Bittensor Blasts Past 118 Subnets as TAO Eyes $1,000—Is This the Next AI Crypto Darling?

Bittensor's network expansion hits hyperdrive—crossing 118 subnets while TAO token flirts with a four-digit price target. The decentralized AI project keeps defying gravity as speculators pile in.

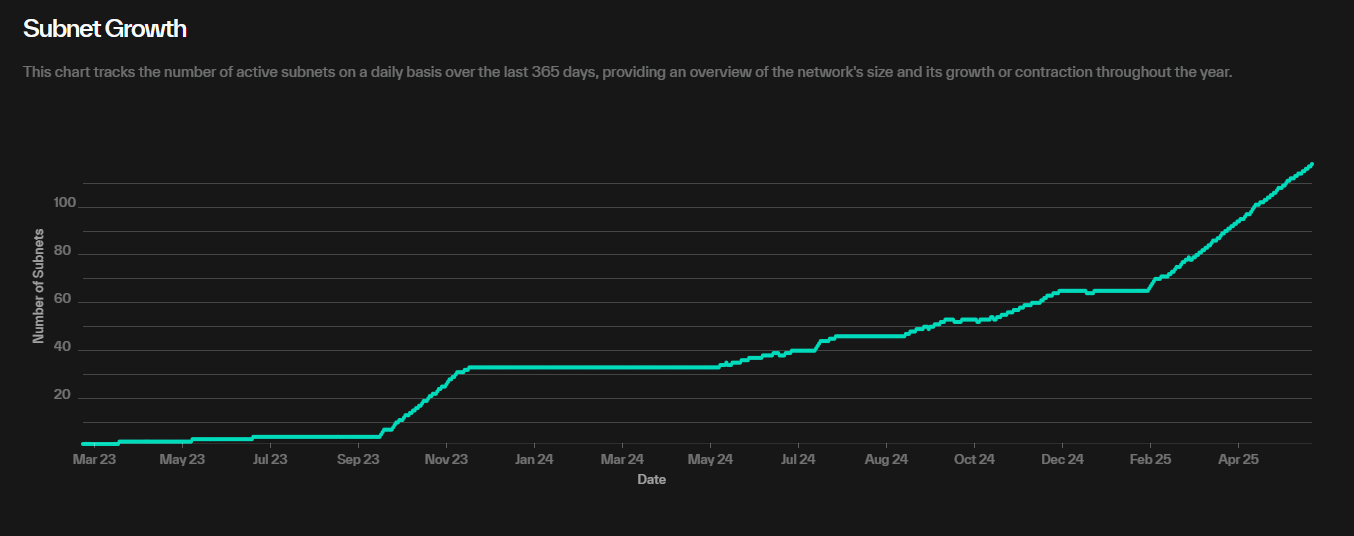

Subnet surge signals growing demand

With 118 subnets now live, Bittensor's modular approach to machine learning is gaining serious traction. Each subnet specializes in distinct AI tasks, creating a marketplace of decentralized intelligence.

TAO's $1,000 price whispers

The native token's rally has traders dusting off their old 'number go up' playbooks. At current trajectories, that psychological barrier could shatter faster than a VC's promises during bull market.

As Bittensor's ecosystem expands, the real test begins: Can it deliver real-world utility beyond crypto's usual speculative frenzy—or is this just another case of 'buy the rumor, sell the AI'?

What Does the Record Number of Bittensor Subnets Mean?

According to data from Taostats.io, Bittensor reached its highest-ever subnet count with 118 active subnets as of early June 2025.

To understand this milestone, it’s important to know that subnets are subnetworks within the Bittensor ecosystem. They are where developers, data providers (miners), and validators collaborate to build, train, and evaluate decentralized AI models.

Each subnet focuses on a specific task, such as natural language processing, data analysis, or AI content generation.

According to project documentation, these subnets operate under an incentive model. Miners and validators receive TAO tokens as rewards for contributing to the network.

The increase to 118 subnets indicates strong ecosystem expansion. This means more AI projects are being launched on Bittensor, drawing more participants, from developers to investors.

This rise also reflects a broader diversification in decentralized AI applications. As a result, the Bittensor network becomes more robust and flexible. However, it also presents challenges.

Maintaining quality and performance across subnets will require ongoing technical upgrades to ensure network stability.

BitGo Partners with Yuma to Drive Institutional TAO Staking

Another key growth driver is the recent partnership between BitGo and Yuma.

BitGo, a leading digital asset management platform, has teamed up with Yuma, a top validator on Bittensor, to offer TAO staking services for institutional investors.

This MOVE enables investment funds, asset managers, and large corporations to participate in the Bittensor network. They can earn staking rewards while supporting the development of decentralized AI.

The partnership boosts TAO’s liquidity and strengthens institutional confidence in Bittensor’s long-term potential.

According to Taostats, over 6 million TAO are currently staked, representing over 70% of the circulating supply.

Additionally, the Yuma Consensus 3 upgrade, announced by Opentensor in early June, introduced major improvements to the network. Yuma Consensus is Bittensor’s Core consensus algorithm. It allocates rewards to miners and validators based on their contributions.

The upgrade enhances fraud detection and punishment mechanisms. It also optimizes how rewards are distributed.

Can Bittensor (TAO) Reach $1,000 in 2025?

Optimism about Bittensor stems from technical upgrades and bullish price forecasts. Analyst Decode, using Elliott Wave Theory, predicts that TAO could break past the $1,000 mark soon.

“You will see a similar structure and bullish setup on many other altcoins, but few are as strong as TAO, imo,” Decode commented.

However, Decode’s forecast may be overly optimistic. The total market cap of AI altcoins has dropped over 50%, from $69 billion at the end of 2024 to $31 billion today.

A recent BeInCrypto report also highlighted that the AI crypto sector has declined by over 45% year-to-date.

TAO seems to face the same issue as many platform altcoins, such as Sei, Sonic, or Avalanche. Despite strong fundamentals, investors remain hesitant to commit capital.