XRP: The Dark Horse Set to Dominate Q2’s Crypto Rally

Forget the usual suspects—XRP's gearing up for a breakout quarter while Bitcoin maximalists nap on their cold wallets.

Why institutions are quietly stacking XRP

Banks and payment processors are suddenly playing hot potato with SWIFT corridors, and Ripple's war chest keeps growing. The 'unsexy' crypto just became the industry's backdoor darling.

The regulatory advantage no one's talking about

While SEC keeps playing whack-a-mole with altcoins, XRP's partial legal clarity acts like Kevlar in this regulatory shootout. TradFi dinosaurs love nothing more than a compliant blockchain bridge.

Liquidity tsunami incoming

Q2's institutional money flows resemble a drunk sailor spending spree—and XRP's poised to catch the spillover from ETH and SOL's congestion issues. That 3-second settlement time isn't just for show.

Here's the kicker: The same Wall Street suits who called crypto a scam in 2022 are now quietly repositioning—with ODL corridors as their Trojan horse. Nothing moves markets like hypocritical capital.

Traders Eye XRP Rally

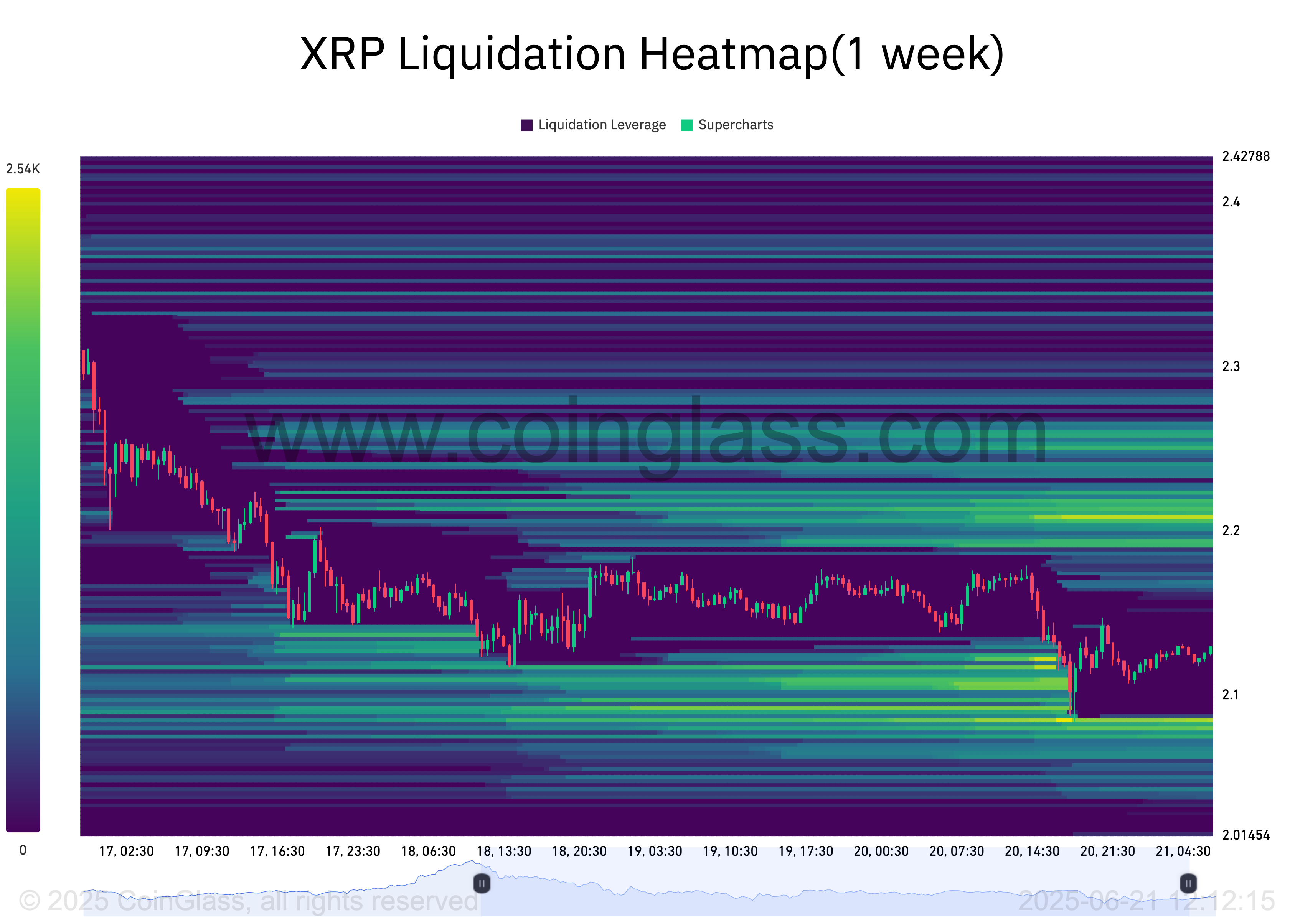

XRP’s liquidation heatmap shows a notable concentration of liquidity around the $2.20 price zone. At press time, the token trades at $2.14, placing it just 2.8% below this liquidity cluster.

Liquidation heatmaps are visual tools traders use to identify price levels where large clusters of Leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones representing larger liquidation potential.

These liquidity zones act like magnets for price action, as markets naturally MOVE toward them to trigger stop orders and open new positions.

In XRP’s case, the liquidity cluster around the $2.20 level highlights strong trader interest in buying or closing short positions at that price. If bullish momentum builds, this setup increases the likelihood of a near-term rally.

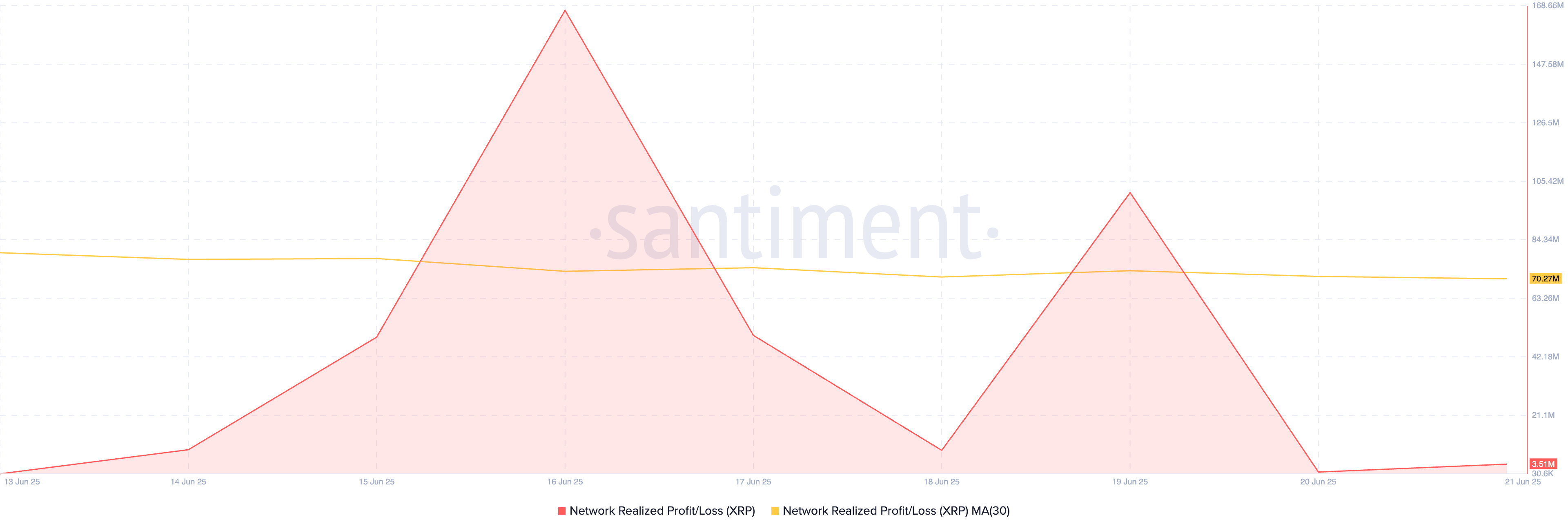

Further, the decline in XRP’s Network Realized Profit/Loss (NPL) supports this bullish outlook. On a 30-day moving average, it sits at 70.27 million, falling by 11% over the past week.

The NPL measures the total profit or loss investors realize when they move their coins. When NPL dips into negative territory, it indicates that more holders are moving their tokens at a loss rather than a gain.

Historically, this trend reduces selling pressure, as investors are generally reluctant to part with their assets while underwater. In XRP’s case, the recent NPL decline suggests that most holders are holding out for a rebound rather than locking in losses.

XRP Eyes Breakout as Bulls Target $2.29

At press time, XRP trades at $2.13. If buying pressure climbs and the altcoin breaks out of its sideways trend, it could rally toward $2.29.

A successful breach of this price mark could set XRP up for a rally toward $2.45.

However, if sell-side pressure surges, the XRP token price could extend its lackluster performance and fall to $2.08. If demand remains low at this point, the altcoin could dip further to $1.99.