SEI Skyrockets 36% in a Day—The Hidden Forces Behind This Altcoin’s Explosive Rally

SEI isn't just climbing—it's mooning. The altcoin ripped past resistance with a 36% gain in 24 hours, leaving bagholders cheering and shorts burning. Here's what's fueling the frenzy.

Exchange Listings & Ecosystem Hype

Binance's surprise SEI perpetual futures launch lit the fuse. Suddenly every degen with a futures account could ape in—and they did. Meanwhile, whispers about SEI's Cosmos-based infrastructure upgrades had devs buzzing like caffeinated coders at a hackathon.

Market Dynamics at Play

Traders piled in as SEI flipped key resistance into support. The 36% pump came on triple-average volume—real money chasing the breakout, not just Twitter hype. Shorts got liquidated faster than a Lehman Brothers vault in 2008.

Warning Lights Behind the Green Candles

Let's not pretend this is all organic growth. Half the 'fundamental catalysts' read like a VC's portfolio justification memo. But when liquidity's sloshing around crypto like champagne at a hedge fund holiday party, even mediocre projects catch bids. Trade accordingly.

SEI Rally as Net Inflows Spike

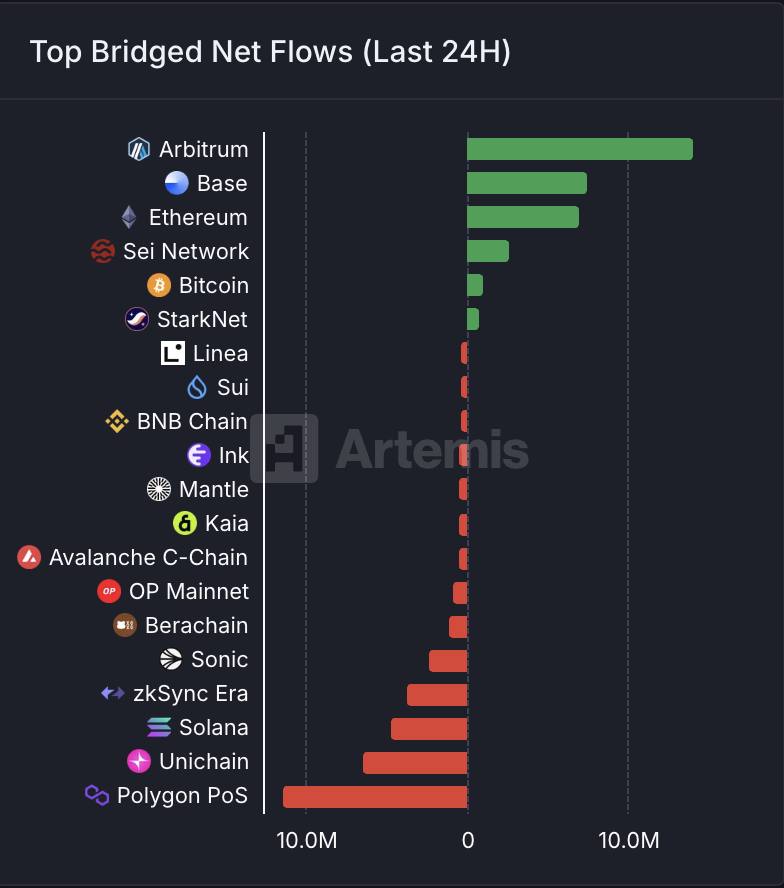

Sei Network has recorded one of the largest net inflows across all chains over the past 24 hours. It ranked fourth in bridged net flows, outperforming major networks like solana during that period.

According to Artemis, the Sei Network has seen $3 million in bridged netflows in the past 24 hours. In comparison, top network Solana has seen net outflows amounting to $5 million during the timeframe.

The spike in inflows signals growing user activity and possibly rising investor confidence in the Sei ecosystem. Per the data provider, only Arbitrum, Base, and ethereum saw higher net inflows.

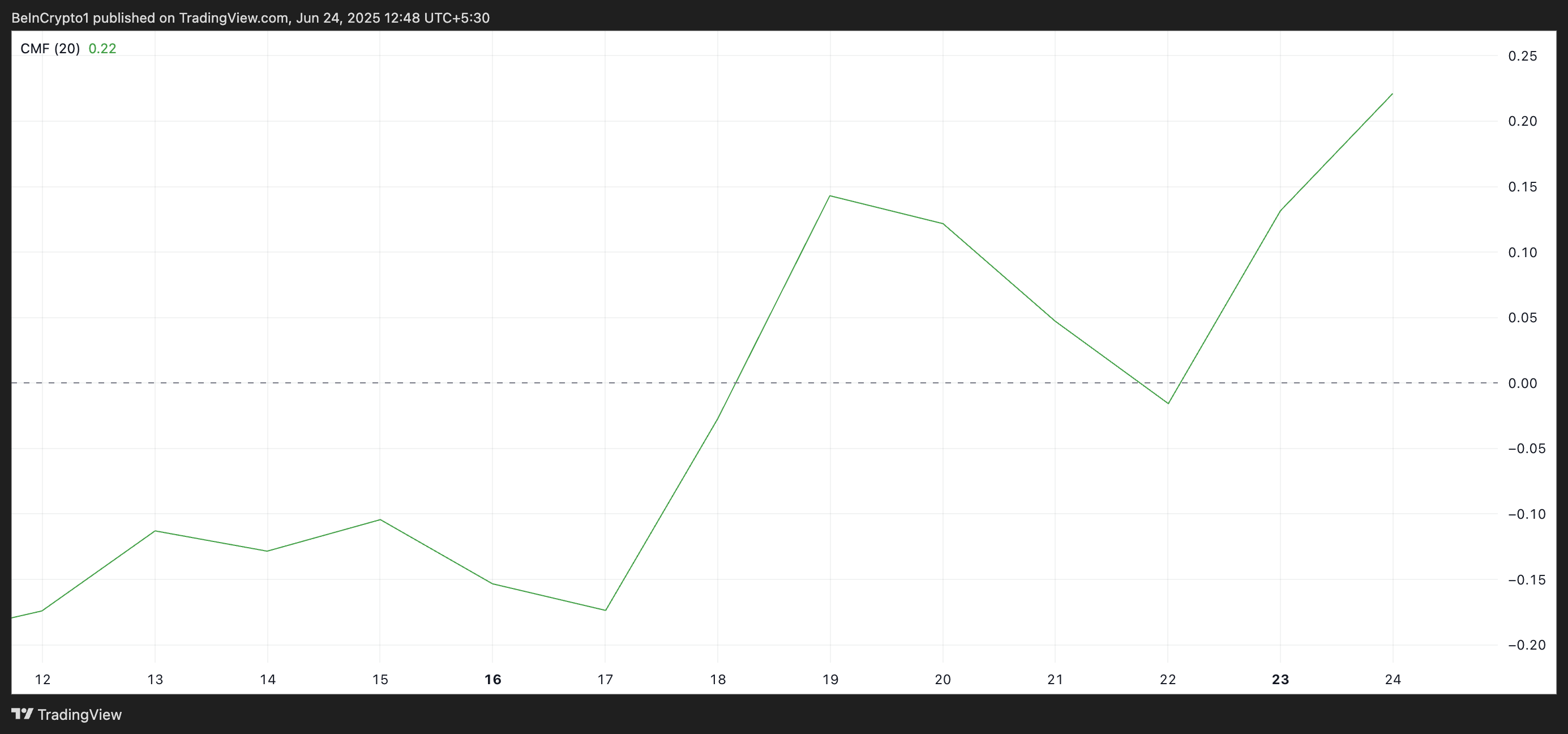

With capital flowing onto the network, the SEI coin has seen a surge in demand, reflected by its climbing Chaikin Money FLOW (CMF). As of this writing, this momentum indicator is at 0.22.

The CMF indicator measures how money flows into and out of an asset. Positive readings indicate that accumulation outweighs selling activity among coin holders. On the other hand, when an asset’s CMF is below zero, selling pressure dominates the market.

For SEI, its CMF setup reinforces the narrative that the current rally is backed by strong demand and liquidity.

SEI Defies the Market Slump

The altcoin trades at a four-month high of $0.28 at press time. In fact, amid the broader market’s lackluster performance over the past week, SEI’s price has soared by over 65%.

With inflows climbing and momentum indicators flashing green, SEI could continue to outperform in the NEAR term. If demand remains high, the coin could climb toward $0.36.

However, if demand craters and profit-taking commences, SEI coin price could break below the support floor at $0.27 and fall to $0.23.