Retail Traders Get Burned as Bitcoin Plunge Follows Trump’s Ceasefire Shock

Bitcoin bulls just got a brutal reminder: geopolitics trumps charts every time.

When retail traders piled into BTC calls, they weren't banking on a former president moving markets with 280 characters. Yet here we are—another 'buy the rumor, sell the news' circus playing out in real-time.

The irony? This exact scenario used to be Wall Street's exclusive party trick. Now even crypto degens get to experience the thrill of being last to exit a crowded trade. How... democratic.

What Are Retail Investors Doing Amid Political Conflicts?

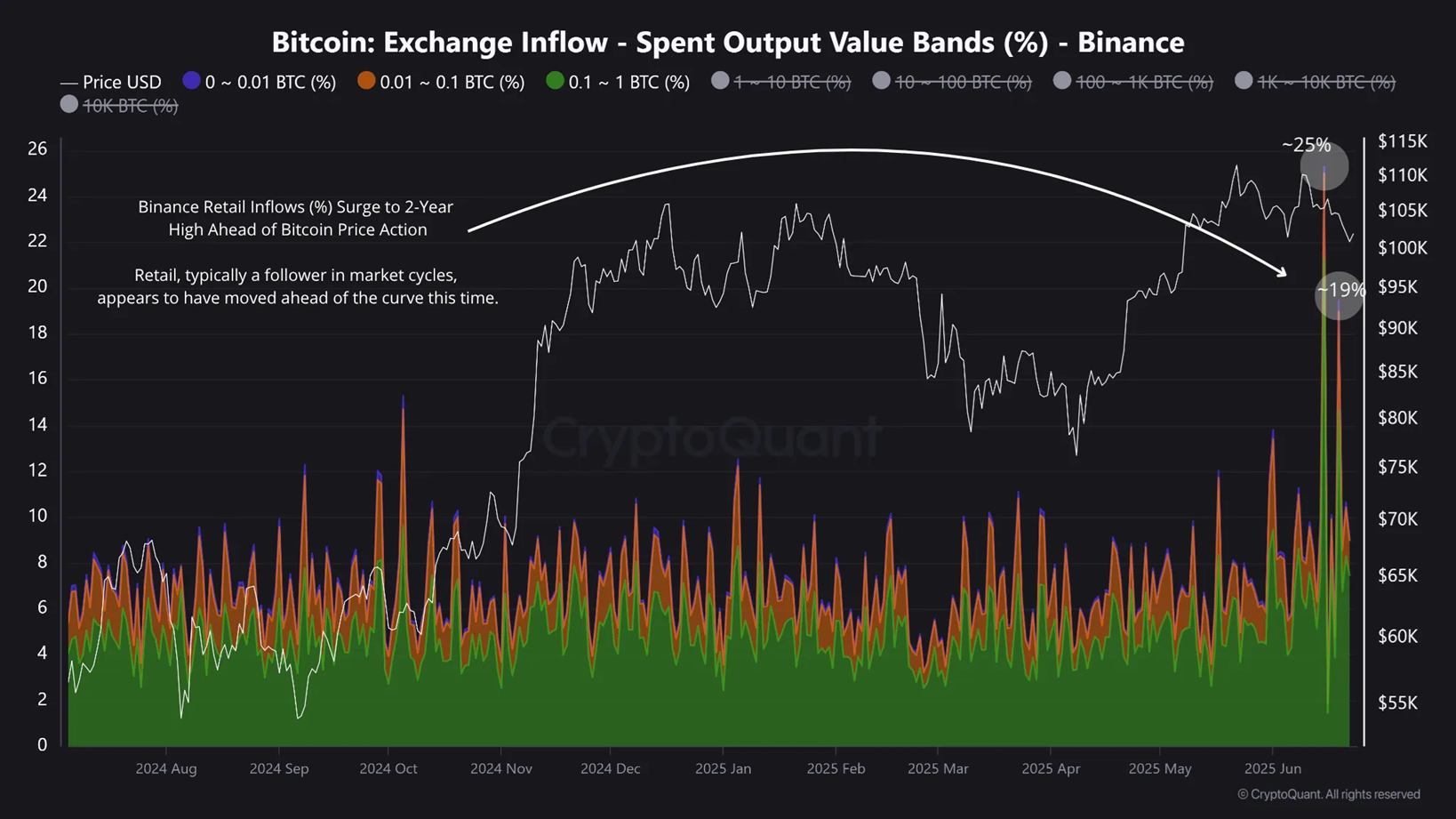

According to data from CryptoQuant, on June 15, the proportion of Bitcoin inflows from retail investors into Binance spiked to over 25% as BTC traded around $105,000. This marked the strongest retail BTC inflow since May 2023.

A second surge occurred on June 19, reaching a 19% share. These two events reflected the group’s active participation amid market volatility.

Notably, both inflow spikes happened before the conflict between the US and Iran escalated. However, earlier tensions between Israel and Iran may have influenced retail sentiment. As a result, many retail investors moved their bitcoin to exchanges in anticipation of worsening conditions.

“The move to deposit BTC on Binance typically signals an intention to trade, not to hold. While retail participants are often seen as lagging market movers, this time they may have been ahead of the curve. This is uncommon, but interesting behavior,” CryptoQuant analyst Maartunn said.

Some retail investors may have avoided the drop below $100,000 by sending Bitcoin to exchanges for selling. However, this trend also led to a rise in short positions from the retail segment.

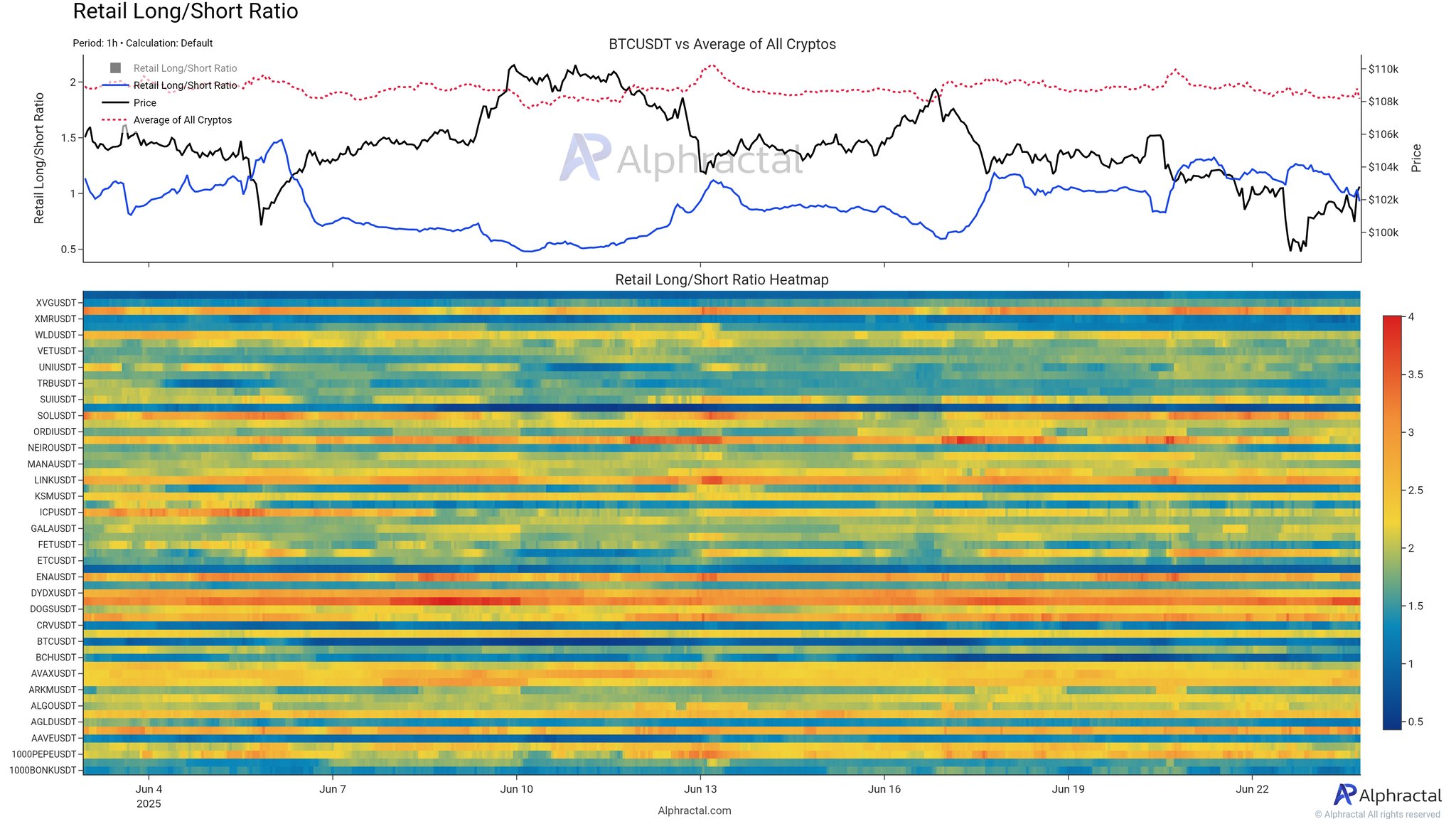

Data from Alpharactal showed that the Retail Long/Short Ratio has been trending downward. Retail investors are shorting Bitcoin and altcoins. This is evident from the heatmap, which is now largely covered in cooler colors.

“Retail short positions are increasing, while whales are showing more interest in longs compared to retail,” Joao Wedson, founder of Alpharactal, commented.

At first, it seemed that retail investors were on the right track. However, positive news—namely, Trump’s announcement of a ceasefire between Iran and Israel—triggered a market rebound. Bitcoin quickly climbed back above $105,000, and the total altcoin market cap (TOTAL2) recovered by 10%.

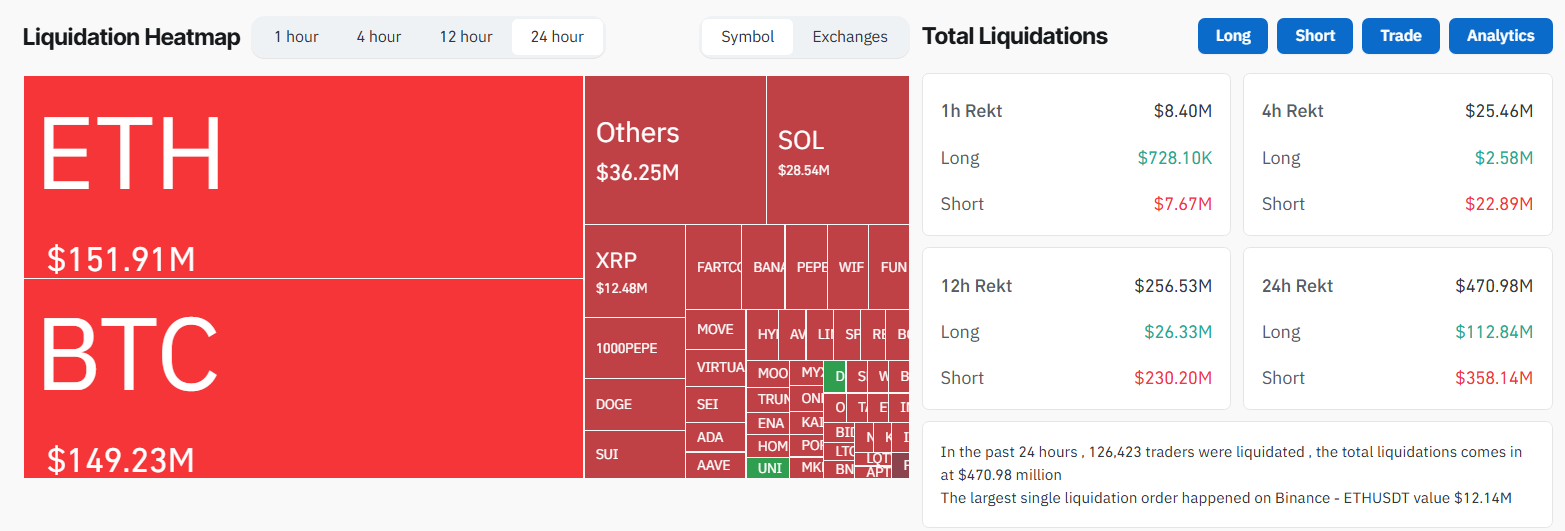

As a result, short sellers faced massive liquidations—nearly half a billion USD in just 24 hours.

According to Coinglass, nearly $500 million in positions were liquidated over the past 24 hours. The majority of this came from short positions, with the total short liquidation volume exceeding $358 million, which is three times the volume of long position liquidations.

This shows how unexpected shifts in geopolitical tensions can still hurt retail investors, even when they believe they are on the right path.

Meanwhile, as retail investors struggle with market volatility, institutional accumulation of Bitcoin continues steadily. This highlights a deepening divide between retail and institutional behavior today.