Solana ETF Hype Explodes: Polymarket Traders Bet 91% on Approval After VanEck’s VSOL Hits DTCC

Solana just became Wall Street’s shiny new toy—and crypto degens are all-in.

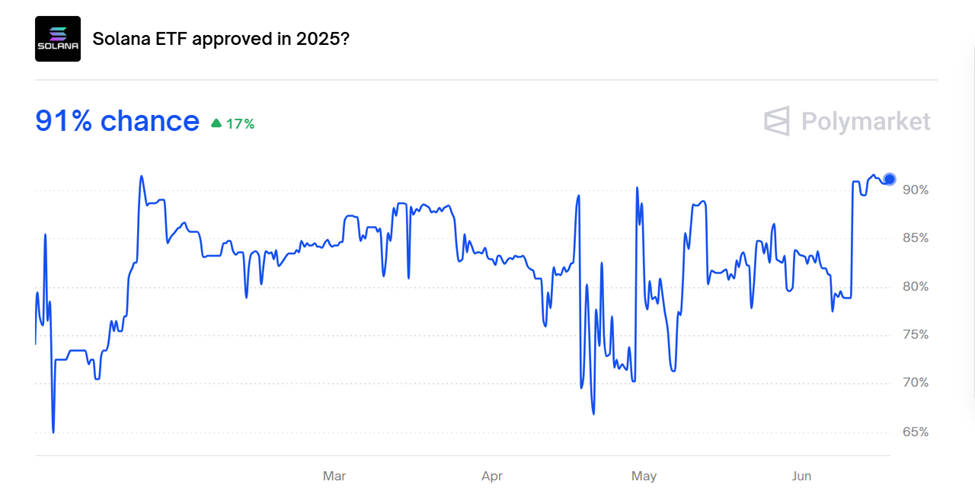

VanEck’s VSOL listing on the DTCC lit the fuse. Now Polymarket’s oddsmakers see a 91% chance of a Solana ETF approval. That’s not optimism—that’s a near-certainty priced in by the crowd.

Why Traders Are YOLO-ing Into SOL

The playbook’s familiar: Institutional infrastructure arrives first (thanks, DTCC), regulators slow-roll the paperwork, and speculators front-run the news. This time? The casino’s taking bets before the SEC even finishes its coffee.

The Fine Print Nobody’s Reading

Remember when Bitcoin ETFs were ‘impossible’ until they weren’t? Same script, different altcoin. But hey—if BlackRock can turn crypto into a prospectus, why shouldn’t Solana get its turn at the money printer?

One hedge fund manager sniffed: ‘We’ll approve anything if the fees are high enough.’ Welcome to financial innovation, 2025-style.

VanEck’s VSOL ETF Moves Closer to Approval After DTCC Listing

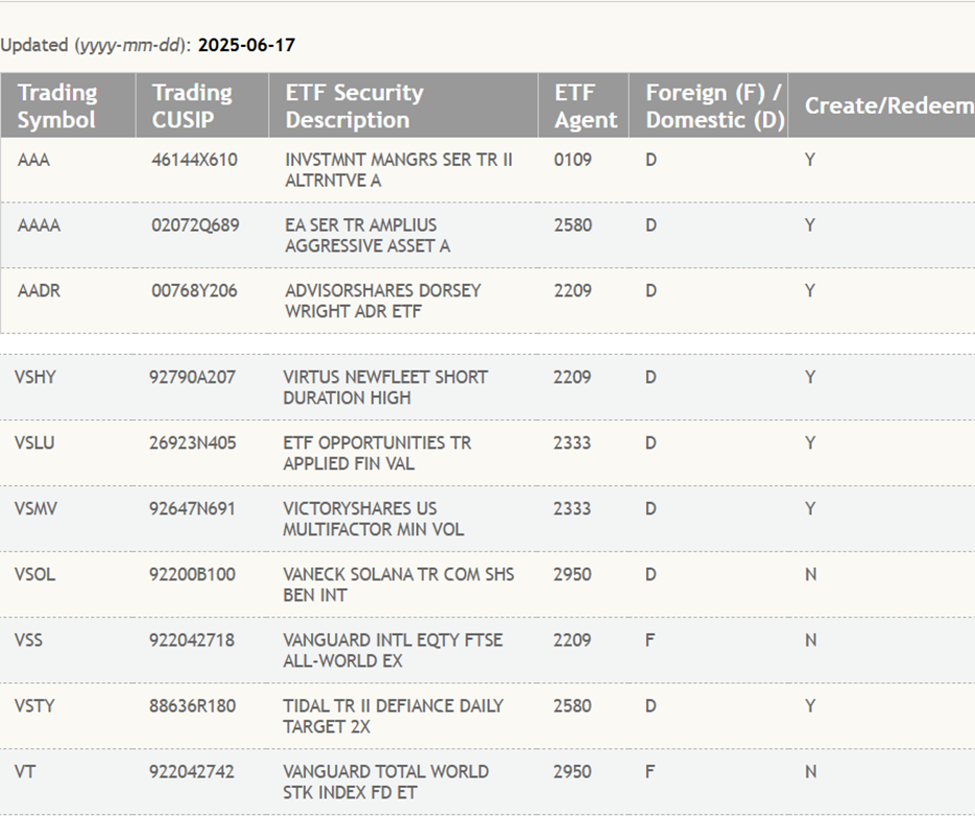

The DTCC listing, under the “active and pre-launch” category, confirms that the fund is eligible for future electronic trading and clearing pending approval from the US SEC (Securities and Exchange Commission).

It is imperative to note that VanEck’s VSOL cannot yet be created or redeemed. However, the firm views the listing as a key part of the launch process, though it does not guarantee approval.

Bloomberg ETF analysts James Seyffart and Eric Balchunas estimate that the SEC could soon approve the fund, among other things. However, this forecast is contingent on filings progressing smoothly.

“SEC is engaging on S-1 for Solana Staking ETFs and that’s a *very* positive sign. Still, timelines for approvals are less certain IMO,” Seyffart noted in a post.

Indeed, this registration comes shortly after the SEC instructed issuers to submit amended S-1 filings for their Solana ETFs. Analysts say this signifies ongoing engagement between regulators and fund managers.

Several firms, including Bitwise, CoinShares, and Franklin Templeton, have entered the race to offer Solana-based ETFs. However, the SEC has delayed a decision on Franklin Templeton’s Solana ETF.

SEC DELAYS FRANKLIN SPOT SOLANA ETF

— Phoenix » PhoenixNews.io (@PhoenixNewsIO) June 17, 2025VanEck has previously introduced Bitcoin and ethereum futures ETFs and multiple global digital asset funds. It aims to offer regulated exposure to next-generation blockchain networks like Solana.

SEC Engagement and Polymarket Odds Signal Growing Confidence in Solana ETF

While the SEC has already approved spot ETFs for Bitcoin and Ethereum, Solana remains waiting. However, Optimism is growing.

On the decentralized prediction platform Polymarket, traders now assign a 91% probability that a Solana spot ETF will be approved in 2025.

The DTCC’s recognition of VSOL follows a trend of growing institutional readiness. Earlier this year, the organization also listed futures-based Solana ETFs, SOLZ and SOLT, though those remain in redeemable-only status.

Beyond ETFs, DTCC has signaled deeper interest in blockchain infrastructure, including plans to launch a stablecoin and tokenized collateral platform.

Solana’s high transaction throughput, active developer ecosystem, and growing DeFi and NFT use cases have positioned it as a credible contender for mainstream financial products.

The SEC’s willingness to engage spot Solana ETFs and its approval of Solana’s futures on the CME suggest the network could soon become the third crypto to gain full ETF status in the US.

Though VanEck has not set an official trading date for VSOL, the appearance on DTCC’s list is a major milestone. If approved, VSOL could catalyze further ETF innovation, potentially including staking-enabled products or multi-asset crypto baskets.

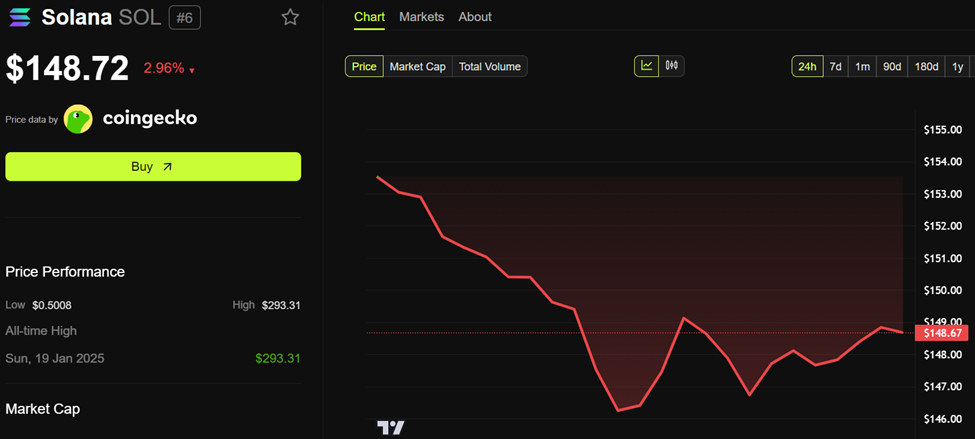

The move could also drive a Solana price surge. However, despite the DTCC listing, SOL was trading for $148.72 as of this writing, down nearly 3% in the last 24 hours.