Bitcoin Smashes Through $105,000 as Powell’s Dovish Whispers Ignite Market Frenzy

Fed chair Jerome Powell just handed crypto bulls the match they’ve been waiting for—and Bitcoin’s roaring back with a vengeance.

The king of crypto surged past $105,000 today after Powell’s International Finance speech sent traders scrambling to price in potential rate cuts. Because nothing makes money move faster than the faintest whiff of cheap liquidity, right?

This isn’t just a rebound—it’s a full-blown market repricing. Traders are now betting the Fed’s next move will involve scissors rather than hammers. And where does that money flow first? To the asset that never needed the Fed’s permission to exist in the first place.

Of course, Wall Street’s suddenly rediscovered its ’risk appetite’—just in time to chase the rally they missed at $20,000. How... predictable.

Bitcoin Surges as IF Models Point to Dollar Weakness

Bitcoin surged past $105,000 on Monday, buoyed by growing expectations that the Federal Reserve may be preparing to pivot its monetary policy stance later this year.

The rally followed Federal Reserve Chair Jerome Powell’s speech at the International Finance (IF) Division’s 75th anniversary conference. Powell reiterated the critical role of global data and modeling in shaping US monetary policy in his speech.

However, he did not directly signal any change in interest rates. While Powell’s remarks were framed as a tribute to the IF Division’s legacy, analysts and crypto investors parsed his words for policy clues amid mounting signs of disinflation and economic resilience.

“Understanding this complex and interconnected web is essential for us to anticipate the path of employment and inflation,” Powell said.

Although Powell did not mention easing or rate cuts, he emphasized that IF research is central to the “risks and uncertainty assessment that FOMC committee participants receive in advance of every meeting.”

That line, coupled with the Fed Chair’s comment that the division’s work is “certainly relevant today,” has sparked speculation that the Fed is preparing for a potential dovish shift if current economic trends continue.

Fed’s Global Lens Aligns with Market Tailwinds

The latest Consumer Price Index (CPI) data showed inflation cooling to just 2.3% year-over-year, nearing the Fed’s 2% target. At the same time, US unemployment remains steady at around 4.2%, suggesting the labor market remains resilient.

This combination of disinflation and job stability supports both prongs of the Fed’s dual mandate. crypto market analyst Kyle Chassé pointed to these dynamics as fuel for risk assets like Bitcoin.

“FED PIVOT INCOMING? The last CPI came in at just +2.3% YoY. Unemployment is steady around 4.2%. Fed officials say if inflation keeps cooling and jobs stay strong, rate cuts are on the table later this year. That’s rocket fuel for Bitcoin,” Chassé posted on X.

Investors also noted that Powell praised the IF division’s development of advanced models for “assessing risks and uncertainties through alternative scenarios.” According to Powell, these are instrumental in understanding the impact of global shocks.

Though not tied to any specific forecast, these capabilities are increasingly viewed by market participants as laying the groundwork for responsive monetary policy in the second half (H2) of 2025.

Is Bitcoin’s Recovery A Bet on Policy Shifts?

Bitcoin’s move above $105,000 reflects broader Optimism that the Fed will begin easing before year-end, especially if inflation continues its downward trend.

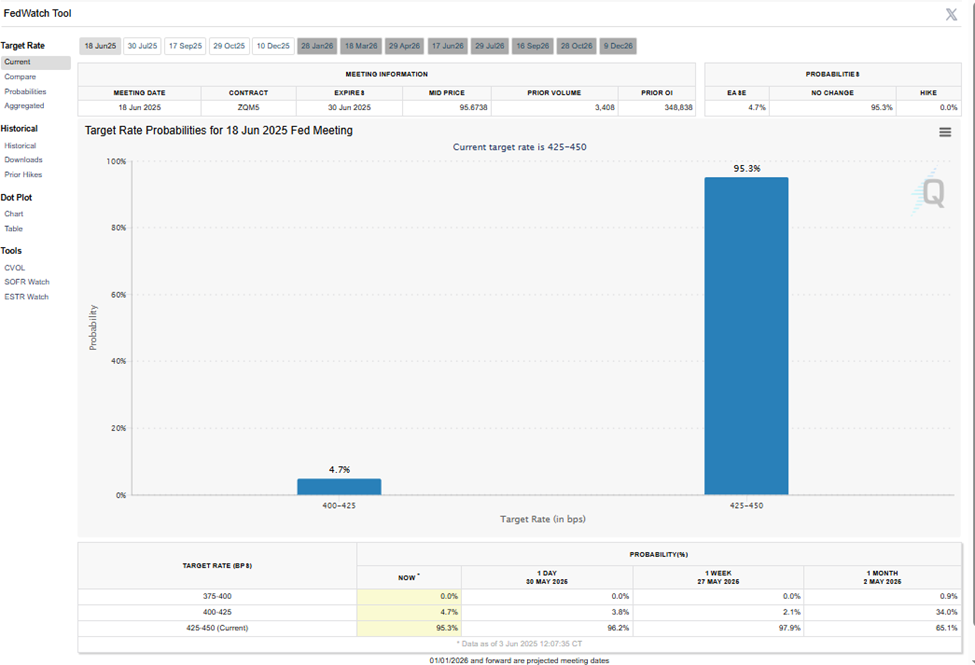

According to data on the CME FedWatchTool, markets are pricing in a 95.3% probability that the Fed will maintain the current target rate of 4.25-4.50 basis points (bps) at the June 18, 2025, FOMC meeting. Meanwhile, there is a 4.7% chance of a 25 bps cut to 40.0-4.25 bps.

Though the central bank remains cautious in its public language, Powell’s focus on global risk modeling and his acknowledgment of ongoing uncertainty suggest a more data-responsive posture.

“This work is critical to understanding the quantitative implications of uncertainty shocks. Certainly, relevant today,” Powell noted.

For Bitcoin bulls, that relevance could translate into a more accommodative environment in which digital assets benefit from loosening financial conditions, a weakening dollar, and investors seeking alternative stores of value.

While the Fed has not confirmed a pivot, the market is listening closely, with bitcoin holding well above $105,000.

BeInCrypto data shows BTC was trading for $105,568 as of this writing, up by a modest 0.62% in the last 24 hours.

As Kyle Chassé suggests, a rate cut could spur Bitcoin’s growth. However, the high probability of no change may delay any significant bullish momentum in the NEAR term, likely explaining the modest gains.