SPX Meme Coin Teeters on the Brink of a Parabolic Surge – Traders Brace for Liftoff

Forget fundamentals—this dog's got rockets. The SPX meme coin, once dismissed as another degenerate casino chip, now flashes bullish signals that even institutional traders can't ignore.

Chart patterns suggest an imminent breakout. Liquidity pools are tightening. And let's be honest—after the last 'stable' coin debacle, everyone's hungry for volatility porn.

Will it moon? Probably. Will it rug? Eventually. But in today's market, that 15-minute window is all you need to pretend you're a genius.

SPX Investors Exhibit Mixed Signals

The adoption rate for SPX6900 has reached a two-month high of 25%. This adoption rate refers to the percentage of new addresses making their first transaction relative to all active addresses on a given day.

The uptick in new investors’ activity is a strong bullish signal, suggesting growing interest in the meme coin.

This rise in adoption is a key indicator of SPX6900’s potential for growth. New holders typically bring fresh capital into the market, which can help push the price higher.

As the number of new addresses increases, investor confidence may follow, pushing SPX closer to a breakout.

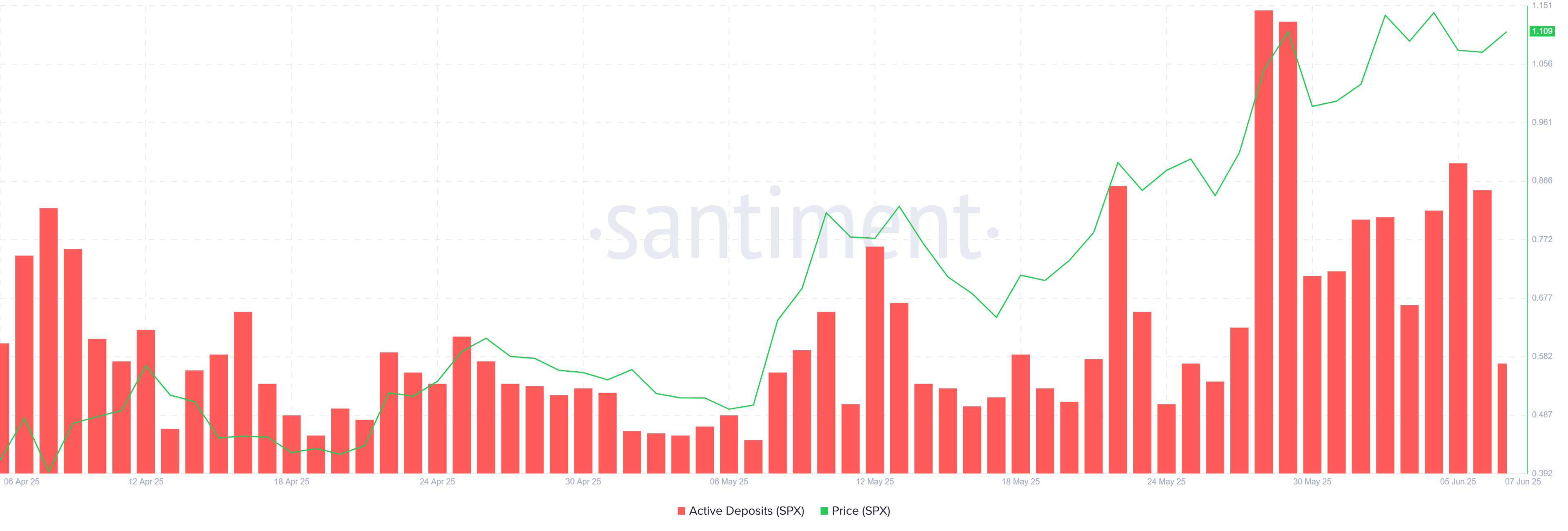

Despite the bullish sentiment driven by new holders, there are signs that SPX6900 may face challenges. Active deposits, which track the amount of SPX being moved to exchanges, have been rising in recent days.

This indicates that investors are likely preparing to sell their holdings, which could put downward pressure on the token.

The rising deposits are contributing to the current consolidation in SPX6900’s price, as selling pressure is counteracting the positive sentiment from new investors. If the trend of increasing deposits continues, the price range could remain bound.

SPX Price Aims For Breakout

SPX6900’s price has been up 9% over the last 24 hours, adding to the 17% growth this week. Despite this, the meme coin continues to struggle at the $1.20 resistance, a level it has been unable to breach for several days.

Trading at $1.16, the ongoing selling pressure may prevent a breakout above this level in the short term.

The recent formation of a Golden Cross with the Exponential Moving Averages (EMAs) towards the end of May suggests bullish potential for SPX. However, this bullish outlook is being tempered by the rising active deposits.

As long as selling pressure persists, SPX will likely remain stuck between the $1.20 resistance and the $1.00 support level, preventing any significant upward movement.

If the current selling trend slows down, SPX6900 could finally break through the $1.20 resistance. This WOULD open the door for the meme coin to move toward $1.40, which would invalidate the bearish outlook and restore investor confidence.