🚨 Crypto Market on Edge: Iran-US Tensions, $23M BLAST Unlock, and Injective Summit Highlights

Geopolitical tensions send shockwaves through crypto markets as Iran-US standoff triggers volatility. Meanwhile, $23 million in BLAST tokens hit the open market—just in time for traders to panic or profit.

Injective's global summit steals the spotlight with major protocol upgrades, proving DeFi innovation won't wait for regulators to catch up. (Because when has it ever?)

Bonus reality check: If you think this week's price swings are 'unprecedented,' you clearly weren't around for 2022. Buckle up.

Potential Iran Retaliation Against the US

Following US President Donald Trump’s directive attacking Iran’s nuclear sites, the market anticipates a retaliation. Already, Iran has taken a bold stance following the attack, closing the Strait of Hormuz, effectively constraining a key oil gateway.

Reporter: Do you think there is a possibility that Iran, North Korea, and the other forces such as China will join forces and retaliate?

Pete Hegseth: Unfortunately, because of the policies of the previous administration, we drove those countries togetherpic.twitter.com/cPbZ2nocsf

A retaliation WOULD be unsurprising, given Iran’s recent move hitting the Israeli Stock Exchange building in Tel Aviv. The attack was retaliatory, after Israeli-linked cyberattacks affected Iran’s banking system and destroyed tens of millions of dollars in digital assets.

Iran’s retaliation could send risk assets into freefall, with analysts speculating a 20% drop in the Bitcoin price. The implications for the Bitcoin price could be extreme as countries rally support amid escalating tension.

Actions have Consequences. Here is everything that has happened since TRUMP bombed Iran:

– China and Russia strongly condemn US attack on Iran they claim violates UN charter.

– Iran's foreign minister says he will head to Moscow today, will meet Putin.

– IRGC Threatens to… pic.twitter.com/2L33SRaDZO

Injective Summit

Another crypto news event to watch this week is the Injective Summit, which kicks off June 26, 2025, in New York. The event is pivotal for the blockchain finance ecosystem.

Injective, a high-performance LAYER 1 (L1) blockchain, is expected to unveil a major announcement, potentially related to its Injective EVM or Real-World Asset (RWA) Module, which will enhance institutional adoption.

“Get ready to witness game-changing announcements, major reveals and the next evolution of finance,” the network said recently.

With a focus on decentralized derivatives and interoperability, the summit may highlight new dApps or partnerships, building on its $137 million daily trading volume.

Attendees anticipate updates on protocol governance or burn auctions, reinforcing INJ’s deflationary model. The event will unite developers, investors, and Web3 innovators, amplifying Injective’s role in borderless DeFi.

The attendees include Thomas Cowan, the head of tokenization at Galaxy Digital; Kyle DaCruz, the director of digital assets product at VanEck; and Josh Olszewicz, the head of trading at Canary Capital. Federico Brokate, the head of US Business at 21 Shares, will also attend.

Infinex Big Announcement

The Infinex ecosystem is also among the crypto news headlines this week. It is a DeFi protocol built on Synthetix and Base chain.

Infinex is expected to make a significant announcement on Tuesday, June 24, likely unveiling Infinex Connect.

Things i'm most Excited about next on @infinex:

1. Infinex Connect

One of the most important features of Infinex is coming soon. With Infinex Connect, you’ll only need a single login to access and use any dApps in 1 click.

Imagine this :

You want to use your @felixprotocol… pic.twitter.com/ly7VK6ScWG

This feature could streamline cross-chain interactions across EVM chains and Solana, enhancing the user experience of its non-custodial wallet. Infinex Connect may integrate protocols like Synthetix Perps V3 or Aave, offering seamless trading, staking, or lending.

Following its $67.7 million NFT sale, Infinex aims to rival centralized exchanges with a Web2-like UX. The announcement could also clarify governance point conversions, despite Kain Warwick’s anti-airdrop stance.

Synthetix DEX Launch

Synthetix, a derivatives liquidity protocol, is set to launch its decentralized perpetual futures exchange on Ethereum Mainnet soon, marking a return from Optimism rollups.

This MOVE aims to consolidate liquidity and reduce fragmentation issues faced on Layer-2 networks. The exchange will leverage Synthetix’s Perps V3, offering low-slippage trading with sUSD and SNX collateral.

A proposed acquisition of Derive’s off-chain matching engine (SIP-415, later withdrawn) hints at ambitions for high-speed derivatives.

With 170 million SNX staked and 19.83% APY yields, the launch could attract significant TVL.

$23 Million BLAST Token Unlock

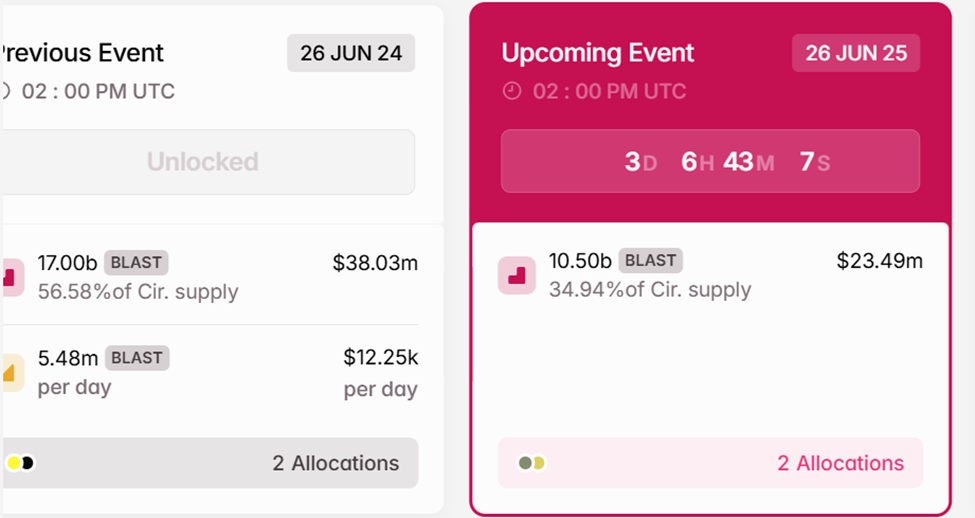

Another highlight of this week’s crypto news is that on June 26, $23.49 million worth of BLAST tokens, representing 34.94% of its circulating supply, will unlock. This high-volume unlock, constituting 10.5 billion BLAST tokens, could introduce market volatility.

BLAST, associated with ethereum L2 scaling solutions, follows a trend of significant unlocks, as seen with Taiko’s $46 million event.

Historical data suggests large unlocks often trigger sell-offs, especially if early recipients cash out for early gains. Data on Tokenomist.ai shows the tokens will be allocated to Core contributors and investors.

The unlock could influence BLAST’s price, which was trading for $0.00223 as of this writing, up by over 3% in the last 24 hours.