Ethereum Long-Term Holders Dump Holdings: Bear Market Rally or Smart Profit-Taking?

Ethereum's diamond hands are cracking—long-term holders just triggered a sell-off wave. Is this the bear market's revenge or just smart money cashing out?

Whale wallets emptying, retail panic brewing. The second-largest crypto's price action hangs in the balance as OGs take profits.

Meanwhile, Wall Street 'experts' who called ETH dead at $800 are suddenly revising their price targets upward. Funny how that works.

Ethereum Liveliness Hits Record High

According to Glassnode, ETH’s Liveliness spiked to an all-time high of 0.69 during Friday’s trading session. This metric tracks the movement of long-held/dormant tokens. It does this by measuring the ratio of an asset’s coin days destroyed to the total coin days accumulated.

When this metric falls, the LTHs of an asset are moving their assets off exchanges, a MOVE seen as a signal of accumulation. On the other hand, as with ETH, when it climbs, LTHs are moving their coins to exchanges to sell them.

This spike in ETH’s Liveliness to 0.69 suggests that its LTHs are increasingly liquidating their positions as uncertainty grows. It reflects the growing lack of confidence in the coin’s near-term price recovery.

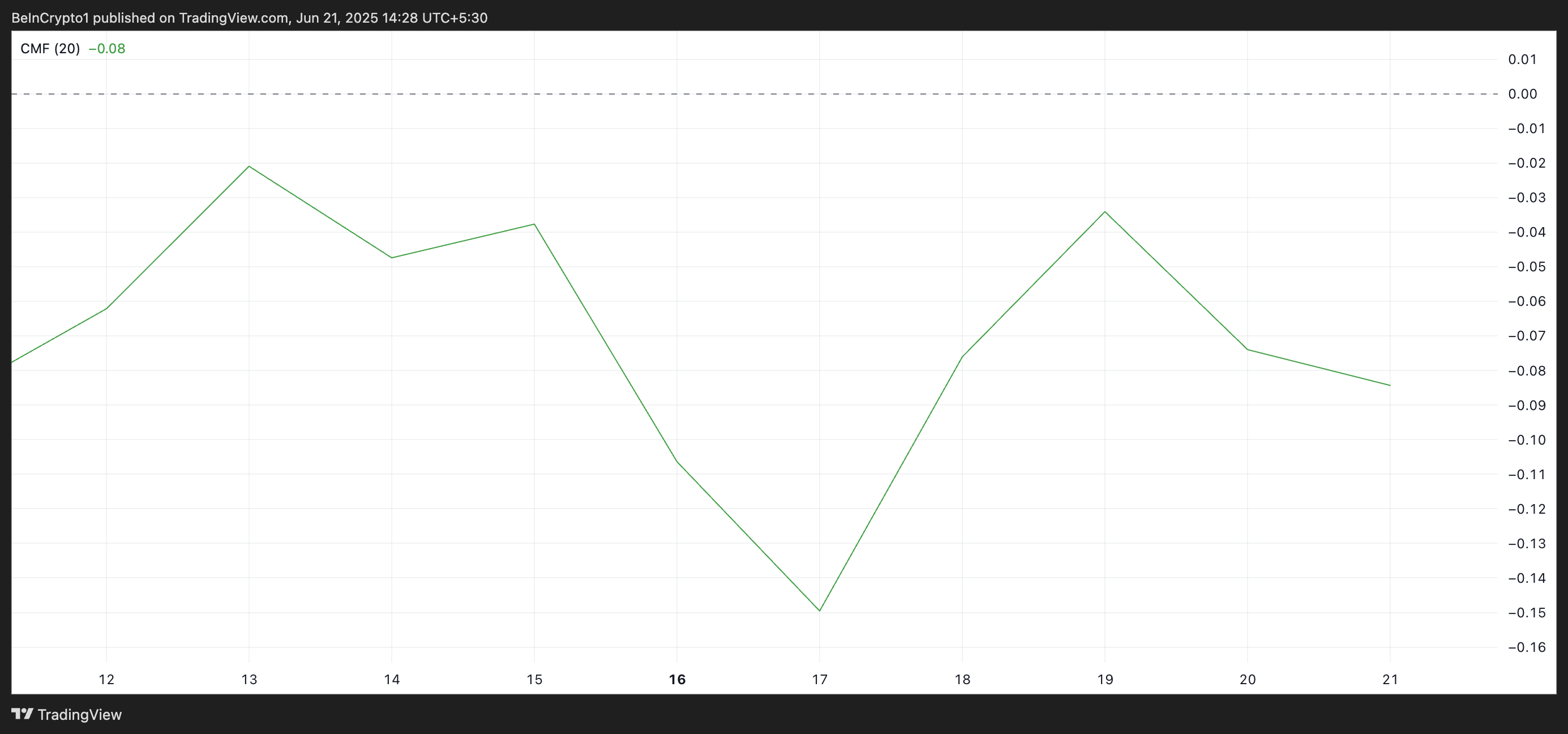

Additional confirmation of this bearish trend can be found on ETH’s daily chart, where the coin’s Chaikin Money FLOW (CMF) is negative and is trending downward. As of this writing, ETH’s CMF stands at -0.08, indicating a drop in capital inflows.

The CMF indicator measures the Flow of money into and out of an asset. When its value is negative, it signals low buying interest and validates the shift toward distribution rather than accumulation.

ETH Eyes Drop to May Lows

Persistent offloading by ETH’s long-term holders, combined with falling market-wide demand for the coin, could cause it to see a deeper correction in the NEAR term.

At press time, the leading altcoin trades at $2,429. If selloffs persist among ETH’s seasoned holders, the coin could drop toward $2,185. If this price floor fails to hold, the coin could dip further to $2,027, a low it last reached in May.

Conversely, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that scenario, its price could reverse its downtrend and climb toward $2,745.