3 Made-in-USA Crypto Gems Poised for a June Surge

Wall Street's sweating—while these homegrown crypto plays heat up.

As institutional money plays catch-up, these three U.S.-minted coins are flashing bullish signals. Forget the Fed's 'stablecoin' theater—real decentralization doesn't ask for permission.

#1: The Compliance Whisperer

One protocol's turning regulatory hurdles into springboards—with on-chain KYC that even TradFi dinosaurs can't ignore.

#2: The Infrastructure Maverick

Silicon Valley VCs missed it. Now this Layer 2 solution eats their lunch with 4000 TPS and gas fees lower than a banker's moral standards.

#3: The Dark Horse Stablecoin

Backed by something actually scarce (hint: not USD), this algorithmic player just flipped Tether's market cap—without the lawsuits.

Bullish? Maybe. American-made defiance of the financial status quo? Absolutely. Just remember—in crypto, 'patriotic' gains still get taxed.

Sei (SEI)

SEI has emerged as one of the top-performing Made in USA coins, surging by 15% over the last 24 hours. Trading at $0.208, the altcoin is currently above the key support level of $0.197. The recent upward movement signals growing investor confidence in the cryptocurrency.

The recent announcement of the Wyoming Stable Token Commission selecting SEI as the blockchain for the WYST USD-backed stablecoin has driven the altcoin’s rise.

The RSI has also climbed above the neutral mark, signaling a shift into the bullish zone. This technical indicator suggests continued momentum for SEI in the NEAR term.

Given the current momentum, SEI is likely to continue its growth toward the resistance at $0.225 in the coming days. However, if the altcoin loses momentum and falls through the $0.197 support, it could drop to $0.183. Such a move WOULD invalidate the current bullish outlook for SEI.

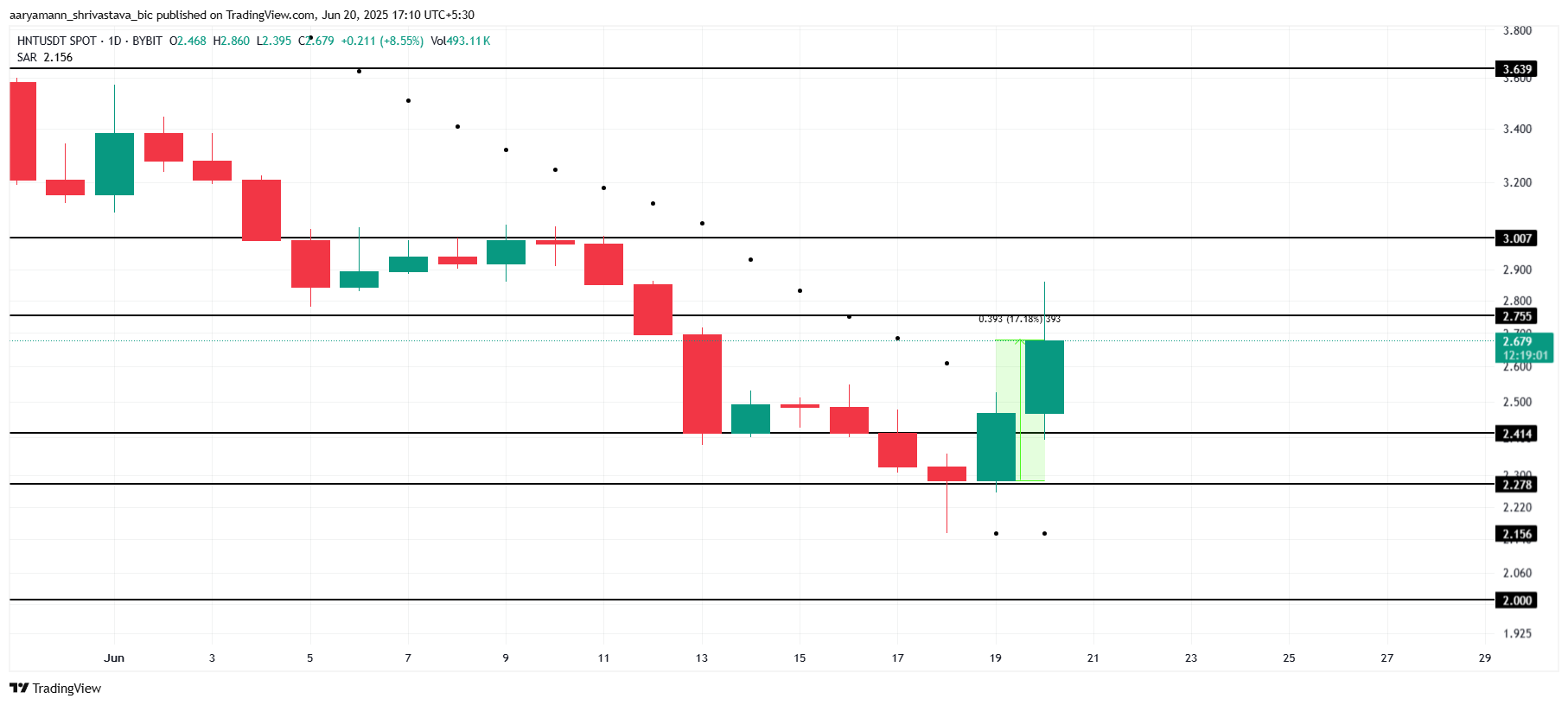

Helium (HNT)

HNT has shifted from bearish to bullish for the first time since the beginning of the month. The altcoin is up by 17%, currently trading at $2.67. This marks a significant change in momentum, with HNT looking to continue its positive price movement in the near future.

The Parabolic SAR is now positioned below the candlesticks, signaling a strong uptrend for HNT. This shift ends a month-and-a-half streak of downtrend, suggesting that the altcoin could break through $2.75 and reach the $3.00 mark.

However, if HNT fails to breach the $2.75 resistance, it could experience a decline. A fall to $2.41 would suggest weakening momentum, and a break below $2.27 would invalidate the current bullish outlook. This scenario could result in further losses for HNT holders.

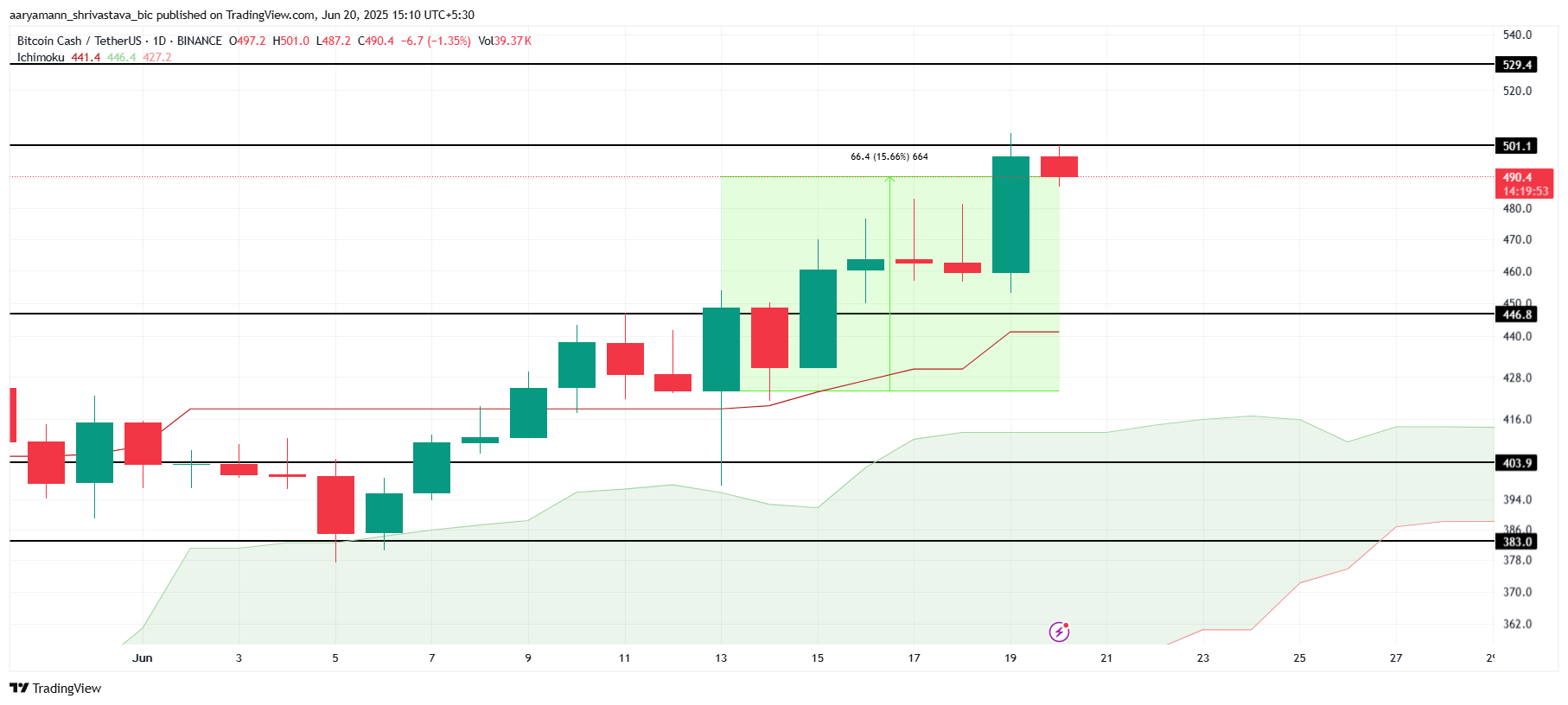

Bitcoin Cash (BCH)

BCH is currently priced at $490, having risen by 15.6% over the past week. The altcoin has benefited from Bitcoin’s rally, bringing it closer to the $500 mark. Investors are closely watching this level as BCH continues to show resilience following Bitcoin’s recent performance.

The key resistance level for BCH is $501, a price it hasn’t surpassed since December 2024. The Ichimoku Cloud is indicating strong bullish momentum, suggesting BCH could break this resistance.

If it does, the price may rise further, potentially reaching $529 and beyond, with more upside possible.

However, if market sentiment turns negative and selling pressure intensifies, BCH might struggle to surpass $501. In this case, the price could retreat to $446, invalidating the current bullish outlook.

A loss of momentum could lead to a price reversal in the short term.