World Liberty Financial Drops $47 in Stablecoins to WLFI Holders—Because Everyone Loves Free Money

In a move that's either generous or desperate for attention, World Liberty Financial just airdropped $47 worth of USD1 stablecoins to WLFI token holders.

Free crypto? Sure—but let's see if this moves the needle for a project that's still trying to convince the market it's not just another DeFi also-ran.

Because nothing says 'financial revolution' like handing out the equivalent of a nice dinner.

47 USD1 Stablecoins Sent to WLFI Participants

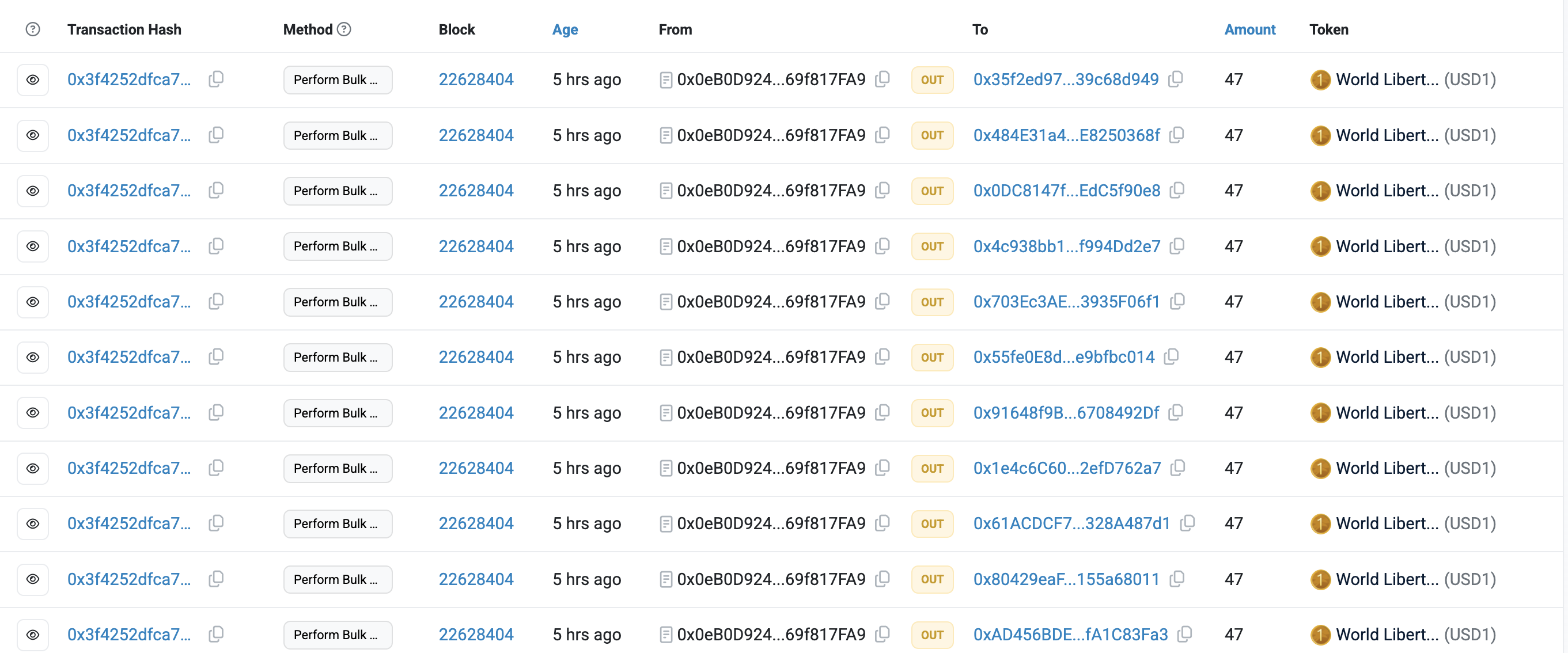

World Liberty Financial’s airdrop sent 47 USD1 stablecoins to each WLFI holder. This distribution reflected the project’s recent governance decisions and its commitment to transparency. Etherscan data provided instant evidence of the transfers, enabling the community to analyze and discuss the event.

“Looks like Trump’s World Liberty (@worldlibertyfi) is airdropping 47 $USD1 to every wallet that participated in the $WLFI sale,” Lookonchain stated.

This quick community verification reinforced trust in the process and affirmed the authenticity of the airdrop event.

Community Response and Project Outlook

The airdrop ignited discussions within the community, as users tracked wallet balances and debated WLFI’s next steps. Moreover, publicly accessible transaction records on Etherscan increased confidence in the event’s legitimacy.

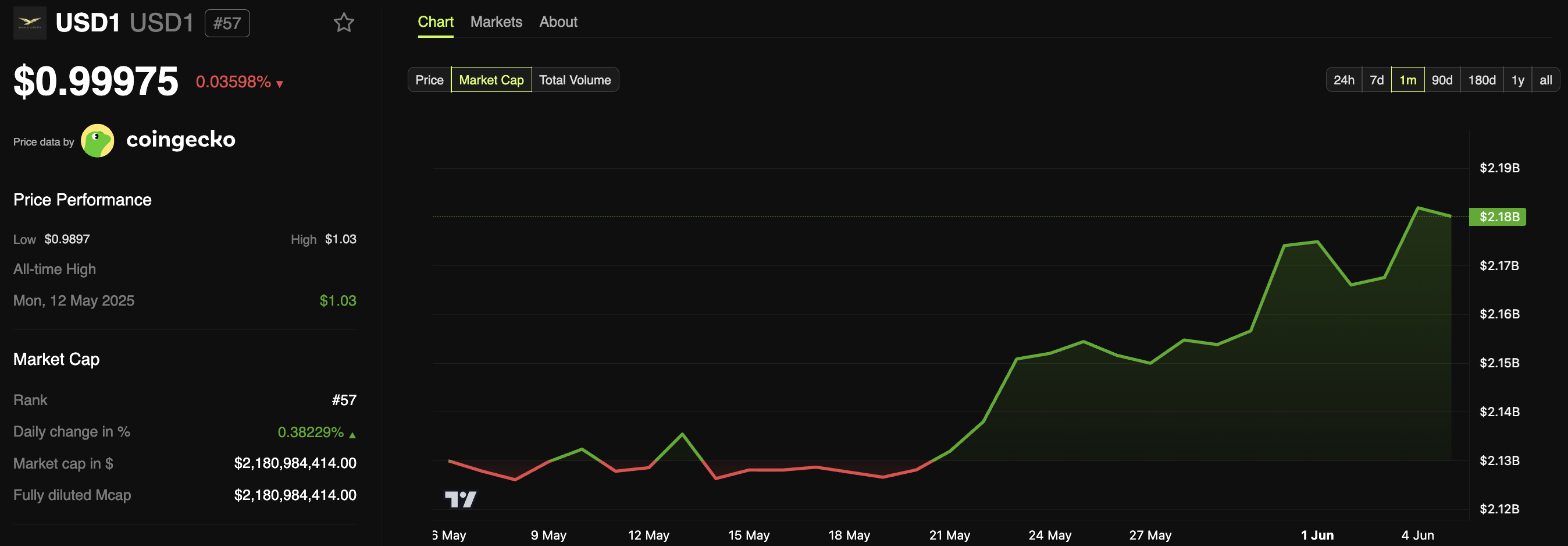

Notably, USD1 stablecoin has rapidly captured a significant market share. Its circulation has surged past $2 billion, a sign of both booming adoption and growing trust in the ecosystem. However, most of its supply remains concentrated in just three wallets, which raises questions about decentralization and poses potential risks around liquidity and control.

Industry analysts emphasize that, while this transparent approach to distribution and tracking sets a benchmark for on-chain projects, ongoing monitoring of wallet concentration will be crucial as World Liberty Financial and USD1 seek broader acceptance. The recent airdrop marks a significant step forward, using verifiable blockchain data and live analysis to demonstrate a large-scale, transparent token allocation in the fast-evolving crypto landscape.