$1 Billion Floods Into Bitcoin ETFs—Defying Market Downturn | ETF Pulse

Wall Street's crypto love affair shows no signs of cooling—even as Bitcoin takes a beating.

The Institutional Stampede Continues

Despite price turbulence shaking retail investors, Bitcoin ETFs just vacuumed up another $1 billion. TradFi's latest gateway drug keeps delivering—whether the underlying asset cooperates or not.

When Fundamentals Don't Matter

The flows prove what cynics suspected all along: financialization trumps technicals. Who needs working products when you've got a shiny wrapper and commission-hungry brokers?

The ETF gravy train rolls on—proving yet again that in finance, packaging matters more than contents.

ETF Demand Cools as Bitcoin Stalls

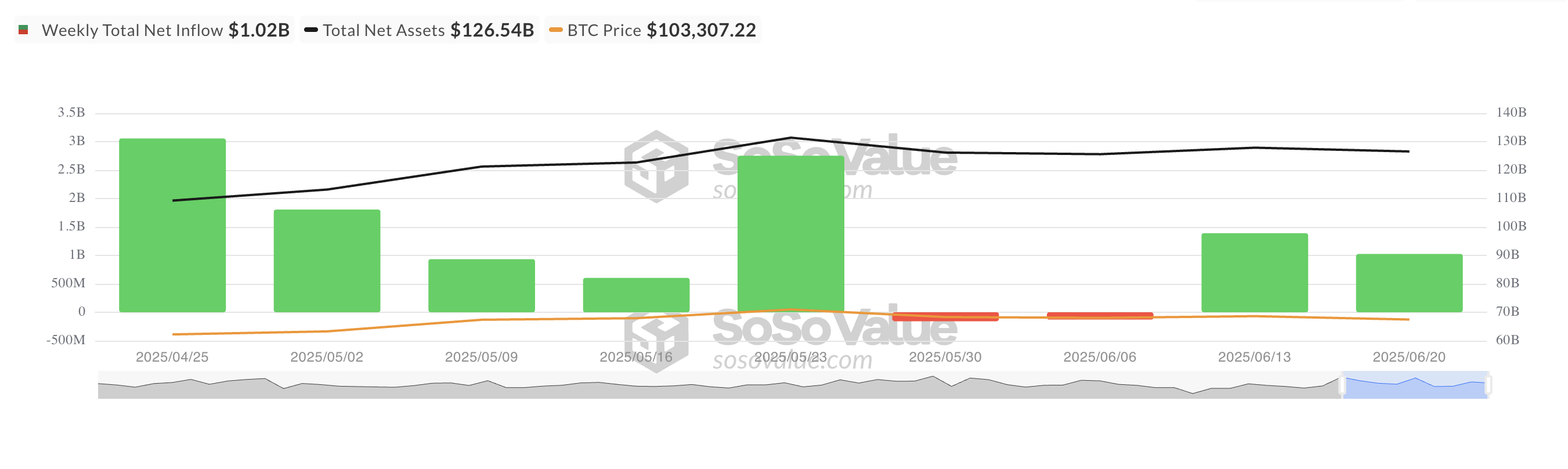

Between June 16 and June 20, Bitcoin-backed funds saw net inflows of $1.02 billion, a nearly 30% decline from the $1.39 billion recorded the previous week.

This pullback in inflows occurred amid BTC’s lackluster performance and its struggles to stabilize at the $103,000 price range during the week in review. This trend highlights the short-term uncertainty in the market as geopolitical tensions in the Middle East continue to dampen investor sentiment.

Last week, BlackRock’s spot BTC ETF IBIT recorded the highest net outflow among all BTC ETFs, with $1.23 billion entering the fund, bringing its total historical net inflows to $51 billion.

Bitcoin Slides Below $103,000

Today, the leading coin has extended its decline, trading below the psychological $103,000 price mark. Down 1% over the past day, BTC currently exchanges hands at $101,000.

The price decline is accompanied by a 37% uptick in the coin’s daily trading volume, reflecting the sell-side pressure in the market. When an asset’s price falls while trading volume increases, it signals strong selling pressure.

However, BTC’s persistent positive funding rate across the derivatives market hints at an underlying bullish sentiment among futures traders. Currently, this is at 0.002%, showing a preference for long positions even amid the coin’s muted price performance.

Moreover, today, the options market has a high demand for call contracts. This indicates that many traders are positioning for a potential upside.

This reinforces the broader risk-on mood and suggests that cautious Optimism continues to dominate short-term derivatives market sentiment.