XRP at a Crossroads: Can It Hold $2 Amid $68.8 Million Daily Profit-Taking?

XRP faces a brutal test as traders cash in $68.8 million in daily gains—threatening to puncture its $2 support.

The tug-of-war between bulls and profit-takers heats up. Will the 'bankers' crypto' live up to its hype or fold like a cheap suit?

One thing's clear: Wall Street's playbook—buy the rumor, sell the news—is alive and well in crypto.

XRP Price Stalls As Investors Cash Out

XRP was trading at $2.17 as of this writing, up by over 0.5% in the last 24 hours. Despite the modest gains, CoinGecko data shows the Ripple token is one of the most notable gainers on Friday among the largest altcoins by market cap.

Analysts at Glassnode highlight the xrp price defending above the $2 mark, noting that investors who accumulated XRP during the previous cycle are now sitting on over 300% gains.

“XRP is trading above $2, more than 3x higher than its base price before the sharp rally in November 2024,” Glassnode said.

However, it may be the same investor cohort who are limiting XRP from achieving further upside potential. The question is, how?

Data on Glassnode shows they began realizing profits at a pace of $68.8 million daily (7D-SMA) in early June. This signals a wave of distribution by early holders.

While this wave of selling activity has not yet reversed XRP’s upward trend, it has injected uncertainty as the broader altcoin market remains under pressure.

Altcoin Winter Persists as $36 Billion in Net Selling Signals Investor Retreat

Indeed, crypto traders and investors are witnessing the colloquial altcoin winter, with a $36 billion gap favoring sellers over buyers. This shows weak investor confidence in the sector. CryptoQuant reported this week that the “altcoin investors are MIA (missing in action).”

“1-Year Cumulative Buy/Sell Quote Volume Difference for Altcoins (Excluding BTC & ETH)” currently sits at -$36 billion… Even though Bitcoin is enjoying a bull run, altcoins are behaving like it’s still winter,” CryptoQuant stated.

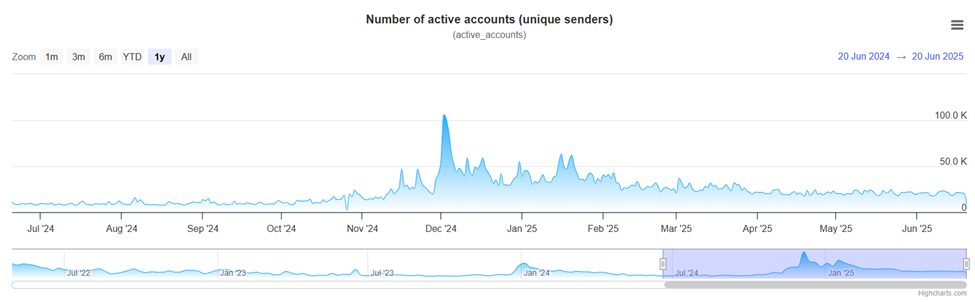

Despite this, XRP continues to show strength in key network metrics. Daily active accounts have risen to around 20,000, double the average seen throughout 2024.

Similarly, XRP processes nearly 1 million payments daily, signaling strong utility even as investor sentiment remains cautious.

One of the key drivers behind XRP’s rally is renewed Optimism around XRP ETFs (exchange-traded funds). Canadian asset managers 3iQ, Purpose, and Evolve launched XRP ETFs this week, marking one of the first moves by major financial institutions into the Ripple ecosystem.

The funds began trading on Canadian exchanges Wednesday, reflecting regulatory openness in North America.

Meanwhile, in the US, markets are still waiting for the SEC to weigh in on several XRP ETF applications. Bloomberg analyst James Seyffart noted that the SEC has until October to decide on XRP ETF filings. This leaves room for speculation through the second half of the year.

XRP not being actioned (at least not publicly that i can tell) Final deadline for XRP ETF also in October

— James Seyffart (@JSeyff) June 17, 2025On prediction platform Polymarket, odds of a US XRP ETF approval by the end of 2025 currently sit at 89%. However, only 13% believe approval will come before July 31, suggesting traders expect delays or a final decision later in the year.

While ETF momentum and increased utility are helping XRP outperform its altcoin peers, the ongoing wave of profit-taking could cap further upside in the NEAR term.

The altcoin’s trajectory may ultimately hinge on the SEC’s ETF decision and whether broader market conditions can shift out of the current altcoin winter.