Trump’s Tariff War Hammered Bitcoin Harder Than Israel-Iran Tensions—Here’s Why

Bitcoin just proved geopolitics isn’t always the market’s biggest disruptor. While rockets flew in the Middle East, it was Trump’s trade wars that left deeper scars on crypto’s flagship asset.

### The Tariff Tango: How Politics Drained Crypto Liquidity

Markets hate uncertainty more than they fear missiles—and nothing screams instability like a sudden 25% levy on imports. When tariffs hit, traders fled to stablecoins faster than a Wall Streeter dodging jury duty.

### War vs. Wallets: Why Crypto Reacts Differently

Bullet points don’t move markets like balance sheets do. The Israel-Iran conflict sparked brief volatility, but Bitcoin’s 30-day correlation with traditional safe havens barely flickered. Meanwhile, tariff headlines triggered double-digit percentage drops—because nothing kills risk appetite like protectionism.

### The Cynical Take: Follow the Money (Even When It’s Digital)

Here’s the brutal truth: crypto markets care more about capital flows than casualties. Until nation-states start paying ransoms in BTC, trade wars will remain the bigger price driver—because at the end of the day, even decentralized finance answers to old-school economics.

Bitcoin Holders Fear Tariff War Over Actual War

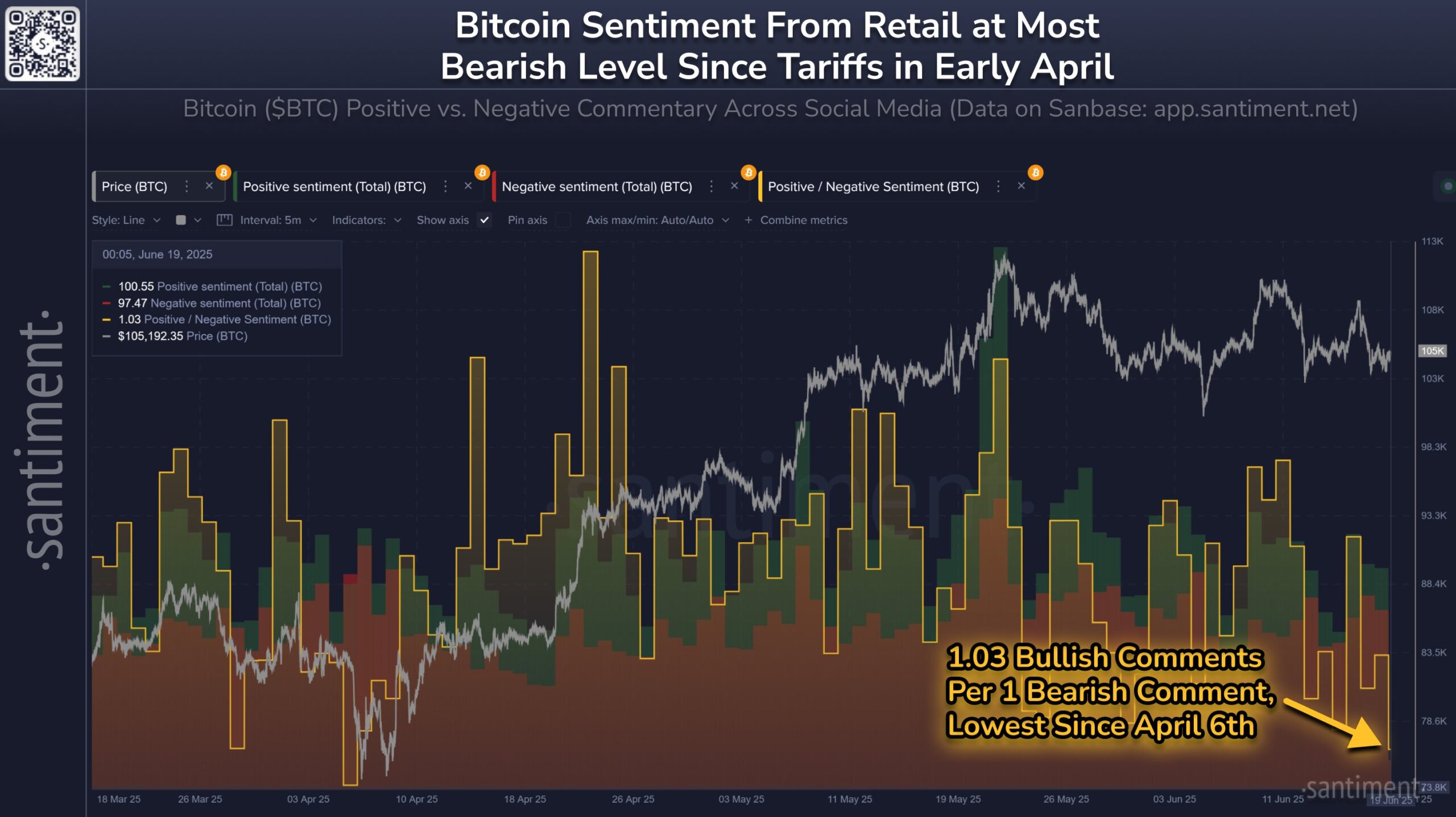

Investor sentiment surrounding Bitcoin has been steadily declining as concerns about the geopolitical climate escalate. While BTC holders are still optimistic about the asset’s long-term prospects, their enthusiasm has waned in recent weeks.

The ongoing tensions between Israel and Iran have contributed to a shift in sentiment, pushing it to its lowest levels in two months. This starkly contrasts the situation in April, when sentiment was also hit hard due to the broader economic effects of the tariff war initiated by former US President Donald Trump.

Despite the drop in sentiment, the current environment is not as dire as it was in April or earlier. During those times, Bitcoin’s price fell below $80,000, driven by broader global uncertainties. The latest geopolitical tensions, while impactful, may not lead to as severe a decline.

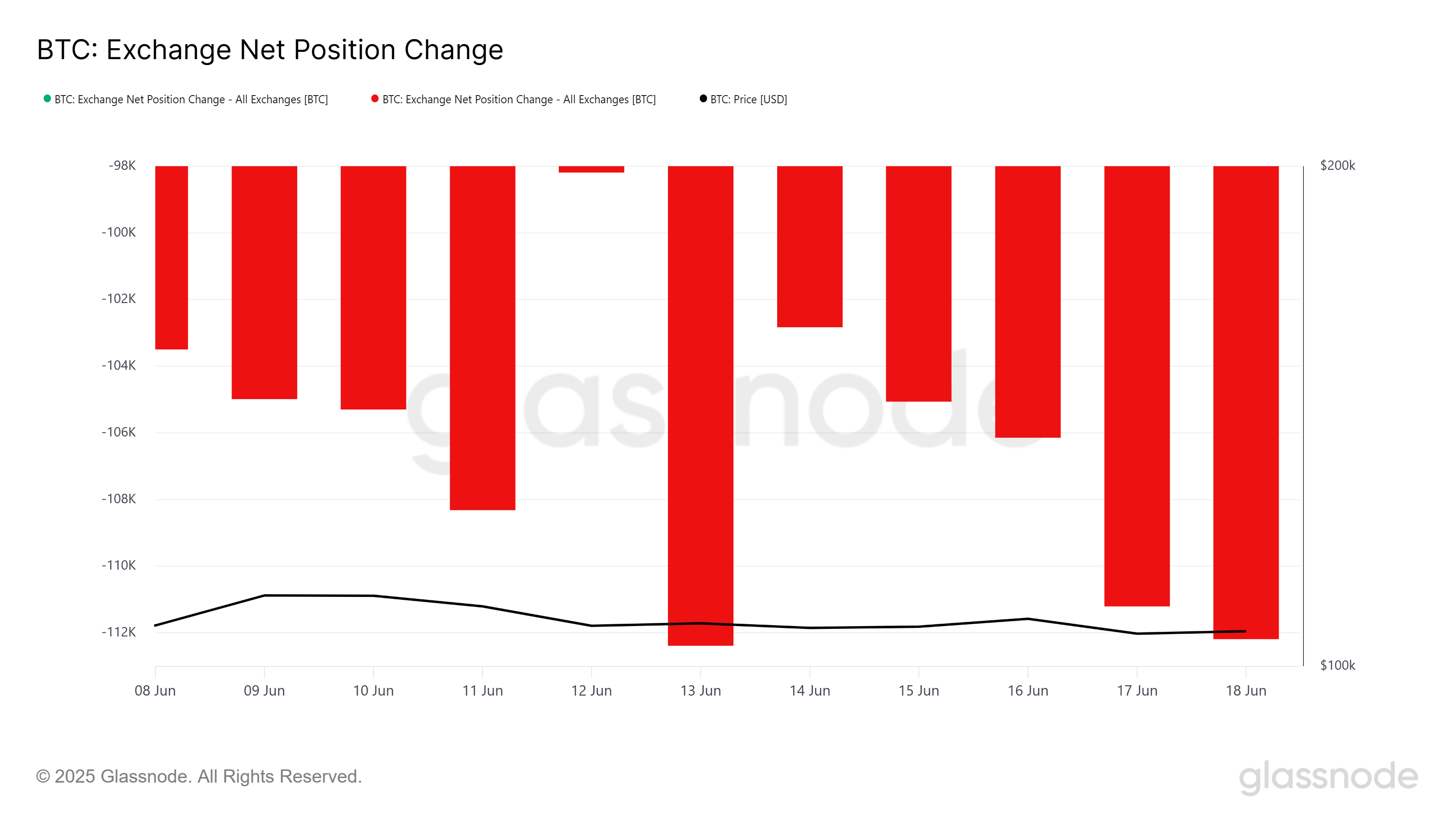

Bitcoin’s recent price action is supported by a slightly bullish trend in its exchange net position. Over the past week, 14,004 BTC, worth over $1.4 billion, were bought by investors.

This demonstrates that, despite the broader market turbulence, there is still strong investor confidence in Bitcoin’s long-term recovery. As long as this accumulation continues, bitcoin may have a better chance of weathering the storm and recovering once market conditions improve.

BTC Price Is Struggling

Bitcoin’s price currently stands at $105,000, and it is attempting to flip this level into support in order to pave the way for a rise toward $108,000. If BTC successfully holds above $105,000, it could trigger an upward movement toward this next key price point, signaling the possibility of a recovery.

Once Bitcoin breaks through the $108,000 resistance, it will likely aim for the next major level at $110,000. Surpassing the $109,476 resistance will help push the price further, bringing back some Optimism among BTC investors. A sustained rise through these levels could bolster investor confidence, reinforcing the bullish outlook for the cryptocurrency.

However, if investor sentiment continues to worsen due to geopolitical tensions, Bitcoin’s price could experience a sharp decline. In such a case, it may fall toward the support level of $102,734 or even lower to $101,503. A drop below these levels WOULD invalidate the current bullish thesis and signal further bearish pressure on Bitcoin.