Ethereum Breaks Free: Surging Toward $3,000 as Month-Long Consolidation Ends

Ethereum just shook off the shackles—bulls are charging as ETH flirts with the psychological $3k level.

Finally, some action. After weeks of sideways torture that had traders questioning their life choices, Ethereum''s breakout is injecting fresh hopium into crypto markets.

The move comes as Bitcoin dominance wobbles—altcoin traders are waking from hibernation. Technicals suggest this could be the start of a bigger leg up, assuming Wall Street doesn''t ruin everything with their usual ''risk management'' nonsense.

Funny how ''consolidation'' is just finance-speak for ''we had no idea what would happen next.'' Now watch the suits scramble to justify this rally with post-hoc fundamentals.

Ethereum Investors Prepare For Surge

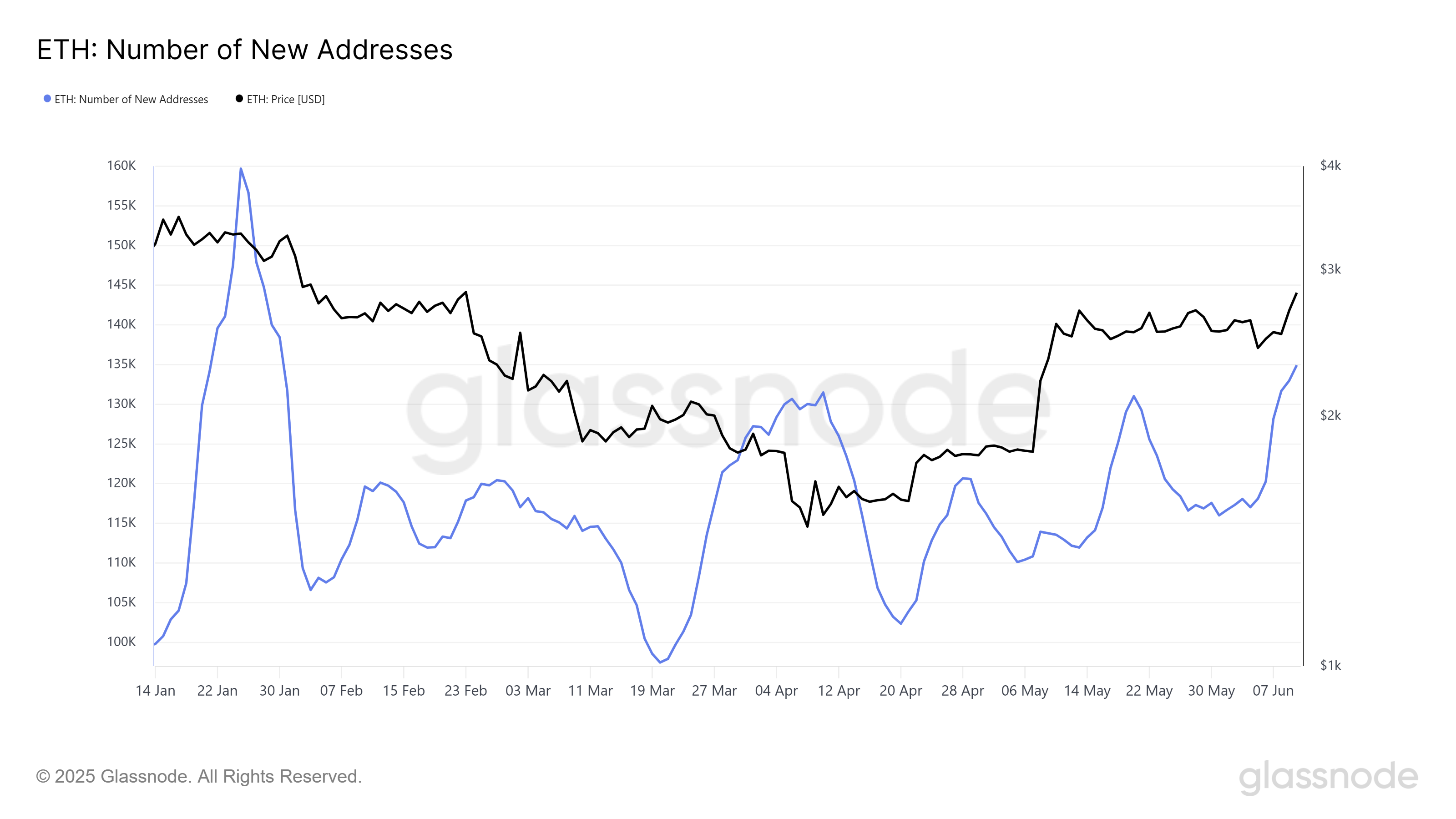

New addresses have reached a four-month high, signaling that ethereum is gaining traction among investors. The increase in new addresses is a positive sign for the altcoin’s adoption, indicating that more investors are showing interest in Ethereum.

However, many of these new addresses could be driven by FOMO (Fear of Missing Out), making them more susceptible to volatility. These investors, while helping boost Ethereum’s price, could also sell off quickly if the market shifts, which poses a risk for sustaining any price surge.

Despite the risks of FOMO-driven behavior, the rise in new addresses is a clear indication that Ethereum is still attracting new participants. The influx of new investors could help drive ETH’s price higher.

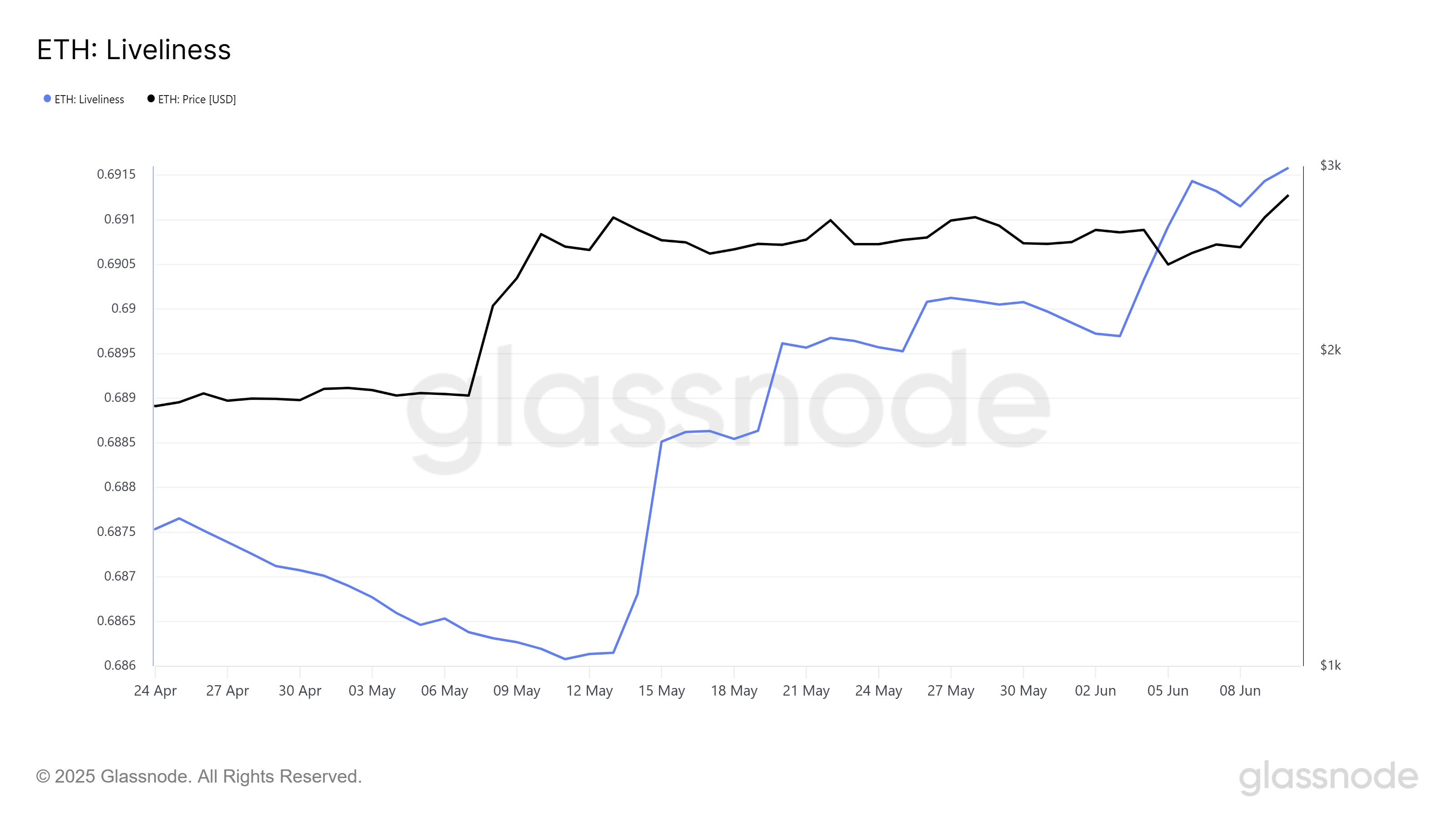

The Liveliness metric continues to climb this week, signaling that long-term holders (LTHs) are increasingly liquidating their holdings. Liveliness measures how frequently coins are moved from wallets, and a rise in this metric indicates selling pressure.

As LTHs exit the market, their selling could negatively impact Ethereum’s price. Since these investors typically hold through volatility, their decision to sell may signal a lack of confidence in ETH’s short-term outlook. This selling trend could hinder Ethereum’s efforts to breach the $3,000 mark, much like it contributed to ETH’s consolidation in May.

LTHs play a critical role in supporting the price of Ethereum, and their exit could make it harder for the altcoin to maintain a strong uptrend. If this trend continues, Ethereum may struggle to make it to $3,000.

ETH Price Needs To Find A Way

Ethereum’s price is currently standing at $2,769, rising by 14.6% this week after escaping a month-long consolidation under $2,681. ETH is now facing resistance at $2,814.

The altcoin’s price is about 8% away from the $3,000 mark, which it last reached in February this year. If LTH selling halts and broader market cues remain bullish, Ethereum’s price could push toward $3,000.

However, if the ongoing LTH selling continues to outweigh bullish cues, Ethereum is likely to dip back to its support level at $2,681. Losing this support could trigger further declines, potentially sending ETH to $2,476. If this occurs, the bullish thesis WOULD be invalidated, and Ethereum could enter another consolidation phase.