ended yet. Five days later, BULLA began trending again, causing Hasbulla himself to brag about the token’s success.

Compared to the Binance listing drop, BULLA recuperated all those losses and posted fresh gains, jumping 40% today.

So, what happened? The community remains convinced that BULLA is a scam, especially considering Hasbulla’s track record. Nonetheless, blockchain analysts haven’t clearly proven this yet.

For example, some skeptics theorized that DWF Labs may have powered BULLA’s gains, as the firm worked with Hasbulla before.

Additionally, DWF Labs has been involved in several controversies, making it an easy scapegoat. To be clear, though, there isn’t a shred of concrete evidence.

Of course, Hasbulla’s own team could’ve managed to pump BULLA without outside help. The more direct problem seems clear: no serious analyst wants to bother circulating hard evidence of a pump and dump.

Experts have been denouncing BULLA since before it launched, but Hasbulla supporters keep buying it anyway. Several analysts have advocated for letting them get scammed.

This apathy and contemptuous attitude won’t produce any advance warnings, but it may yield interesting postmortems.