Chinese Bitcoin Mining Giants Flee to US—Tariffs Force Billion-Dollar Exodus

Beijing’s loss is Texas’ gain—again. Top Chinese Bitcoin mining hardware manufacturers are relocating operations to the US, dodging tariffs that could’ve sliced into their 70% global market share. The move signals a seismic shift in crypto’s geopolitical chessboard.

Why the US? Three words: Cheap energy, friendly regulators, and—irony alert—a trade war they helped create. These firms aren’t just escaping costs; they’re chasing next-gen infrastructure like immersion cooling farms near shale gas fields.

The twist? These ‘refugee’ companies now dominate North American mining. Some Texas towns report 300% spikes in energy demand—all while Wall Street still pretends Bitcoin is ‘just a speculative asset.’

One exec quipped: ‘We manufacture the shovels in this gold rush. Tariffs just made us dig elsewhere.’ Meanwhile, China’s crypto crackdown looks increasingly like an own goal as its tech exodus accelerates.

US-China Trade War Reshapes Bitcoin Mining Industry

According to Reuters, Bitmain, Canaan, and MicroBT plan to build manufacturing facilities in the US. They aim to take advantage of local labor and infrastructure to meet the rising demand in the bitcoin market.

This MOVE is widely seen as an effort to shield themselves from tariffs and restructure their supply chains.

“The US-China trade war is triggering structural, not superficial, changes in bitcoin’s supply chains,” said Guang Yang, Chief Technology Officer at crypto tech provider Conflux Network, as quoted by Reuters.

Currently, these three companies produce over 99% of the world’s ASICs (Application-Specific Integrated Circuits) used for Bitcoin mining.

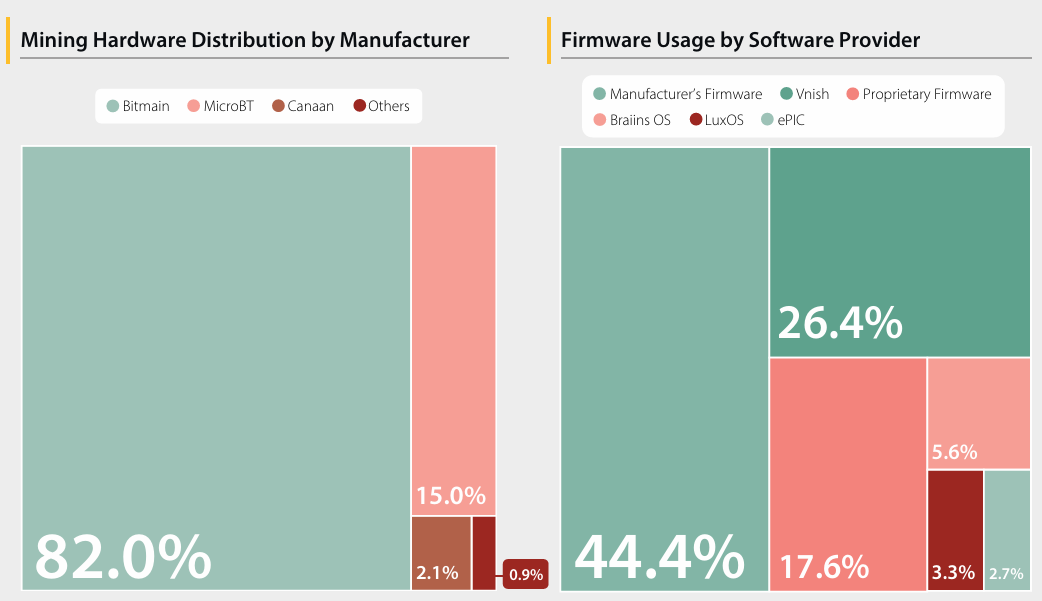

According to research from the University of Cambridge, Bitmain leads with an approximately 82% market share. MicroBT follows with 15%, and Canaan holds about 2%.

This dominance makes the shift in production not just a tax-avoidance strategy. It also has the potential to significantly reshape global supply chains.

Previously, according to Bloomberg, US-based crypto miners faced delays in receiving shipments of new equipment after Trump’s election victory.

This shift is expected to bring substantial benefits. Most notably, it will shorten the time it takes for mining rigs to arrive at US facilities. That will help optimize supply chains and reduce logistics costs.

“Bullish for US Bitcoin mining,” an investor commented on X.

This is especially crucial as Bitcoin mining becomes increasingly competitive. Companies must maintain high efficiency to cope with rising mining difficulty after halving events.

A recent report from BeInCrypto further stated that Bitcoin mining costs have jumped over 34% as the hashrate hits a new all-time high. Many mining firms are now looking to diversify their revenue streams in order to survive.

Additionally, the United States has already established itself as the world’s leading Bitcoin mining hub, contributing more than 75% of the global hashrate. With this new plan, the US is gaining even more dominance, especially as TRUMP positions himself as a Bitcoin-friendly president.