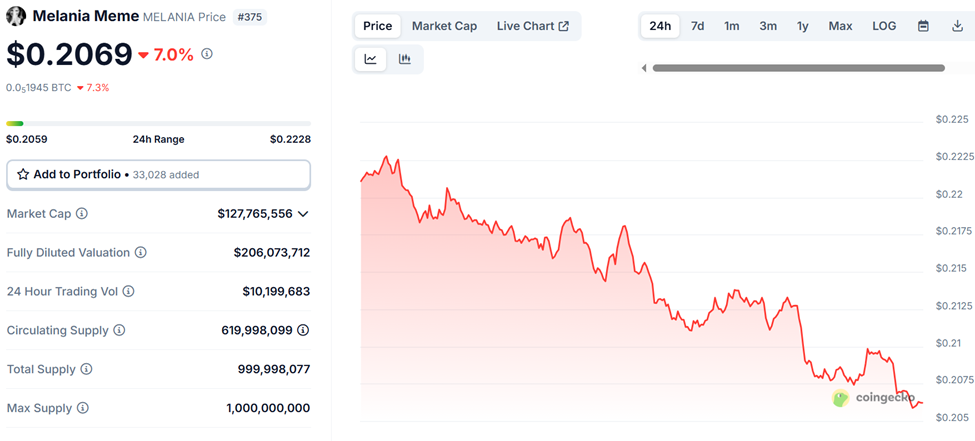

MELANIA Token Tanks 7% After Devs Dump $35M—Here’s Why It Matters

Another day, another crypto team cashing out while retail holds the bag.

The MELANIA token plunged 7% in minutes after its developers offloaded $35 million worth of tokens—because nothing says 'long-term project' like a massive sell pressure event. The move triggered predictable panic selling, proving once again that in crypto, the house always wins.

While the team claims the funds are for 'ecosystem development,' the timing—right as markets show fragility—reeks of opportunism. Traders now face the classic dilemma: buy the dip or brace for further declines as confidence erodes.

Welcome to decentralized finance, where the roadmap is made up and the tokenomics don't matter.

MELANIA Team Sold Over 8% of Total Supply in 4 Months

According to on-chain investigator Lookonchain, the tokens were distributed through 44 separate wallets. Further, the team sold these meme coins in a way designed to avoid detection by dumping directly onto exchanges.

The sales, primarily by strategically adding and removing liquidity rather than placing open market sell orders, netted the team 244,934 SOL. At current solana prices, $145.68 as of this writing, this is worth approximately $35.68 million.

The #Melania meme team sold 82.18M $MELANIA(8.22% of total supply) over the past 4 months across 44 wallets, cashing out 244,934 $SOL($35.76M).

Most of the $MELANIA tokens were sold through adding and removing liquidity.https://t.co/EJYWtbB5aE pic.twitter.com/gtmRdkNq1y

The pattern is concerning, raising questions about transparency and tokenomics, especially given the project’s lack of ongoing development.

More concerning, the MELANIA project’s documentation makes no effort to pretend otherwise. Its official terms state that the token has “no functionality,” and there are no plans to reinvest proceeds into product development, user engagement, or ecosystem growth.

This effectively positions MELANIA token as a pure meme coin play with zero utility, making its sustained market capitalization of $127 million all the more surprising.

The project announced a promising partnership with top market Maker Wintermute in early June.

MELANIA Meme (https://t.co/S2km4bxIMT) ($MELANIA) has entered into an agreement with Wintermute to provide liquidity.

Holders will notice movement of the $MELANIA tokens to new wallets.

Further, the $MELANIA team is launching a new website for $MELANIA.

Data from EmberCN revealed that 150 million MELANIA tokens, valued at around $50 million then, were moved from the community wallet to new addresses, including 20 million tokens sent to Wintermute’s wallet.

The goal was to boost liquidity, reduce price slippage, and create a more stable trading environment.

Wintermute Partnership Boosted Liquidity—But Couldn’t Stop the Slide

While the Wintermute deal did improve liquidity across platforms, it failed to halt the downward momentum. Over the past 60 days, MELANIA has fallen by 59%, despite occasional recovery attempts.

At the time of writing, CoinGecko lists the token at $0.2069, down 7% in the last 24 hours and at an all-time low since its January 19 debut.

Community skepticism has grown in parallel with the token sales. Many traders, initially drawn in by the high-profile branding and viral marketing strategy, are now questioning the long-term viability of a project whose team is aggressively liquidating holdings while contributing little to no technical innovation.

“The Trump token wrecked the entire crypto market when it was on an upward swing. Almost everything was diverted to Trump token, and then the insiders cashed out bigly. Then came the Melania token to put icing on the cake,” one user remarked.

Still, the project remains one of the more visible PolitiFi meme coins. Some analysts argue that its ability to attract major liquidity partners like Wintermute suggests existing institutional interest in the meme coin sector, at least from a market-making standpoint.

BeInCrypto also reported concerns around market makers, amid controversy over whether they are acting as stabilizing forces or exploiting their position for massive profits at the expense of retail investors.

However, without a roadmap or utility, MELANIA’s recent cash-outs may be a sign of top-heavy token control rather than ecosystem maturity. Unless there’s a shift in project direction or community governance, the token’s future may depend more on sentiment cycles than substance.