$4 Billion Crypto Bomb: Bitcoin and Ethereum Options Expire Today—And Traders Are Betting Big

Wall Street’s crypto casino is cashing out today—with nearly $4 billion in Bitcoin and Ethereum options hitting expiry. Call buyers dominate, signaling bullish conviction... or just another round of speculative FOMO.

Why it matters: When this much notional value flushes through the system, volatility tends to follow. Market makers will be scrambling to hedge, and the algos are already licking their lips.

The cynical take: Of course the calls outweigh the puts—retail traders haven’t met a leverage trap they didn’t like. Just don’t ask what happens when the music stops.

Crypto Markets to See $3.7 Billion in Bitcoin, Ethereum Options Expire

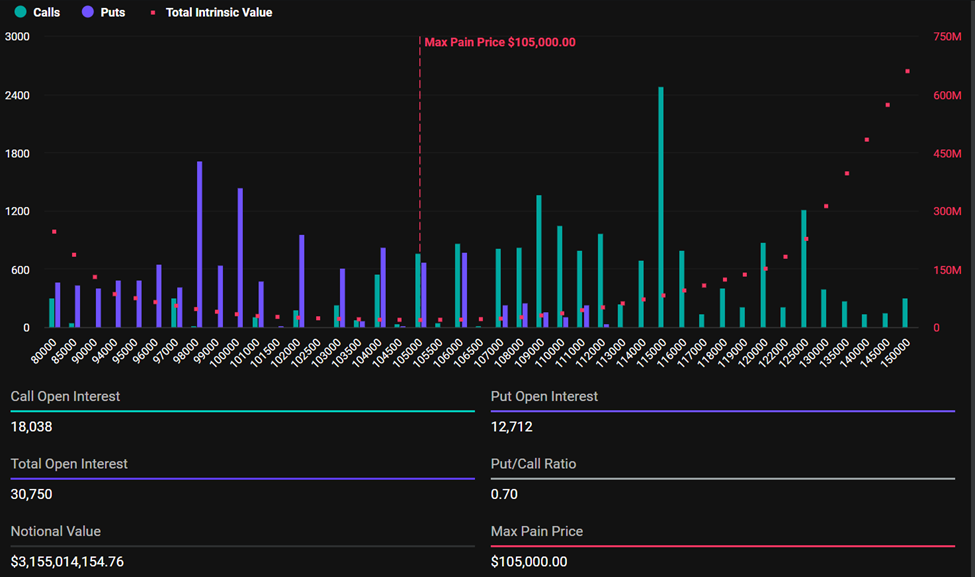

According to data from Deribit, 30,750 Bitcoin options contracts will expire on June 6. This tranche is significantly smaller than last week’s 92,459 contracts.

These contracts have a put-to-call ratio of 0.7 and a maximum pain point of $105,000.

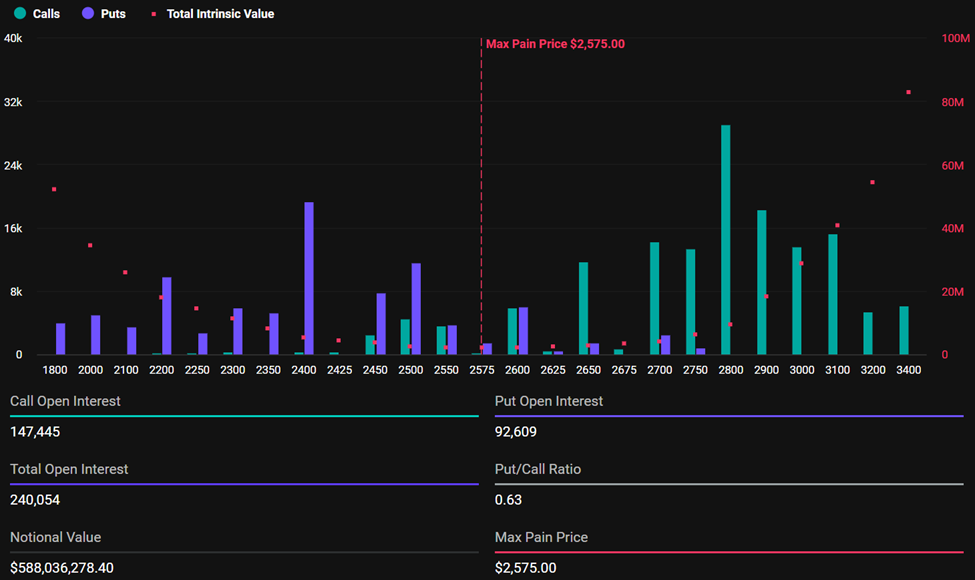

Similarly, Ethereum’s options market is set to expire with 240,054 contracts. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.63 and a maximum pain point of $2,575.

In crypto options trading, traders analyze put-to-call ratios to gauge market sentiment. Bitcoin’s put-to-call ratio indicates a prevalence of Call options rather than Put options, suggesting more bullish expectations. The same applies to Ethereum, whose put-to-call ratio is also below 1.

Notably, Bitcoin was trading for $102,769 as of this writing. Meanwhile, Ethereum exchanged hands for $2,456, with both assets below their Max pain levels.

The maximum pain point suggests that Bitcoin and Ethereum prices may hover around these critical levels as the options expire. This explains the bullish expectations as both assets remain below their strike prices. This could cause losses for both bulls and bears.

As these options settle, they could generate volatility, with the potential for sudden price shifts. However, this hinges on how the market reacts.

“Calls dominate up the curve. What do you expect to happen after the expiry,” analysts at Deribit posed.

Bitcoin Traders Bearish Short-Term, but Massive Options Bet Signals Q3 Optimism

Elsewhere, Bitcoin traders show signs of caution. This is likely attributed to the fallout between President Donald TRUMP and Elon Musk.

According to Greeks.live, most market participants remain bearish and expect further correction. The range of $105,000 to $109,000 is seen as a strong resistance zone. Many traders believe Bitcoin will struggle to break through it in the short term.

Volatility also remains unusually low, which creates a challenging environment for options traders. In response, many are selling short Call options that expire on June 7, particularly around the $108,000 to $109,000 level.

This strategy reflects the belief that Bitcoin will stay below that resistance in the NEAR future. Some traders even use this approach as a longer-term rolling strategy.

Specifically, they anticipate a possible rise to $150,000 by the fourth quarter (Q4), but not before more short-term weakness or consolidation.

“Traders suggest implementing a short call spread strategy as a potential ‘flywheel’ for permanent rolling portfolio positions, with a view that BTC may reach $150K by Q4,” Greeks.live indicated in a post.

Many traders stay on the sidelines despite the temptation to buy into the market now. They await a deeper pullback before entering long positions.

Further, Greeks.live analysts also reported the largest crypto options block trade in history. The trade was valued at $1.19 billion, which involved 11,350 BTC and generated $7.5 million in premiums.

This trade was split into two parts. The first is a bullish spread for September, betting on both a price increase and higher volatility later this year. The second is a sale of July at-the-money (ATM) calls, signaling low expectations for upside in the short term.

However, the market remains quiet and uncertain ahead of today’s options expiry. Some traders are preparing for a major MOVE later in the year. The massive options trade shows that while July may remain flat, there is growing confidence in a stronger Bitcoin rally by Q3.