Polymarket Soars to $200M Valuation – Crypto’s Latest Unicorn Charges Into 2025

Prediction markets just got a nine-zero adrenaline shot. Polymarket's monster funding round catapults it into the rarified air of crypto unicorns—proving even in 2025, speculative capital finds its playground.

The Bet Pays Off

While traditional VCs nurse their NFT hangovers, this decentralized betting platform turned a niche idea into a valuation that'd make a Wall Street quant blink. $200 million buys a lot of credibility in a sector where 'trustless' is a feature, not a bug.

Market Makers Take Notice

The raise didn't just validate Polymarket—it threw gasoline on the prediction market arms race. Suddenly every crypto exchange is scrambling to offer 'event derivatives' while regulators sharpen their pencils.

Memo to finance bros: Your Bloomberg terminal can't price geopolitical chaos like a properly incentivized hive mind. Game on.

Polymarket Nears $200 Million Raise, Eyes Unicorn Status

According to Reuters, Polymarket is preparing to finalize a $200 million fundraising round led by billionaire Peter Thiel’s Founders Fund.

Data from Cryptorank shows that Polymarket raised $74 million between 2020 and 2024. Notable investors, including ethereum co-founder Vitalik Buterin, have backed the platform’s future.

Founders Fund led a $45 million Series B round in May last year. The current round signals the fund’s continued commitment and long-term belief in Polymarket.

The new capital is expected to help Polymarket expand its infrastructure, enhance product development, and address legal challenges, especially in the US, where the platform is currently banned due to gambling regulations.

Additionally, a key highlight of Polymarket’s growth strategy is its partnership with Elon Musk’s social media platform X, announced on June 6, 2025.

This agreement makes Polymarket the official prediction market partner of X. The integration combines Polymarket’s forecast data with real-time analysis from Grok AI and posts on X to provide users with deeper insights.

The partnership strengthens Polymarket’s market position and grants it access to millions of users worldwide.

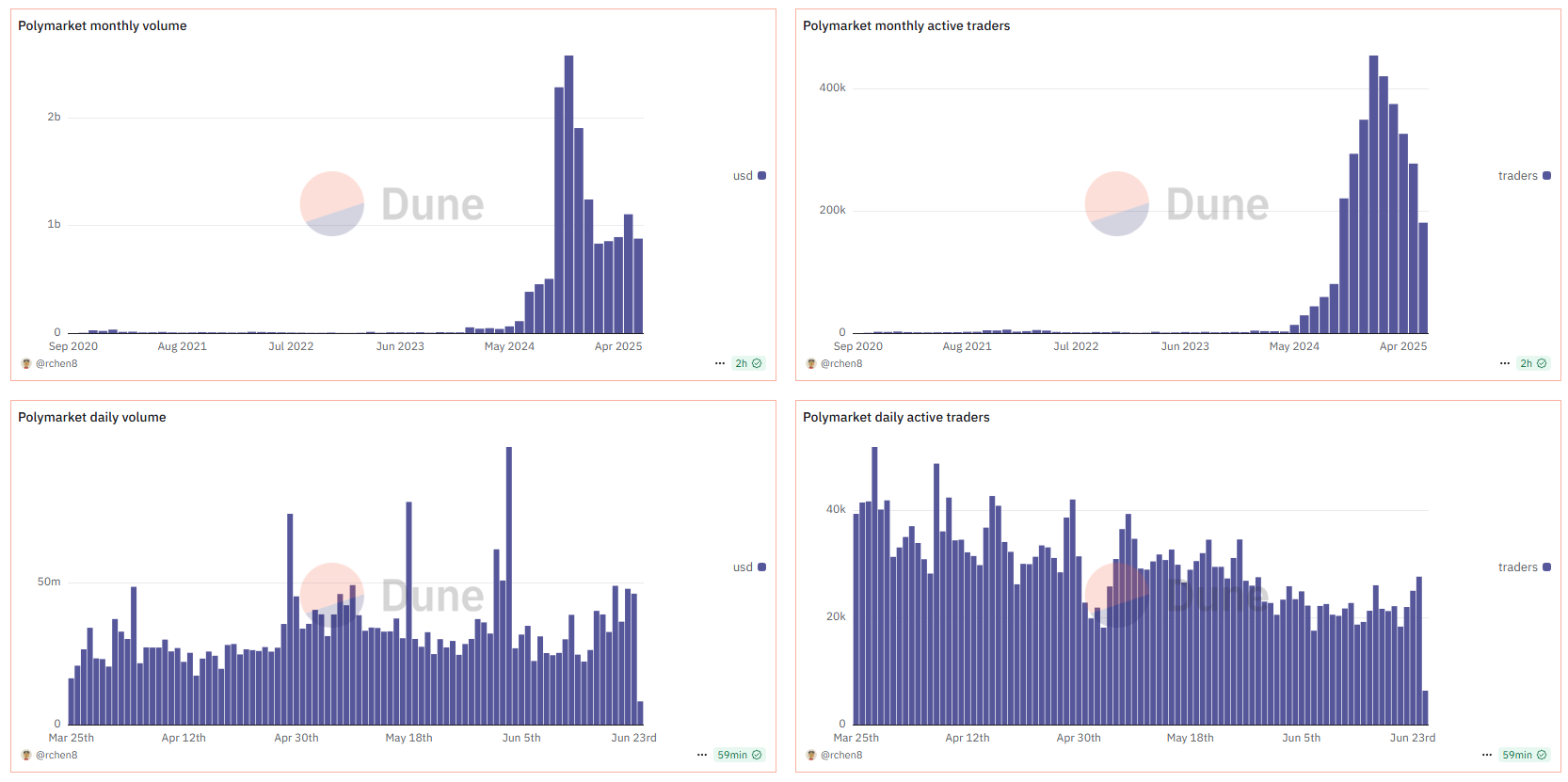

Monthly Trading Volume on Polymarket Recovers Above $1 Billion

According to Dune Analytics, May 2025 marked a strong comeback for Polymarket, with trading volume exceeding $1 billion. This follows a decline earlier in the year caused by post-election fatigue.

The platform also recorded over 100,000 new accounts each month. It maintained an average daily trading volume of $40 million, with around 20,000 active traders.

This resurgence reflects growing community confidence in the potential of decentralized prediction markets. It comes at a time when both the crypto sector and the broader world are experiencing increasingly eventful and attention-grabbing developments.

While traffic to most crypto exchanges declined, Polymarket’s traffic jumped 50%, rising from 10 million visits in March to over 15 million in May.

Despite the growth, Polymarket continues to face significant regulatory challenges. Recently, the US CFTC issued a subpoena to Coinbase seeking information related to Polymarket. It is to be noted that Polymarket has been inaccessible to US residents since 2022. This followed a $1.4 million settlement with the CFTC for operating an unregistered derivatives trading platform.

Polymarket has also faced legal trouble in France for violating gambling laws related to prediction markets. Furthermore, some people believe that large investors can manipulate market prices, raising questions about the platform’s neutrality.