Whales Gobble 68% of Toncoin (TON) Supply as Network Activity Plummets – Is This a Red Flag?

Toncoin's whales are feasting while retail traders scramble for crumbs. With over two-thirds of TON's supply now concentrated in mega-wallets, the network's fading activity paints a worrying picture of centralization.

The whale watch: When 68% of any cryptocurrency sits in a handful of wallets, it's not decentralization – it's a VIP club with velvet ropes. The timing couldn't be worse as on-chain metrics show transactions drying up faster than a meme coin's utility.

Network decay: The protocol's fading pulse raises questions about whether TON's fundamentals can support its valuation – not that crypto markets ever cared about fundamentals before. This is the same industry where 'number go up' counts as technical analysis.

As the whales circle their digital assets, one wonders: are they preparing for a moon mission... or just waiting to dump on retail? Only time will tell if this is healthy accumulation or the calm before a storm.

Over 68% of TON Supply Held by Whales While Long-Term Holding Remains Low

According to CoinMarketCap, over 68% of the total Toncoin supply is held by whale wallets. This disproportionate distribution raises red flags, increasing the risk of price volatility caused by large-scale trades from major holders.

Additionally, only under 20% of TON holders have kept their tokens for over a year. This low long-term holding rate suggests that most investors speculate on short- to medium-term price movements rather than committing to a long-term investment.

Such instability may deter new investors, who often prefer tokens with wider distribution, a strong base of long-term holders, and less exposure to whale-driven selling pressure.

Over the past year, TON’s price has plunged by more than 65%, dropping from $8.20 to $2.84. This suggests that the majority of investors who entered within the last 12 months are now underwater.

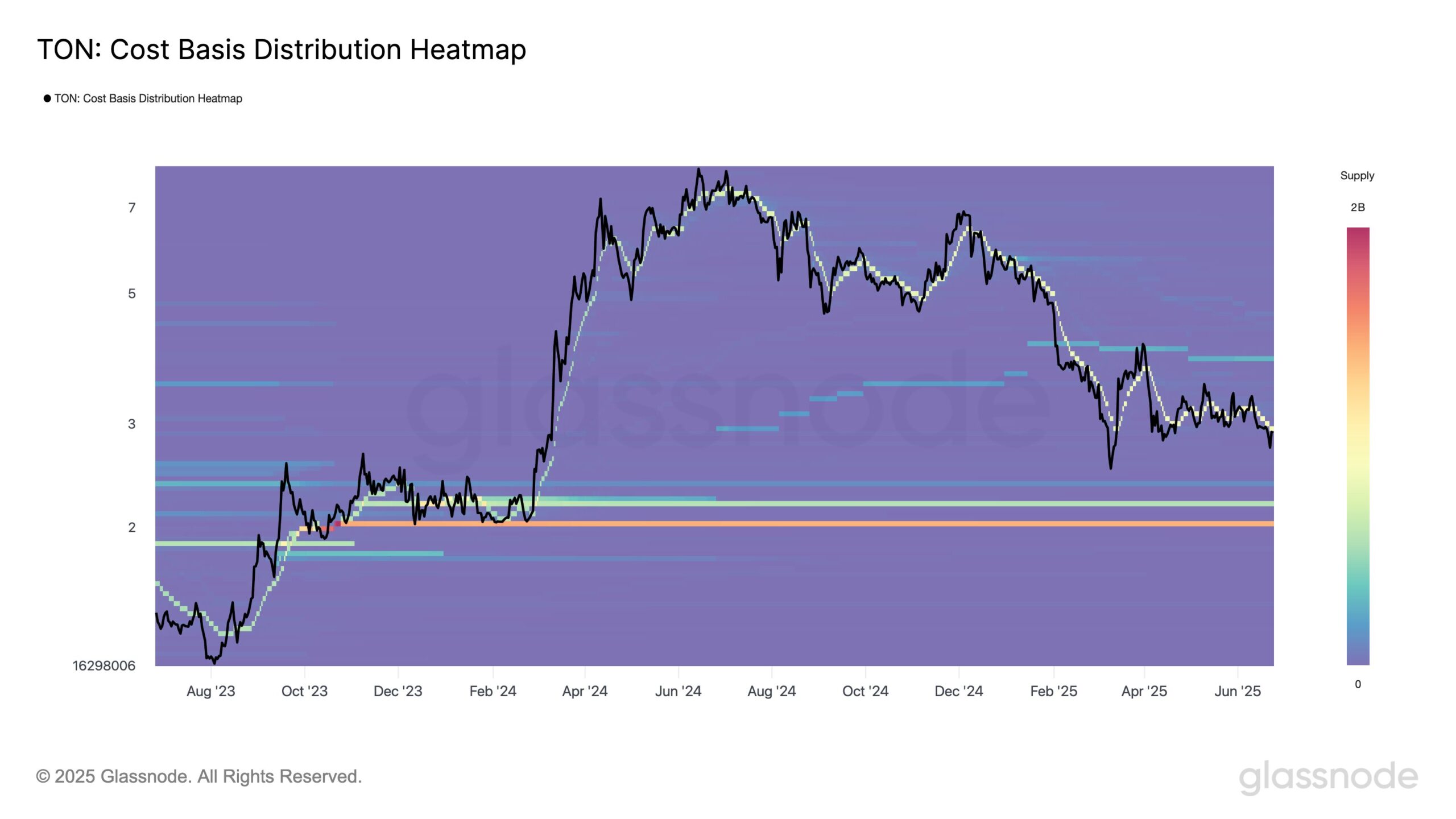

Whales May Be Accumulating Below $3, Data Suggests

Data from Glassnode’s Cost Basis Distribution indicates that most TON supply was accumulated at below $3. Combined with the whale concentration data from CoinMarketCap, this points to significant accumulation by large wallets before 2024, when TON was trading under $3.

“Cost Basis Distribution for $TON reveals four key supply clusters:

• $2.01–2.05 (1.32B TON)

• $2.18–2.22 (535M TON)

• $2.91–2.98 (863M TON)

• $3.83–3.87 (261M TON)

These levels represent zones of investor cost concentration — potential support/resistance,” Glassnode reported.

If prices fall further, even whales could face losses. Conversely, current price levels NEAR historical cost bases may provide a solid support zone for potential recovery.

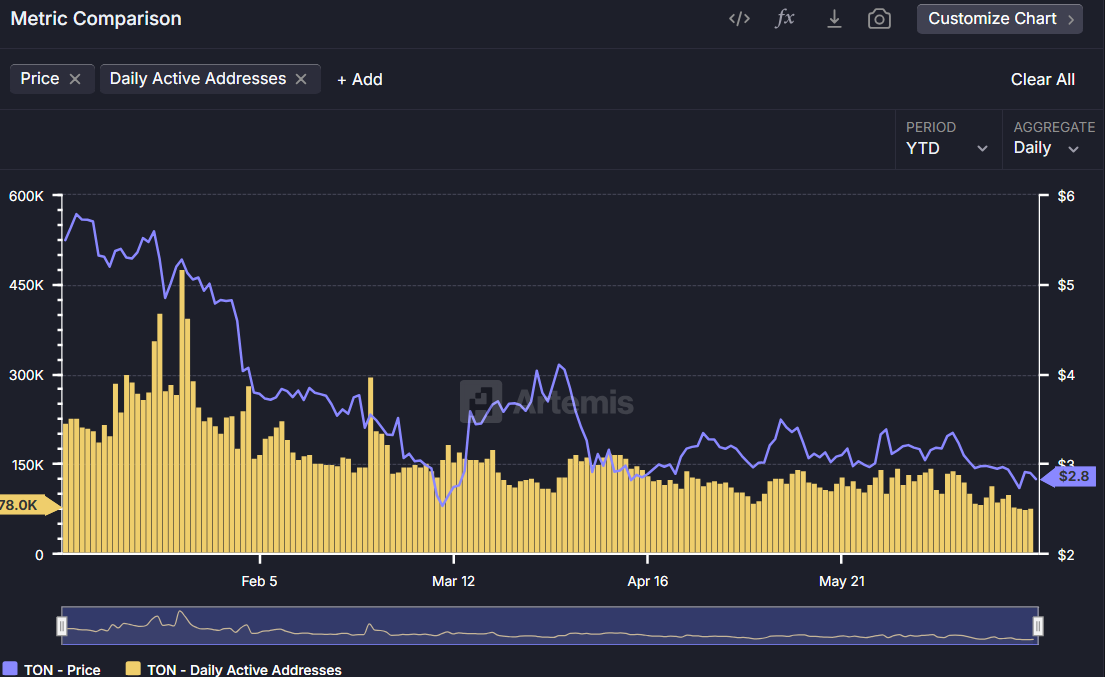

Daily Active Wallets Hit Yearly Low, but Long-Term Outlook Remains Positive

Activity on The Open Network has been quite low. As of June 25, there were only 78,000 active wallets, the lowest level recorded this year. According to Artemis, this represents a decline of over 82% from a peak of more than 450,000 active wallets at the beginning of the year.

Despite sluggish metrics following the tap-to-earn craze, some experts remain optimistic about TON’s long-term trajectory.

Tracy Jin, COO of the MEXC exchange, believes Toncoin could become the first blockchain used in daily life by 2027, driven by its DEEP integration with Telegram and focus on user experience.

“TON is betting on a completely different future — one that’s already unfolding inside Telegram. With over 900 million users globally, Telegram is the largest active social layer in crypto — and TON is the only blockchain natively embedded into it. This isn’t just about building dApps; it’s about making Web3 disappear into the UX in the best possible way.” – Jin mentioned to BeInCrypto.

New investors currently need to see a recovery in price and network activity despite the positive long-term predictions. Given the overall negative sentiment in the altcoin market, this presents a challenge for the project.