Bitcoin Dominance Soars to Record Highs – Is This the End of the Altcoin Rally?

Bitcoin flexes its muscles as altcoins crumble under its dominance. The king of crypto isn't just reigning—it's conquering.

Market shakeout leaves 'altseason' dreams in the dust

While Bitcoin's dominance metric hits stratospheric levels, altcoin traders are left scraping for crumbs. The once-hopeful narrative of an altcoin resurgence now looks like wishful thinking—or as Wall Street would say, 'a classic case of greater fool theory in action.'

No mercy from the crypto monarch

Active traders are getting squeezed as Bitcoin sucks liquidity from the entire market. Those waiting for the 'flippening' might want to check their calendars—it's 2025, and Bitcoin's still writing the rules.

Final thought: In crypto, there's Bitcoin... and then there's everything else trying to justify its existence.

Bitcoin Dominance Hits Highest Level Since 2021

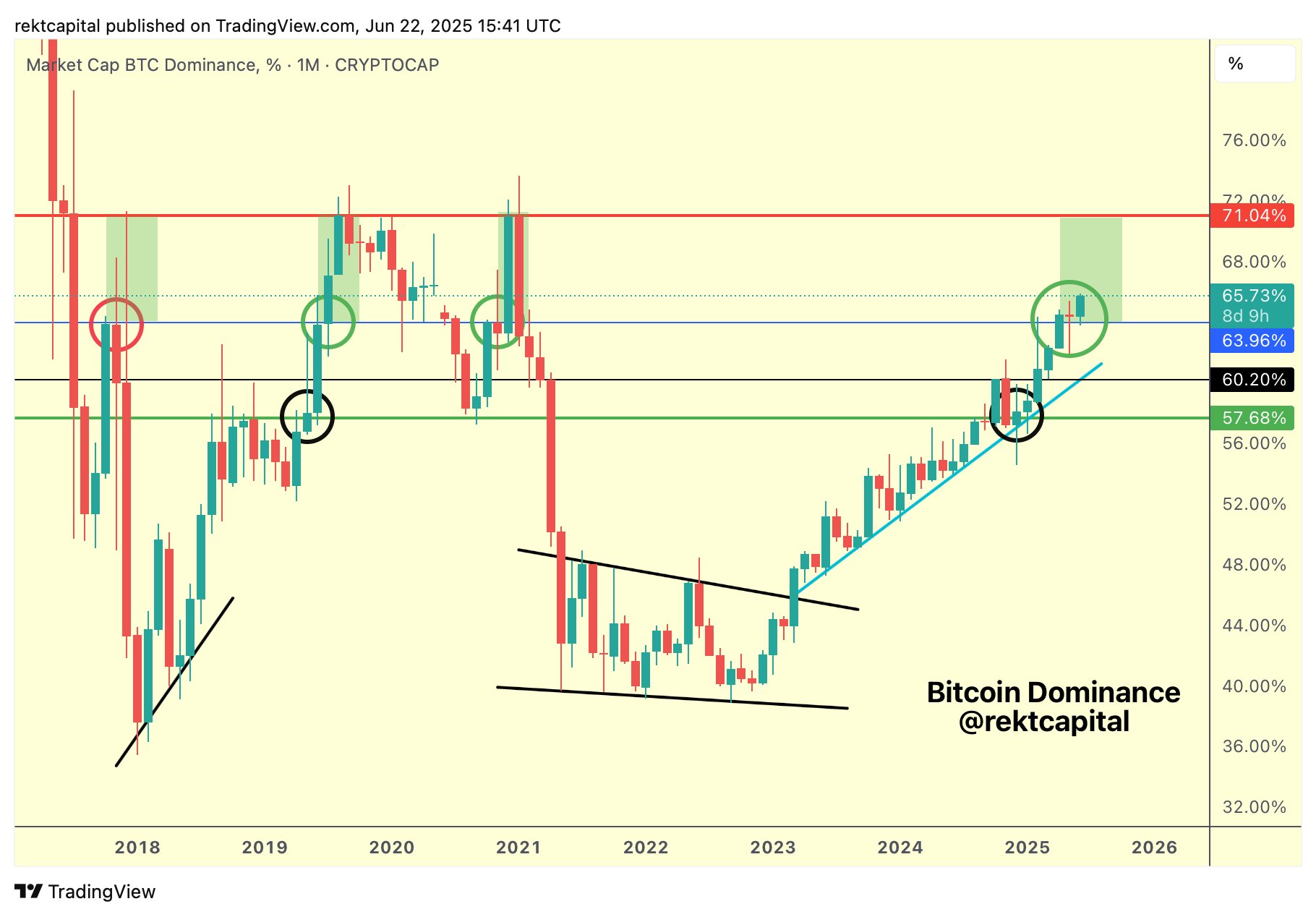

At the time of writing, Bitcoin Dominance (BTC.D), which measures Bitcoin’s market capitalization as a percentage of the total crypto market, has hit a new high for 2025. It now exceeds 65%, marking the highest point since February 2021.

Data from TradingView shows that BTC.D has risen for seven consecutive quarters without a single quarterly correction. This trend reflects strong long-term confidence in bitcoin from both retail and institutional investors.

Crypto analyst Rekt Capital made a bold prediction that Bitcoin Dominance could rise to 71% in the NEAR future.

If that happens, it could trigger a sharp correction in the altcoin market. A similar scenario played out in February 2025, when Bitcoin’s dominance peaked and led to steep declines in many major altcoins.

“Now Bitcoin Dominance is only 5.5% away from 71%. Altcoins won’t go to zero. Instead, they may react similarly to Feb 2025,” Rekt Capital predicted.

In February 2025, the altcoin market cap (TOTAL2) fell from $1.4 trillion to $1 trillion. If Rekt Capital’s prediction holds true, the altcoin market cap could drop below $700 billion.

Nic, Co-founder of CoinBureau, also suggested that BTC.D could rise to 70%—a prediction close to Rekt Capital’s. Raoul Pal, Founder and CEO of RealVision, shared the same outlook. He believes altcoins will bleed more than Bitcoin during any correction.

The rising tensions between the US and Iran, marked by airstrikes and threats of larger military deployments from President Trump, have caused unexpected market volatility.

Although leaders in the crypto industry remain optimistic, their sentiment does not extend to altcoins.

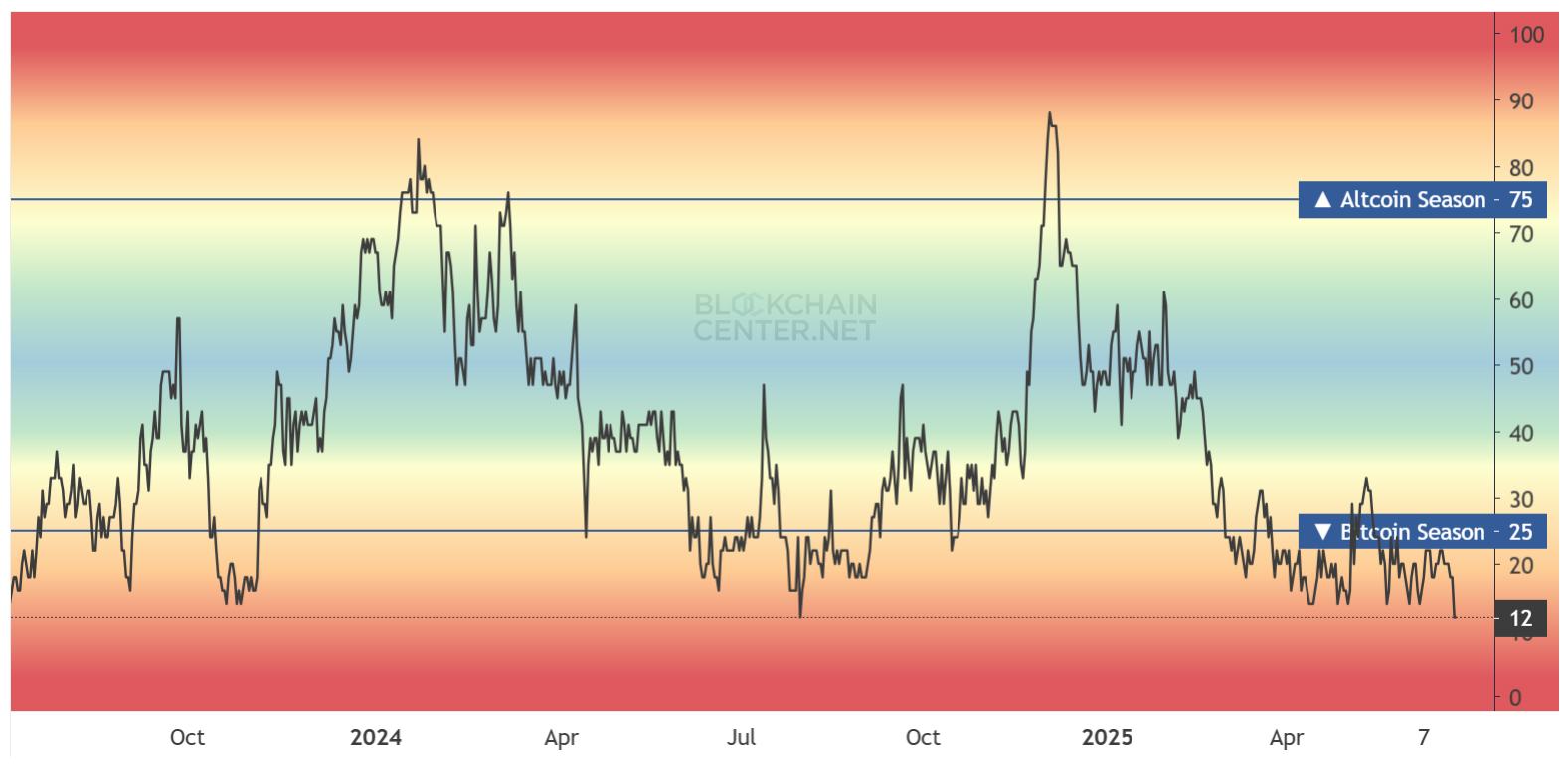

Altcoin Season Index Hits Rock Bottom

As of June 23, the Altcoin Season Index dropped to 12 points—its lowest level in two years. This index tracks whether altcoins have outperformed Bitcoin over the past 90 days. A score of 75 or higher typically signals an altcoin season. The current reading is far from that threshold.

“It’s now the furthest we have been from Altcoin season in almost a year. That’s if you believe the ‘Altcoin Season Index’,” Nic said.

However, renowned crypto analyst Michaël van de Poppe pointed out an interesting pattern. In recent years, the Altcoin Season Index has tended to bottom out in June or July.

#Altcoin season indicator hits the lowest number in 2 years.

Fun fact, the low of this indicator in the previous years was:

– June '19

– June '20

– July '21

– June '22

– June '23

– June '24

And now: June '25.

There seems to be a pattern. pic.twitter.com/CZqfd9TqvT

This suggests a seasonal trend: investors tend to shift capital into Bitcoin at the start of summer, and then potentially rotate back into altcoins in July or August.

Analyst 0xNobler also believes altcoin seasons typically begin in the summer. This aligns with the previous predictions that Bitcoin Dominance may still rise to 71% before undergoing any correction.

Therefore, these analysts say patience is key for altcoin investors, despite surprises from ongoing geopolitical conflicts.

However, a recent report by BeInCrypto highlighted several reasons why the altcoin winter could last longer. And even if an altcoin season does occur, it may not benefit every project currently on the market.