Chainlink & Mastercard Just Opened the Floodgates: Billions Can Now Tap Into DEXs With a Swipe

Finance's old guard meets crypto's wild west—and your grandma might just become a degen trader.

The Plastic Key to DeFi's Kingdom

Mastercard's 2.8 billion cardholders worldwide can now bypass centralized exchanges entirely. Chainlink's CCIP tech stitches traditional finance rails directly into decentralized liquidity pools—no KYC, no custody, just pure on-chain swaps.

Banks HATE This One Trick

The partnership effectively turns every payment card into a stealth crypto gateway. Watch as legacy institutions suddenly discover 'the beauty of open networks'—right as their interchange fees evaporate into smart contracts.

A Cynic's Footnote

Of course Mastercard embraced Web3. Nothing unclogs innovation like the scent of 1.5% settlement fees on every cross-chain swap.

Chainlink and Mastercard Combine Forces

Chainlink, a decentralized blockchain oracle network, has recently integrated with several payment services to broaden market access to crypto.

By partnering with Mastercard, chainlink will be able to turbocharge this overarching strategy. Essentially, this will combine an industry standard for interoperability with billions of potential users:

We’re excited to announce that Chainlink and @Mastercard have partnered to enable billions of cardholders to purchase crypto directly onchain.https://t.co/1pKz03jQ7t

Chainlink verifies and synchronizes key… pic.twitter.com/5jfLAAYn4D

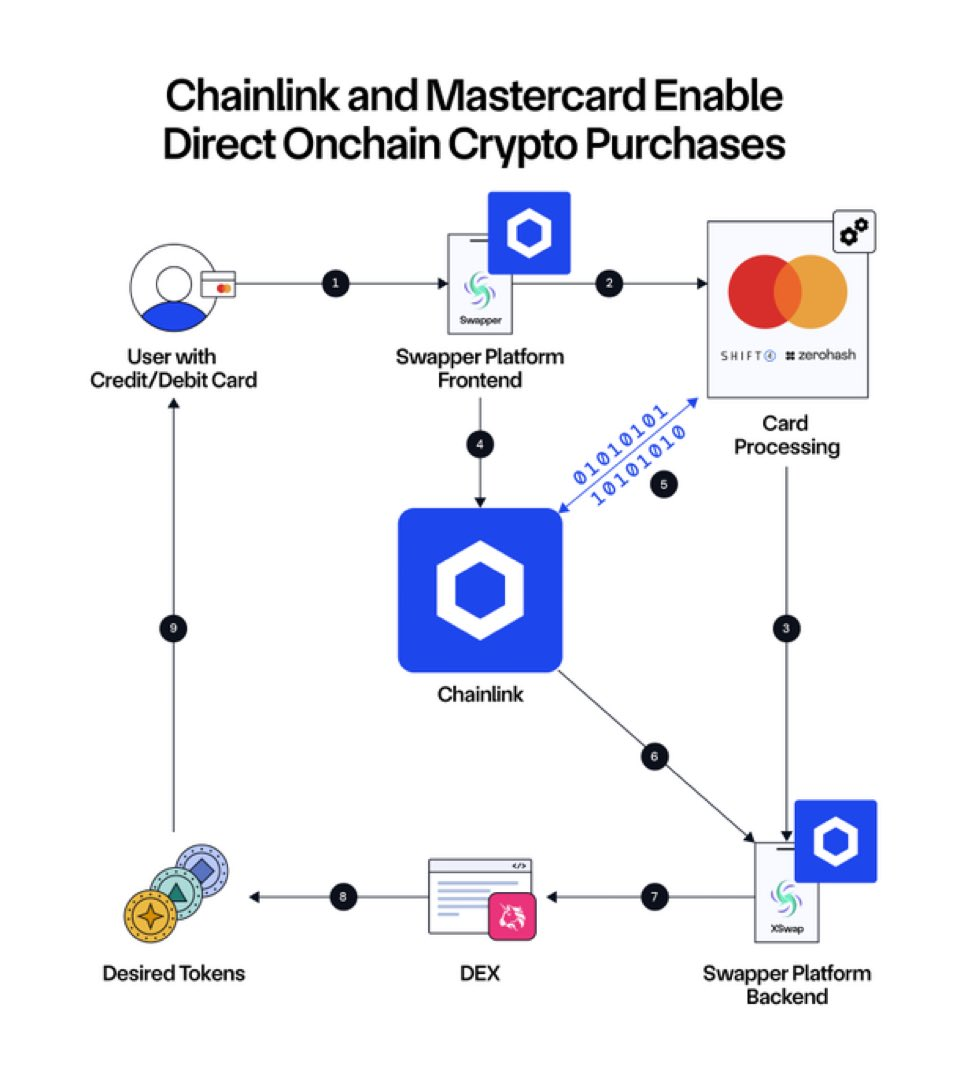

To be clear, these companies are formidable, but Chainlink and Mastercard can’t build this kind of infrastructure on their own.

The two firms have partnered with several ancillary companies, like Swapper Finance, Shift4, Zerohash, and more to provide liquidity, execute smart contracts, power the underlying platform, and perform other such functions.

As a result, these companies’ combined result is quite formidable. As Chris Barrett, Chainlink’s Head of Communications, put it, Mastercard clients will be able to integrate with major decentralized exchanges.

Uniswap is already participating in the program. This will give Mastercard’s enormous user base access to a very broad range of available cryptoassets.

Mastercard has ventured into the crypto industry before, but this Chainlink partnership is on a whole new level. Raj Dhamodharan, the firm’s Executive Vice President of Blockchain and digital Assets, called the new infrastructure a way to “revolutionize on-chain commerce” and drive global crypto adoption.

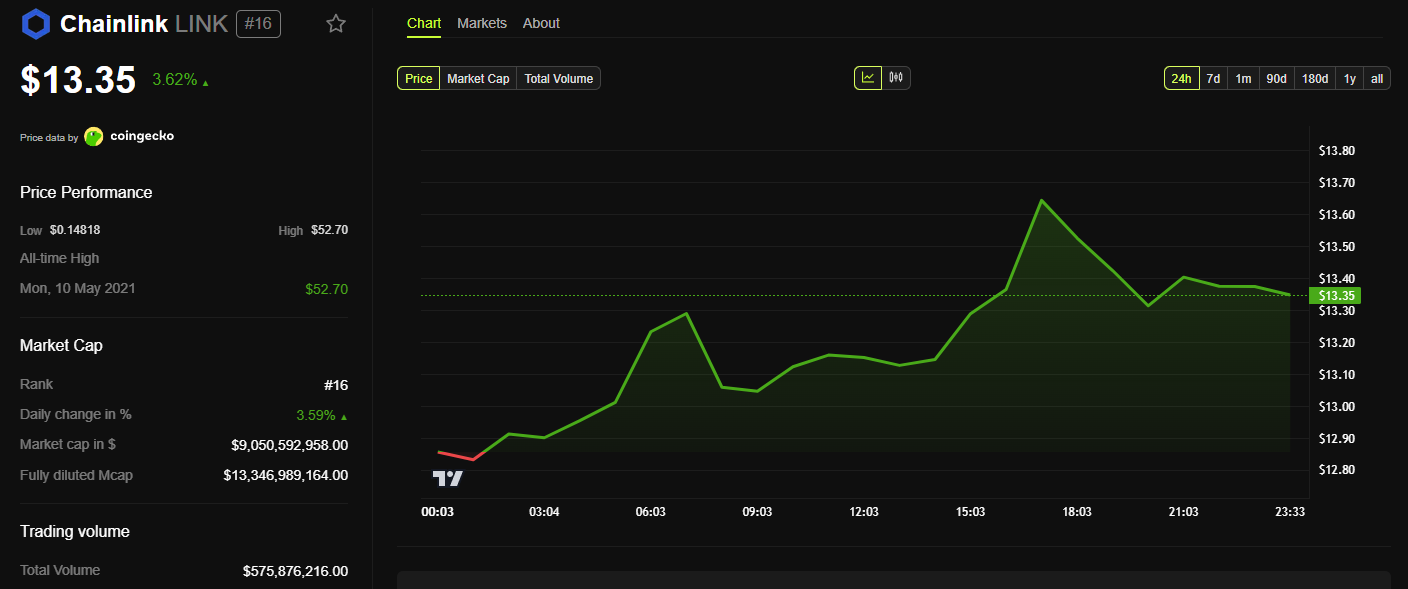

Although Chainlink’s LINK token isn’t directly involved in the Mastercard partnership, it still stands to benefit. Despite hitting a monthly low earlier this week, the token’s price has skyrocketed in the last few hours, recovering around 8% since yesterday.

The platform for this massive crypto expansion is already live, allowing users to experiment with this new infrastructure layer. Chainlink and Mastercard have their work cut out for them, setting some extremely ambitious goals.

If even a fraction of the credit card company’s users participate in the program, it could enable truly massive crypto adoption.