Bitcoin ETFs Rack Up Biggest Inflows Since May—But Skepticism Creeps In

Wall Street''s latest crypto crush shows signs of cooling off. Bitcoin ETFs just posted their strongest inflow surge since May—yet traders are suddenly hedging their bets.

The numbers don''t lie (but hedge funds might)

While institutional money flooded in, the mood shifted faster than a meme coin pump-and-dump. Even Goldman''s custodial wallets couldn''t mask the side-eye from traditional finance.

The closer:

When ETF flows and trader sentiment diverge this hard, someone''s about to get rekt—and it''s usually the guy who still thinks ''stablecoin'' isn''t an oxymoron.

Bitcoin ETF Demand Rises Sharply

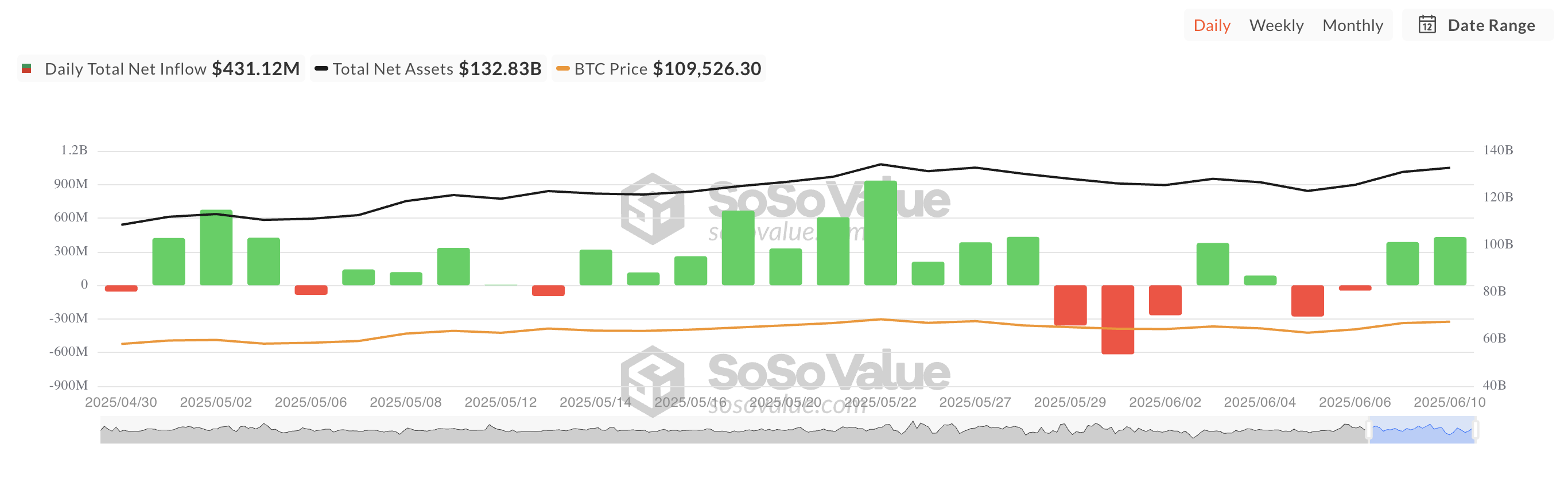

Tuesday saw a significant uptick in demand for US-listed spot Bitcoin ETFs, with net inflows climbing to $431.12 million, up 12% from the previous day’s $386 million.

The capital influx into ETFs is a leading indicator of broader market appetite, suggesting that institutional players are positioning for further upside. The surge in demand for ETFs comes amid growing Optimism that the leading coin, BTC, could soon reclaim the $110,000 level, with some traders eyeing a potential return to its all-time high.

Yesterday, BlackRock’s IBIT led with the highest daily inflows, totaling $337 million, bringing its total historical net inflow to $49.11 billion.

Fidelity’s FBTC recorded the second-highest daily net inflow at $67.07 million, bringing its total historical net inflows to $11.68 billion.

BTC Price Holds Steady, but Futures and Options Signal Caution

With profit-taking activity gradually gaining momentum, the BTC spot price has remained largely flat over the past 24 hours. As of this writing, the king coin trades at $109,601, noting a modest 0.11% gain.

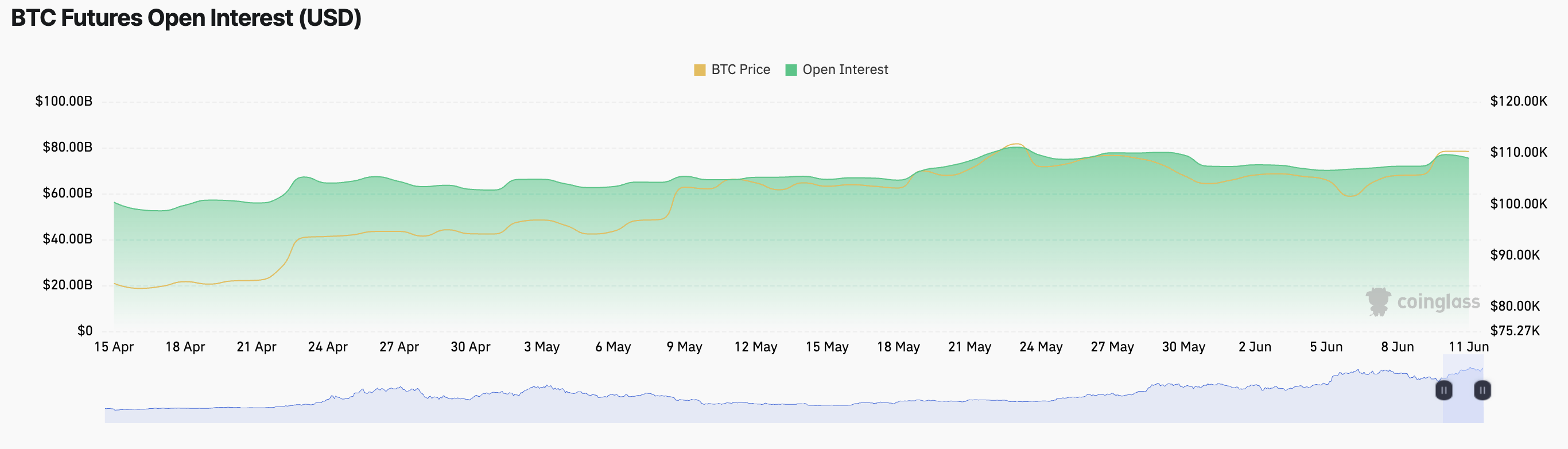

Meanwhile, open interest in the coin’s futures has declined, signaling a pullback in trading activity. At press time, this is at $75.33 billion, falling 1% over the past day.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. A decline in open interest signals reduced trading activity or profit-taking, as traders close out existing positions.

In BTC’s case, the slight dip in futures open interest indicates early-stage profit-taking among traders who had positioned long during the recent rally. If this trend persists, the downward pressure on the coin will strengthen.

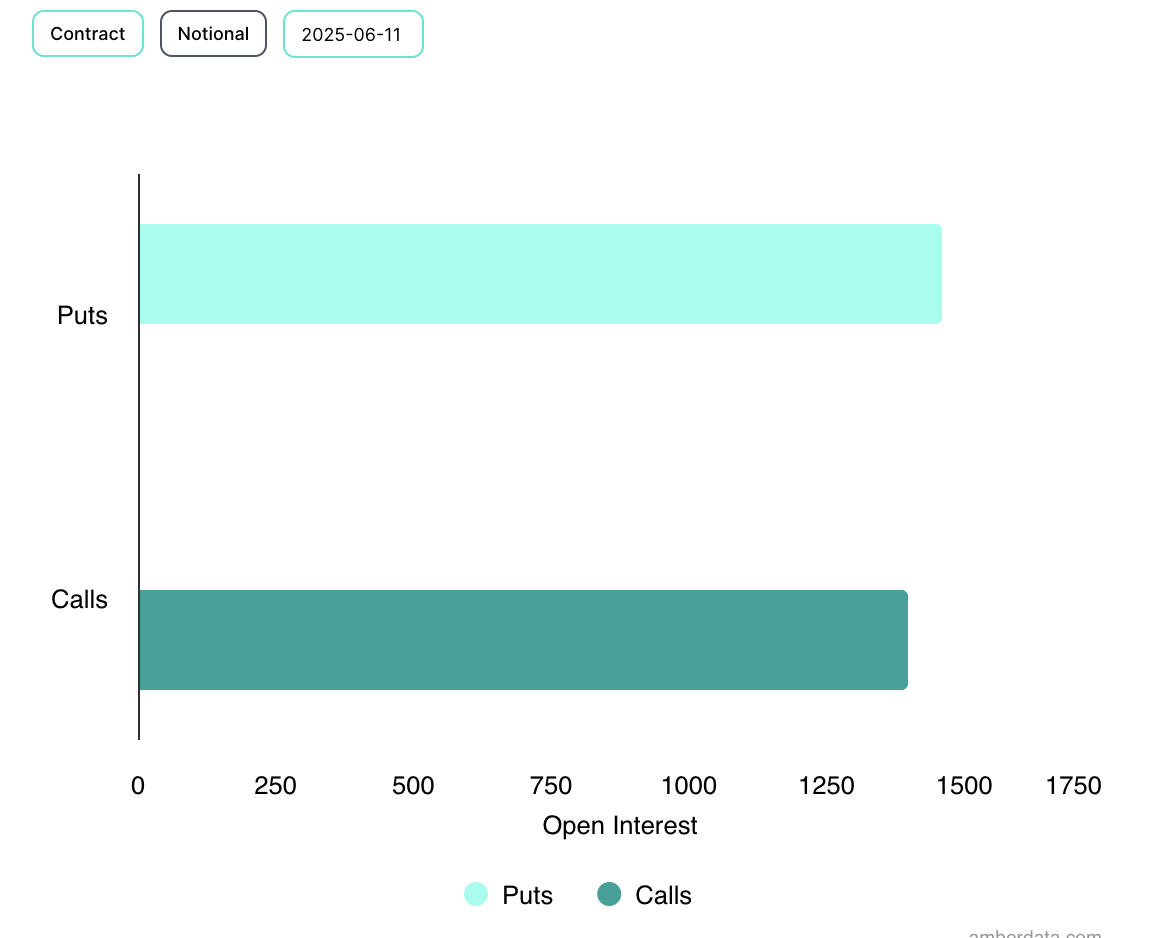

Further, sentiment is also cautious in the options market. Demand for put options has risen, suggesting a subtle resurgence of bearish expectations.

Therefore, while ETF inflows paint a bullish macro picture, near-term price action and derivatives positioning indicate a potential cooling-off period as investors take profit.