Hedera Teeters on the Edge of a Golden Cross – Will HBAR Skyrocket or Crash Back to Reality?

Technical traders are buzzing as Hedera's charts hint at a bullish golden cross formation—a classic signal that could send HBAR prices soaring. Or, you know, it might just be another false alarm in crypto's endless parade of 'sure things.'

What's a golden cross? When the 50-day moving average punches above the 200-day, historically a sign of momentum shifting in favor of the bulls. HBAR's flirtation with this pattern comes after months of sideways action—enough to make even the most patient bagholders twitchy.

But here's the kicker: In crypto-land, TA patterns work until they don't. Remember when that 'death cross' last year was supposed to bury HBAR? The token promptly gained 40% just to spite the chartists. Never change, crypto.

Whether this golden cross delivers or becomes another 'buy the rumor, sell the news' event depends on one thing: Can Hedera's enterprise adoption narrative finally outweigh the market's addiction to vaporware and memecoins? Place your bets—the house always wins.

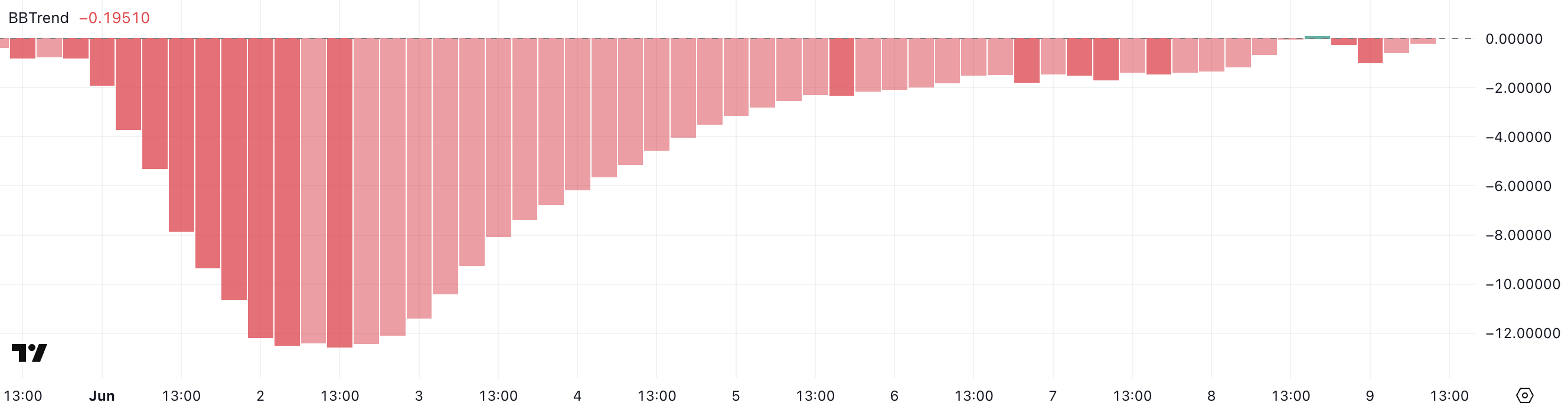

HBAR’s Persistent Negative BBTrend Could Delay Bullish Breakout

As reflected by its BBTrend indicator, Hedera has shown persistent bearish momentum over the past two weeks. Since May 26, the BBTrend has remained in negative territory, reaching a low of -12.54 on June 2.

As of now, the indicator sits at -0.195, suggesting a potential easing of the downtrend, though the overall sentiment remains weak.

Despite briefly touching 0.09 yesterday, the negative BBTrend trajectory shows that bullish pressure has yet to take hold convincingly.

BBTrend, short for Bollinger Band Trend, measures the direction and strength of price movements based on the position of the price relative to Bollinger Bands.

A positive BBTrend suggests bullish momentum, while a negative reading indicates sustained selling pressure or sideways movement within the lower part of the Bollinger Band range.

With HBAR’s BBTrend still slightly negative at -0.195, it signals caution—although the extreme bearishness seen earlier in June has moderated, the asset hasn’t firmly transitioned into a bullish phase.

HBAR Recovers From Oversold Levels

Hedera is showing signs of recovering momentum, with its Relative Strength Index (RSI) currently at 57.17—up sharply from 27.62 on June 5.

Since June 6, RSI has held consistently above the neutral 50 mark, suggesting buyers gradually gain control.

However, despite this upward shift, HBAR’s RSI has struggled to break above the 60 threshold over the past three days, signaling that bullish momentum remains limited and faces resistance just as it begins to build.

The RSI is a widely used momentum oscillator that ranges from 0 to 100. Values above 70 indicate overbought conditions, while those below 30 point to an oversold market. Readings around 50 suggest a neutral stance.

With HBAR’s RSI currently testing the 50–60 zone, the asset is in a transition phase—neither strongly bullish nor bearish.

A decisive break above 60 could open the door to further upside, but its recent inability shows that the bulls still lack conviction for a sustained rally.

Will Hedera Break $0.20?

Hedera price is approaching an important moment, as its Exponential Moving Averages (EMAs) hint at a potential golden cross formation. This bullish signal occurs when a short-term EMA crosses above a long-term EMA.

If this crossover materializes, it could trigger upward momentum and drive HBAR to test the resistance at $0.175.

A strong breakout above that level may open the path toward $0.193, and if the uptrend gains traction, HBAR could surge to as high as $0.209, reclaiming the $0.20 zone for the first time since May 23.

However, the bullish scenario hinges on sustained upward momentum. HBAR may retreat to test the immediate support at $0.160 if the rally fails to develop.

A breakdown below that level could drag the price to $0.155, placing it at risk of deeper short-term losses.