Ethereum ETFs Quietly Rake In Cash While Price Stalls—Is a July Explosion Coming?

Money keeps flowing into Ethereum ETFs like clockwork—even as ETH itself flatlines. Are smart-money players quietly building positions for a summer breakout?

Steady inflows defy bearish sentiment

While retail traders yawn at Ethereum's sideways action, institutional money hasn't stopped pouring into spot ETH funds. The divergence screams one thing: big players see value at these levels.

The July catalyst no one's talking about

With SEC deadlines looming and staking yields still juicy, ETH's setup mirrors Bitcoin's pre-ETF approval consolidation. Cue the Wall Street analysts suddenly 'discovering' crypto fundamentals—right after they finish dumping their bags.

When boring is bullish

Remember: smart money accumulates in silence. The real fireworks start when everyone realizes they've been sleeping on the second-largest crypto while chasing memecoins and 'AI-blockchain fusion' vaporware.

Ethereum ETF Weekly Inflows Surge 400%

After US President TRUMP announced the Israel-Iran ceasefire on Monday, the market saw some relief from last week’s sell-off and rebounded. On that day, ETH recorded an intraday rally of 8%.

However, its price has mostly moved sideways since then, failing to break out clearly in either direction. Interestingly, amid this tepid performance, institutional investors have remained resilient.

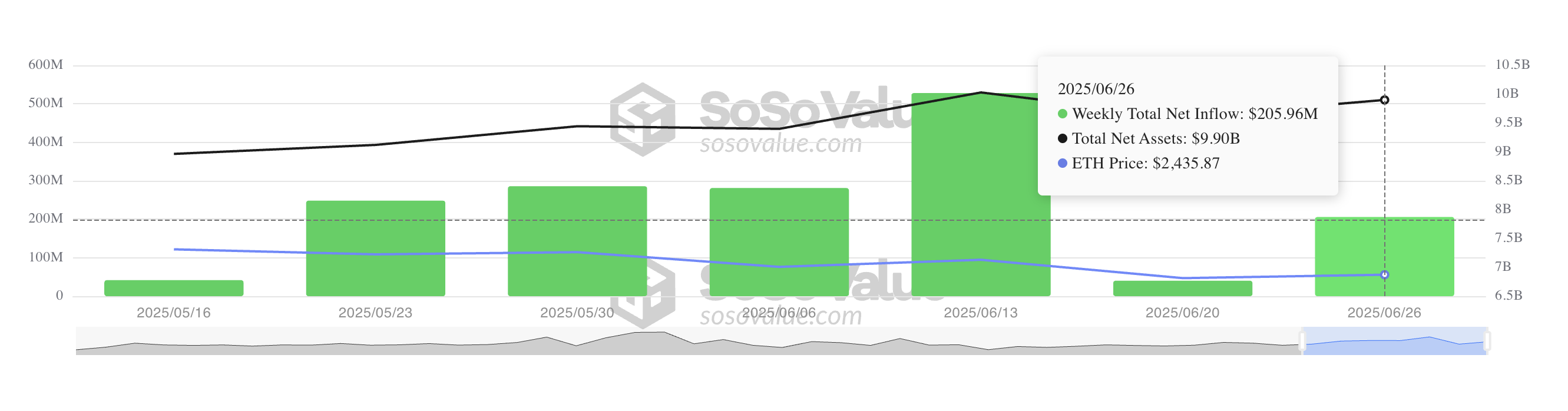

According to SosoValue, demand for ETH exchange-traded funds has surged this week. At press time, the weekly inflow into these funds stands at $206 million.

Total ethereum Spot ETF Net Inflow. Source: SosoValue

Although the latest daily figures are yet to be recorded as of this writing, cumulative net inflows for the week have already surged over 400% higher than last week’s total of $40.24 million, marking a sharp increase in institutional appetite.

This spike in ETF inflows signals that professional investors are positioning themselves for a potential upside, betting that ETH could recover strongly in July.

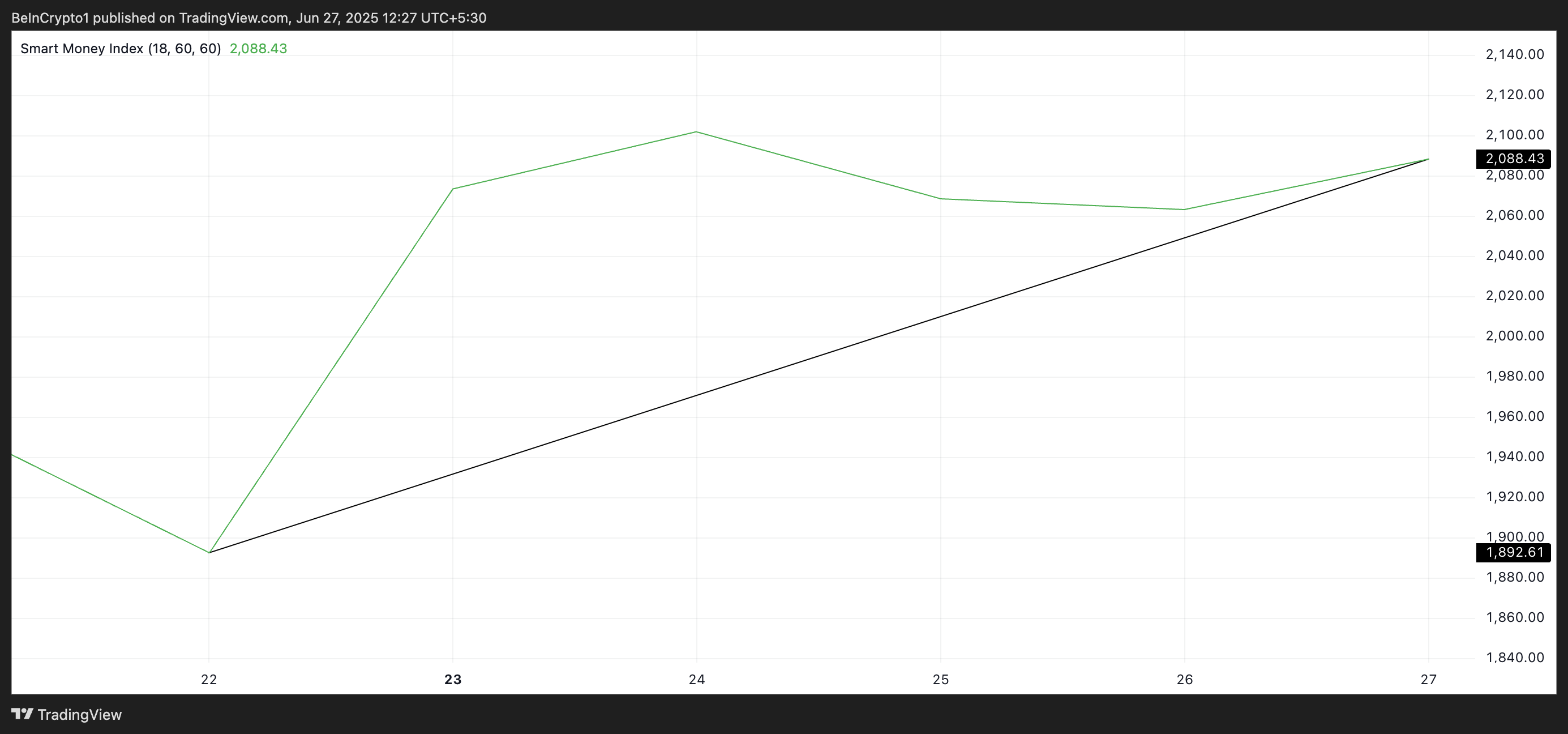

Furthermore, ETH’s Smart Money Index (SMI) has trended upwards this week, confirming the growth in bullish bias toward the leading altcoin. At press time, this indicator, which tracks the trading activity of key market participants, is at 2,088, climbing 1% since Monday.

The uptick in ETH’s SMI aligns with the surge in ETF inflows, reinforcing the growing bullish sentiment among sophisticated investors.

Ethereum’s Fate Hinges on New Demand

The combination of rising ETF inflows, smart money accumulation, and a recovering broader market could help ETH break out of its current stagnation going into July.

If the altcoin sees a resurgence in demand in the coming days, its price could climb to $2,569. A breach of this resistance could send the coin toward $2,745.

However, if demand craters and the bears regain dominance, ETH’s price could break to the downside, and fall to $2,185.