World Liberty Financial’s Treasury Gamble: Can It Pump Life Back Into the TRUMP Meme Coin?

Another day, another corporate entity trying to ride the crypto hype train—this time with a side of political meme magic. World Liberty Financial’s latest treasury plan has traders whispering: Is this the lifeline the fading TRUMP token needs, or just another desperate grab for relevance?

The Setup: Meme Coins on Life Support

TRUMP, the cheeky digital asset that peaked during the 2024 election cycle, has been bleeding value faster than a scandal-plagued campaign. Now, a financial firm wants to play hero—because nothing screams 'stable investment' like tying corporate strategy to an internet joke.

The Punchline: Treasury Plays and Tokenomics

Details are scarce (shocking for crypto), but the plan reportedly involves diverting capital to 'strategic acquisitions' of TRUMP tokens. Because if there’s one thing markets love, it’s artificial demand propped up by suits who still think 'HODL' is a financial term.

Closing Irony: A Cynic’s Paradise

Will it work? Maybe—if you believe in miracles, momentum, and the infinite gullibility of crypto speculators. Either way, it’s a fitting tribute to modern finance: where memes, money, and murky treasury maneuvers collide.

Eric Trump Announces Major Stake by World Liberty Financial

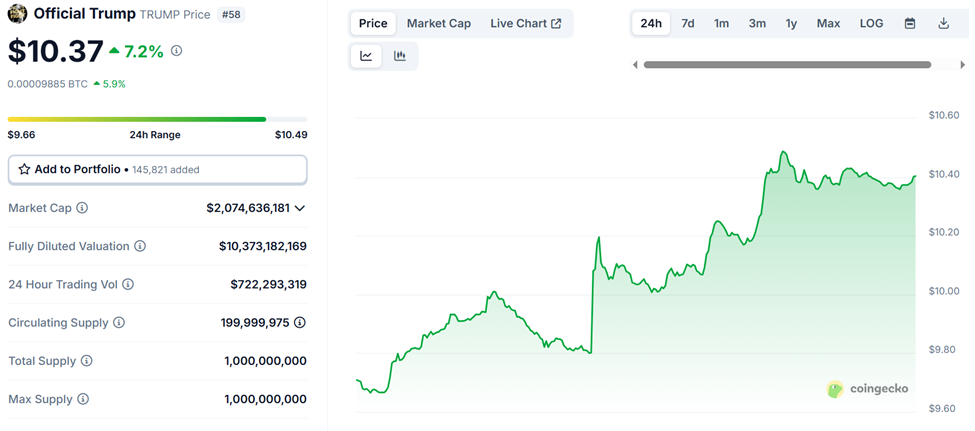

The TRUMP meme coin has risen 7% in the last 24 hours and was trading for $10.37 as of this writing. The surge follows a high-profile announcement from Eric Trump, who revealed a new partnership between the token and World Liberty Financial (WLFI).

The financial firm, partially owned by a Trump entity, plans to acquire a “substantial position” in TRUMP for its Long-Term Treasury.

“I am proud to announce the TRUMP Meme Coin has aligned with World Liberty Financial… We’re proud to announce that World Liberty Financial plans to acquire a substantial position in TRUMP for their Long-Term Treasury,” Eric Trump posted on X (Twitter).

Trump’s DeFi project, World Liberty Financial, echoed the announcement on its official Twitter account, citing common values and mission.

The Trump meme and WLFI may be different lanes, but they share the same highway. Same values, same mission—amplifying American strength through innovation.

https://t.co/7QwCzpz7fa

https://t.co/7QwCzpz7fa

The announcement sparked investor enthusiasm. Supporters quickly celebrated the move as a strategic step toward integrating patriotism and crypto innovation.

According to CoinWings, a popular account on X and WLFI investor, the combination of the two could generate tremendous momentum.

Beyond cheer, however, there were also equal parts skepticism, amid suspicion and ethical concerns.

Backlash And Ethical Storm Around TRUMP Coin

Critics immediately raised questions about the deal’s ethics and transparency. Crypto trader Clemente called the collaboration a “joke,” while another user pointed to a potential scandal and likely lawsuit.

Meanwhile, talk of manipulation and insider trading is also rising after a World Liberty Financial advisor shorted TRUMP with $1 million and flipped long.

ogle(@cryptogle), the advisor of @worldlibertyfi, closed his short position on $TRUMP at a loss of $188K.

Then he flipped to long $TRUMP 4 hours ago, with a liquidation price of $8.https://t.co/K8fEhxAMV4 pic.twitter.com/DAkCwCdtIu

Specifically, the advisor, Ogle, opened a 10x Leveraged short position on TRUMP. He then closed it at a $188,348 loss and went long again on the same token, this time with a 4x leveraged position worth $3 million.

“What kind of operation you guys got running over there?” one user chimed.

If the TRUMP coin price falls below $8, Ogle will be liquidated.

Some users are comparing WLFI’s financial practices to those of Alameda Research, the controversial trading arm of the now-defunct FTX exchange.

Critics argue that insider trading and profit-seeking may be behind the patriotic branding. According to an April 2025 NewYork Times investigation, 60% of WLFI is owned by a Trump-affiliated entity. Meanwhile, 75% of its revenue stems from TRUMP coin sales.

This has raised major ethical concerns around blending political power and personal profit.

Regulatory uncertainty adds another LAYER of complexity. While the SEC has classified TRUMP as a non-security due to its speculative meme-based nature, the CFTC claims it falls under commodity jurisdiction.

SEC Commissioner Hester Peirce has stated that the TRUMP token is outside the SEC's regulatory scope, indicating that investors should not expect guidance on the meme coin.

In February, the SEC announced that most meme coins are not classified as securities under U.S. federal…

Meanwhile, in January, Trump’s crypto czar, David Sachs, said TRUMP coin was considered a collectible, quashing claims of conflict of interest.

“This means you should sell TRUMP just like when Eric Trump told you to buy $ETH and it dumped 50% over the next month,” wrote one user, referencing prior dubious trading advice.

A Forbes report from May 2025 estimates WLFI has generated $550 million in sales during Trump’s second term, potentially netting the family $400 million. Reports from The Verge also show strategic shorts of the TRUMP coin by contest winners and insiders.

Against this backdrop, concerns arise about whether this is a long-term treasury play or another well-dressed pump.