3 US Crypto Stocks Primed for Explosive Growth in 2025

Crypto''s back in the headlines—and these equities are riding the wave.

1. The Miner Defying Market Gravity

While traditional finance scrambles to catch up, one NASDAQ-listed mining operation keeps printing BTC like it''s 2021.

2. The Exchange Outperforming Its Token

Even as their native token stagnates, this platform''s stock charts tell a radically different story. Somebody''s cooking the books—or actually turning a profit.

3. The Dark Horse Infrastructure Play

Silicon Valley won''t admit it, but this unsexy blockchain-as-a-service company powers half their ''innovations.'' Now trading at P/E ratios that won''t give your CFA nightmares.

Remember: stocks aren''t coins, and your broker still charges commissions. The more things change...

Circle Internet Group (CRCL)

Circle (CRCL) shares jumped over 10% yesterday after USDC announced that it has expanded natively to Sam Altman’s World Chain.

The MOVE follows a strong IPO last week, where Circle raised $1.1 billion and saw its stock surge nearly 280%.

Technically, CRCL closed yesterday at $116.33, up over 10.6%, but is trading 2% lower in the pre-market. The stock recently failed to break above two resistance levels at $118.95 and $123.

If these levels are tested again and broken, and momentum returns, CRCL could aim for a retest of its high at $138.57.

However, if the $106.30 support is breached, the stock risks sliding toward $101.51.

GameStop Corp. (GME)

GameStop (GME) reported a 17% year-over-year revenue decline in Q1, as the shift toward digital downloads erodes its brick-and-mortar business.

Despite efforts to expand e-commerce and streamline operations, hardware and accessories sales dropped by 32%, and store closures continue into 2025 following nearly 600 shutdowns last year.

The company posted a net profit of $44.8 million—boosted by cost cuts and the sale of its Canadian subsidiary—but still reported a $10.8 million operating loss due to restructuring charges.

In a separate announcement, GameStop plans to raise $1.75 billion through zero-interest convertible notes due in 2032, leveraging its strong liquidity position to explore new investments and potential acquisitions.

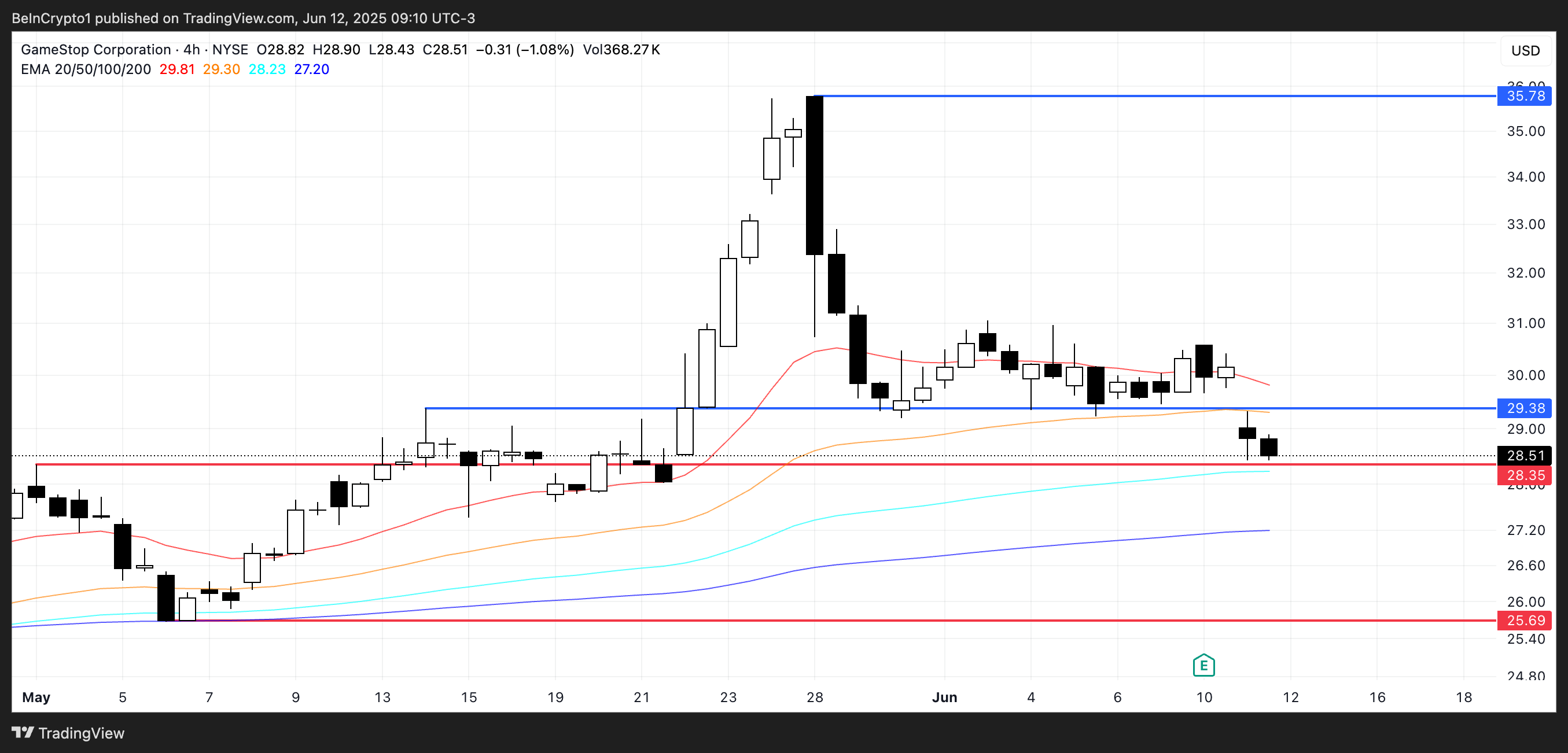

GME shares closed yesterday down 5.31% and are now down another 16% in pre-market trading. The stock is hovering just above a key support level at $28.35; if that level fails, it could quickly slide to $25.69, with further downside risk toward $23.

A confirmed open near $24 WOULD indicate that bearish sentiment is accelerating, potentially triggering another wave of selling pressure.

Whether the convertible note offering and Bitcoin investment can stabilize investor confidence remains to be seen amid growing volatility.

Coinbase Global (COIN)

Coinbase has expanded its political advisory council by adding David Plouffe, a top Democratic strategist known for leading Barack Obama’s 2008 presidential campaign and advising Kamala Harris in 2024.

Plouffe joins a growing list of bipartisan figures, including former Trump campaign manager Chris LaCivita and ex-Senator Kyrsten Sinema, as Coinbase aims to strengthen its influence in shaping U.S. crypto regulation.

COIN closed yesterday down 1.62% and is down another 2% in pre-market trading. The stock is currently near a key support level around $240.

If it manages to hold that support and reclaim resistance at $257, an uptrend could take COIN back toward the $270 level. However, failure to hold above $240 could trigger additional downside pressure in the short term.