GameStop’s $450 Million Power Move—Is a Bitcoin Buying Spree Next?

GameStop just reloaded its war chest—and the market's buzzing about what comes next. With $450 million fresh off the press, the meme-stock legend could be eyeing its next big play. Bitcoin, anyone?

The Crypto Gambit

After its 2021 short-squeeze saga, GameStop's been quietly building a reputation for unconventional moves. Loading up on digital assets would fit the script—especially as institutions FOMO into BTC like it's a Black Friday sale.

Wall Street's Worst Nightmare

Imagine the chaos if a retail investor darling starts funneling millions into Satoshi's invention. Traders would short-circuit trying to price the 'meme-Bitcoin correlation.' (Spoiler: There isn't one—yet.)

One thing's certain: In a market where CFOs use shareholder money like Monopoly bills, this would at least be entertaining. Game on.

GameStop & Metaplanet Continue to Ramp Up BTC Accumulation

According to SEC filings, with this latest bond issuance, GameStop has increased the total funds raised from its mid-June 2025 offering to $2.7 billion. The zero-interest bonds, maturing in 2032, are convertible into shares at a price 32.5% higher than the average on June 12.

This could create significant opportunities for GameStop to diversify its assets, including Bitcoin. This MOVE comes as a close competitor in the BTC accumulation race, ProCap, recently claimed that they have surpassed GameStop in BTC holdings.

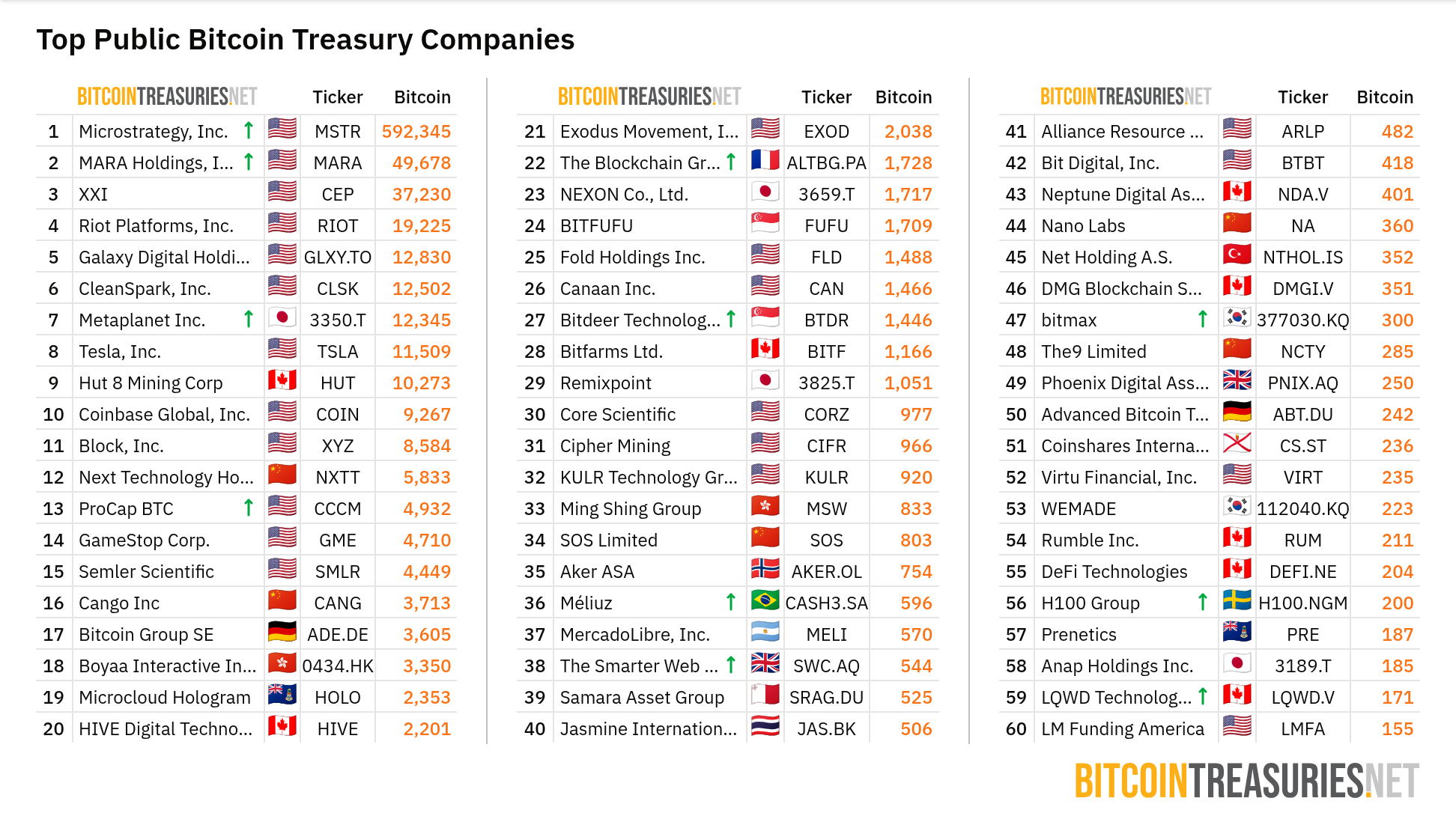

As of now, data from BitcoinTreasuries shows GameStop holding approximately 4,710 BTC, ranking 14th. Asia’s “Strategy”, Metaplanet, has the 7th position with 12,345 BTC after recently purchasing an additional 1,234 BTC at an average price of $107,557.

“Supercycle wouldn’t be a supercycle without GameStop” An X user stated.

Bitcoin as the Future of Corporate Treasuries

In addition to GameStop, Metaplanet, and ProCap, many other public companies are intensifying their efforts to acquire and hold BTC.

Mega Matrix, a US-listed company, recently announced the purchase of 12 BTC. H100 Group AB increased its holdings to 200.21 BTC. Sixty Six Capital added 18.2 BTC and plans to raise more capital to buy additional amounts. Meanwhile, Unitronix, a real-world asset (RWA) tokenization company, committed to investing $2 million in Bitcoin.

Nano Labs raised 600 BTC through a $500 million issuance. KaJ Labs invested $160 million in bitcoin to support AI infrastructure.

Strategy‘s participation has sparked a wave of Bitcoin investment among other companies. Data from BitcoinTreasuries indicates that Strategy currently holds the most BTC, 592,345 BTC, followed by MARA Holdings with 49,678 BTC. The involvement of these leading companies demonstrates that this model can enhance shareholder value.

However, price volatility risks and SEC regulations could impact their plans. With the July 2025 CPI set to be announced soon, GameStop’s and other companies’ decisions will be pivotal in shaping the future of Bitcoin in corporate treasuries.