Solana Traders on Edge: Exchange Inflows Surge to 14-Day High – Is a Sell-Off Imminent?

Solana''s ecosystem is flashing warning signs as exchange inflows hit their highest level in two weeks. Are traders preparing to dump their bags—or is this just another false alarm in crypto''s endless drama?

The inflow spike: What it really means

When coins flood exchanges, it typically signals one thing: selling pressure. The 14-day high suggests a growing queue of SOL holders itching to cash out. But in crypto, even obvious patterns love to play tricks.

Market psychology at work

Traders aren''t just reacting to charts—they''re front-running each other''s fear. The moment someone whispers ''sell-off,'' it becomes a self-fulfilling prophecy. Classic herd behavior, now with 100% more blockchain.

The institutional wildcard

While retail panics, whales might see this as a discount buffet. Nothing moves markets like big money playing contrarian—except maybe a Musk tweet.

Solana''s proving once again that in crypto, the only certainty is volatility. Whether this turns into a full-blown liquidation event or just another ''buy the dip'' opportunity depends on who blinks first. After all, what''s decentralized finance without a little decentralized panic?

SOL Investors Prepare to Sell

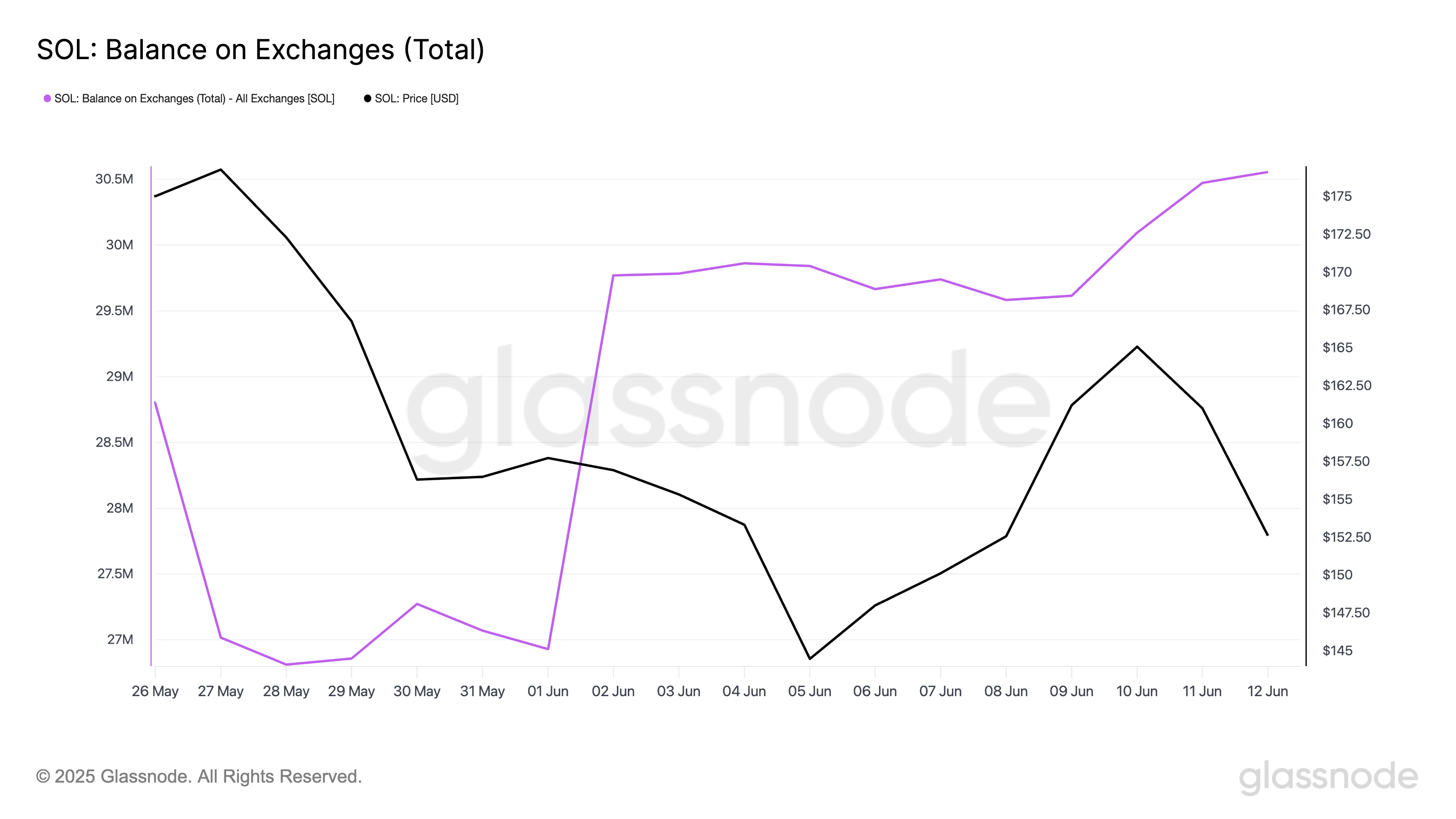

Over the past several days, digital assets have struggled to maintain upward momentum. This has dampened investor interest and triggered an uptick in SOL’s exchange-held balance. It now sits at 31 million SOL, its highest in two weeks.

When an asset’s exchange balance spikes, more of its coins ot tokens are being deposited into centralized exchanges. This is seen as a bearish signal, as traders typically MOVE tokens to exchanges when they intend to sell.

Solana exchange balance climbing to a 14-day high confirms that its investors are preparing to exit their positions amid weakening market sentiment.

Moreover, SOL’s futures funding rate has turned negative for the first time in over a week, confirming the resurgence in bearish pressure. According to Coinglass, this is currently at -0.0006%.

The funding rate is a periodic fee paid by traders in perpetual futures contracts to keep the contract price aligned with the underlying asset’s spot price. A negative funding rate indicates short positions are in higher demand than longs.

This trend highlights the mounting selling pressure on SOL and hints at a possible continuation of its price fall.

Bearish Pressure Mounts on SOL

SOL’s rising exchange inflows and negative funding rates paint a cautionary picture for its near-term performance. If bearish pressure gains, SOL’s price could breach the support at $142.59 and fall toward $123.49.

However, if the bulls regain dominance, they could drive a rebound to $171.88.