Crypto Whales’ Post-Ceasefire Shopping Spree: Where the Smart Money Flows After Israel-Iran Truce

Crypto's big players aren't waiting for the ink to dry—whales are already repositioning portfolios as geopolitical tensions ease. Here's where the smart money's rushing in.

Bitcoin's acting like it just snorted the ceasefire news—up 8% in 24 hours with institutional inflows spiking. ETH's riding the wave too, but the real action's in altcoins.

DeFi blue chips are seeing whale-sized bids. Aave and Uniswap positions getting loaded like Wall Street's suddenly remembered what 'yield' means. Meanwhile, privacy coins are getting love from... let's call them 'geopolitically cautious' investors.

And of course there's the obligatory shitcoin pump—some Iran-linked 'Peace Token' did a 300% dead cat bounce. Because nothing says stability like gambling on a meme coin tied to Middle East diplomacy.

Pro tip: Watch for the inevitable profit-taking. These whales didn't get rich by HODLing through pullbacks—they'll dump retail bags faster than a central bank reverses QE.

Virtuals Protocol (VIRTUAL)

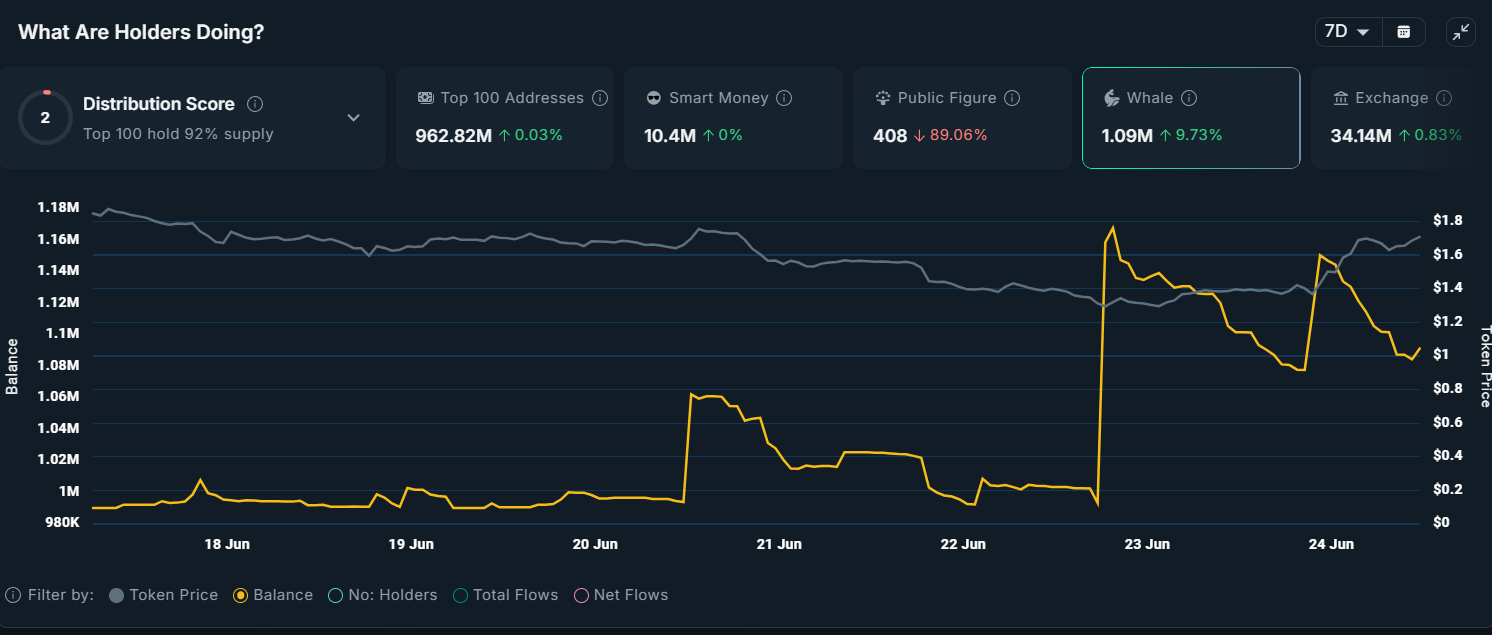

Virtuals Protocol has seen whale interest, albeit minimal, with only $25,000 worth of VIRTUAL purchased in the last 24 hours. Despite this, the altcoin also faced significant selling pressure, showing a balance between accumulation and distribution. This has resulted in mixed market sentiment surrounding the asset’s near-term price movement.

The recent selling was primarily profit-taking, as whales capitalized on the 23% rise in VIRTUAL’s price over the last 24 hours. However, the selling activity outpaced accumulation, with nearly 1 million VIRTUAL entering exchanges during this time. This suggests that many investors are looking to secure gains rather than accumulate further.

VIRTUAL remains a key altcoin to watch after a strong start in Q2, maintaining growth despite broader market downturns. If whale accumulation strengthens, it could drive VIRTUAL back above $2, signaling potential for continued upward momentum. Investor interest will largely depend on the actions of major market players.

Uniswap (UNI)

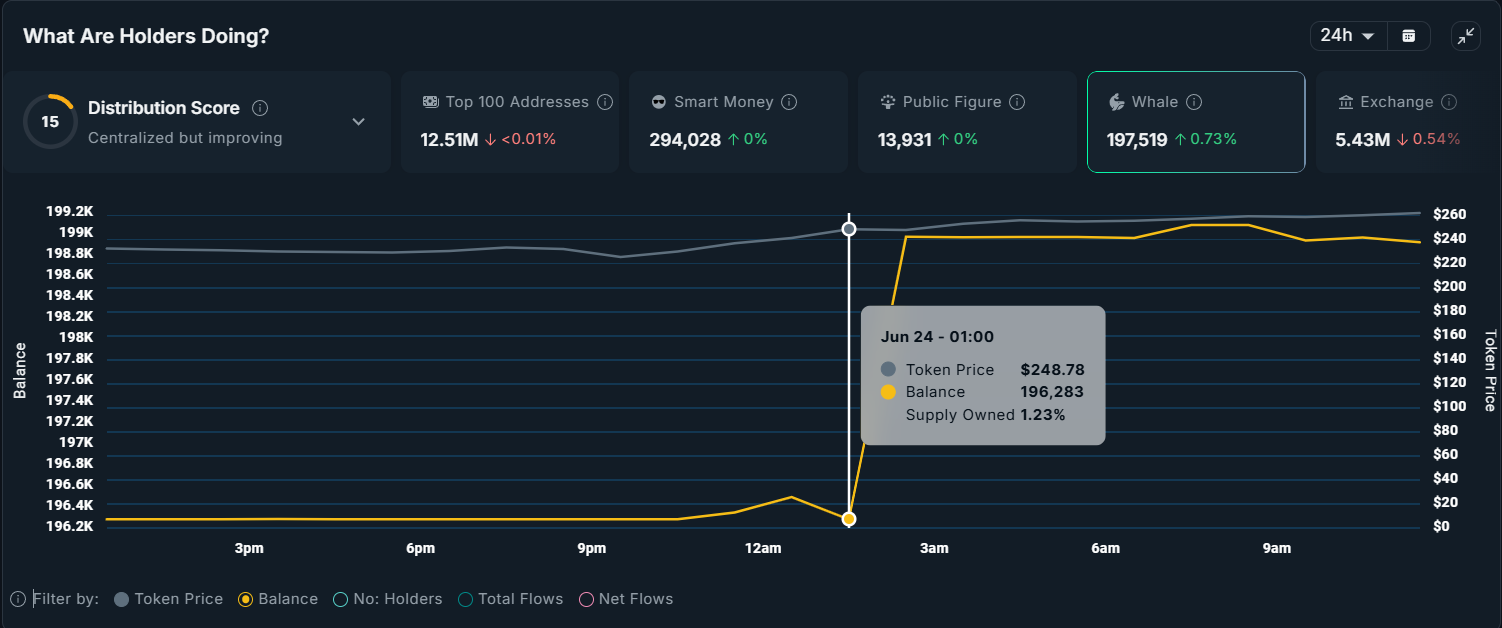

UNI whales have purchased over 200,000 UNI, worth more than $1.4 million, in just 12 hours today. This surge in whale activity follows a bullish market response to the ceasefire announcement, which seems to have reignited interest from large investors in Uniswap’s potential.

The impact of this whale accumulation is reflected in Uniswap’s price, which has increased by 9% over the last 24 hours. This price movement indicates strong demand from larger players in the market, signaling confidence in Uniswap’s future growth despite broader market uncertainties.

However, the future direction remains uncertain, as exchanges are showing no significant inflows, indicating that selling activity remains low. Whether this leads to further accumulation or profit-taking from investors will depend on how the broader market reacts in the coming days.

Aerodrome Finance (AERO)

AERO has experienced similar whale activity to UNI, with whales gradually accumulating the asset. In less than 24 hours, over 2 million AERO, worth over $1.6 million, were purchased. This accumulation signals growing interest from larger investors, setting a positive tone for AERO’s price movement.

AERO has caught the attention of investors due to its impressive 61% rise since the beginning of June. The altcoin is now nearing the $1 mark, currently 19% away from reaching this key price level. This growth indicates strong momentum, and AERO is becoming an increasingly attractive investment.

This growth is likely to continue as investors are focused on accumulating AERO rather than selling. After the 5% price increase, exchanges show more outflows than inflows, indicating that buying activity outweighs selling. This trend suggests sustained investor confidence and potential for further price increases.