Why Bitcoin Miners Might Hold the Key to BTC’s Next Breakout

Bitcoin miners are sitting on a powder keg of potential—and the market’s starting to notice.

As accumulation patterns shift and hash rate stabilizes, these network validators could trigger the next parabolic move. Here’s why.

The Miner Reserve Factor

On-chain data shows miner wallets holding 1.8M BTC—that’s 8.6% of circulating supply gathering dust in cold storage. When these coins start moving, price discovery follows.

Hash Ribbons Signal

The 30-day hash rate recovery after capitulation events has preceded every major rally since 2016. We’re currently 23 days into the current cycle.

Energy Arbitrage Play

With Texas mining ops now leveraging real-time grid pricing, operational costs dropped 34% last quarter—freeing up capital for strategic accumulation.

Of course, Wall Street will claim they saw it coming all along—right after they finish downgrading their price targets. The smart money’s watching the mempool, not the analysts.

BTC Miner Reserve Climbs to 1.8 Million as Selling Pressure Eases

According to CryptoQuant, miners on the Bitcoin network continue to hold tightly to their coins amid BTC’s sideways price movement. This is evident in the rising BTC miner reserve, which indicates that fewer coins are being sent to exchanges for liquidation.

As of this writing, the BTC miner reserve holds 1.8 million coins, adding 1,556 BTC over the past week. When the miner reserve rockets like this, miners on the network are holding onto more of their mined coins instead of selling them. This behavior signals bullish sentiment, as miners expect higher prices in the NEAR term.

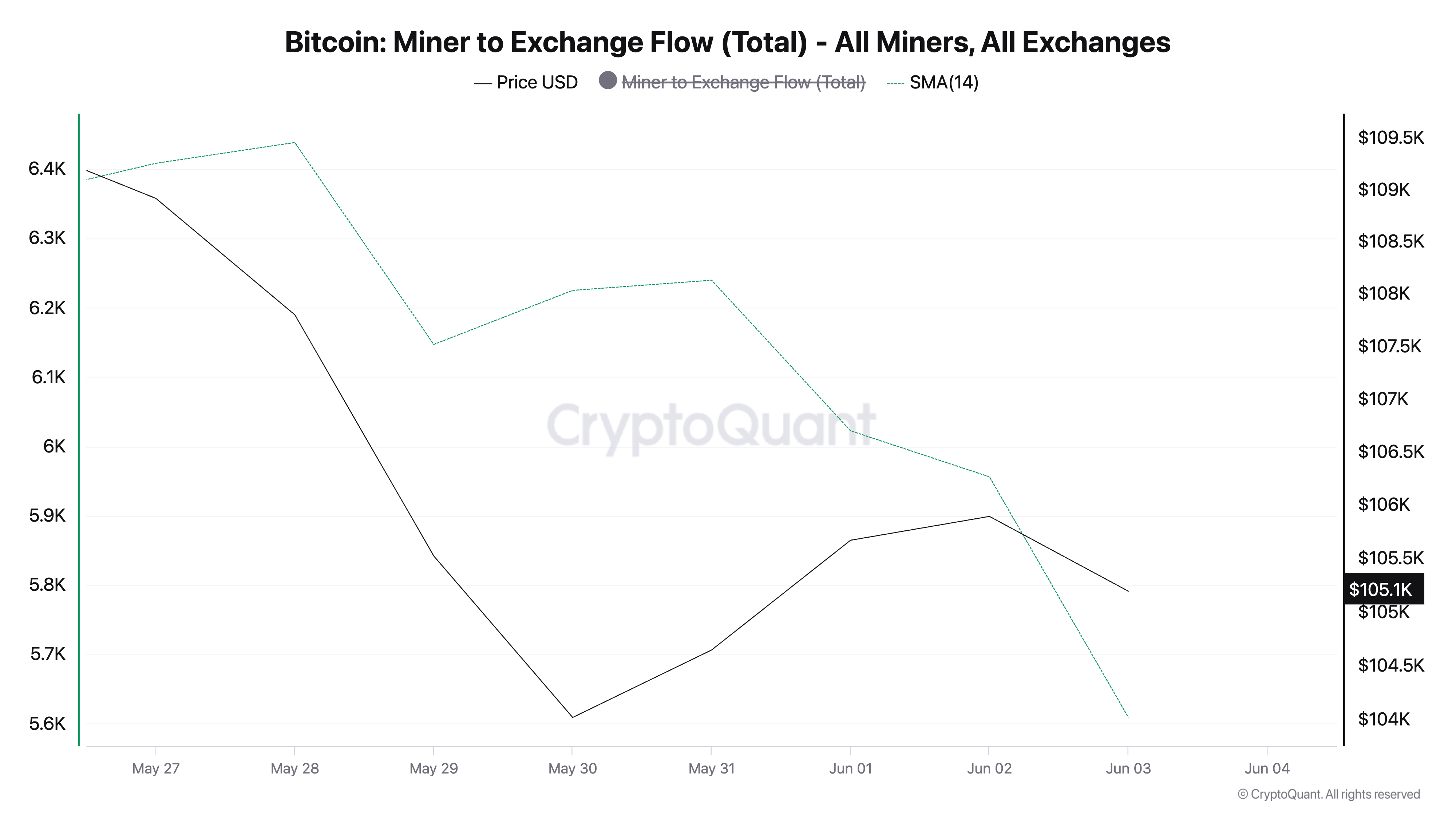

Moreover, BTC’s Miner-to-Exchange Flow—which measures the total amount of coins sent from miner wallets to exchanges— has dipped. Observed on a 14-day small moving average, it has dropped 14% over the past seven days.

When BTC’s Miner-to-Exchange FLOW drops like this, it suggests that miners are not selling their coins. This reduced selling pressure can help stabilize BTC’s price and trigger a sustained rally.

BTC Teeters Between $109,000 Target and $100,000 Breakdown

BTC trades at $105,103 at press time, just below the resistance formed at $106,548. If bitcoin miners refrain from selling, this could trigger a market-wide accumulation that pushes BTC past this resistance level.

In this scenario, the coin could trade at $109,310.

However, if profit-taking strengthens, BTC could fall further to $103,061. Should this support floor weaken, the coin risks breaking below $100,000.