Solana Plunges 15%—Is This the Dip Before the Rip?

Solana’s price just got mauled—down 15% in a brutal sell-off. But crypto veterans know: blood in the streets often signals opportunity.

Here’s why the pain might be temporary:

- Markets love symmetry. Sharp drops frequently precede violent rebounds—especially in altcoins with Solana’s liquidity.

- The 15% haircut mirrors previous corrections that launched SOL toward new highs. History doesn’t repeat, but it sure rhymes.

- Network activity remains strong while the ’tourists’ panic-sell. Real adoption doesn’t care about price charts.

Of course, Wall Street analysts will now solemnly declare they ’saw this coming’—right after upgrading their price targets during last month’s rally. Stay nimble, stack wisely, and remember: in crypto, the best discounts come wrapped in fear.

Solana’s Long-Term Holders Show Confidence as Market Cools

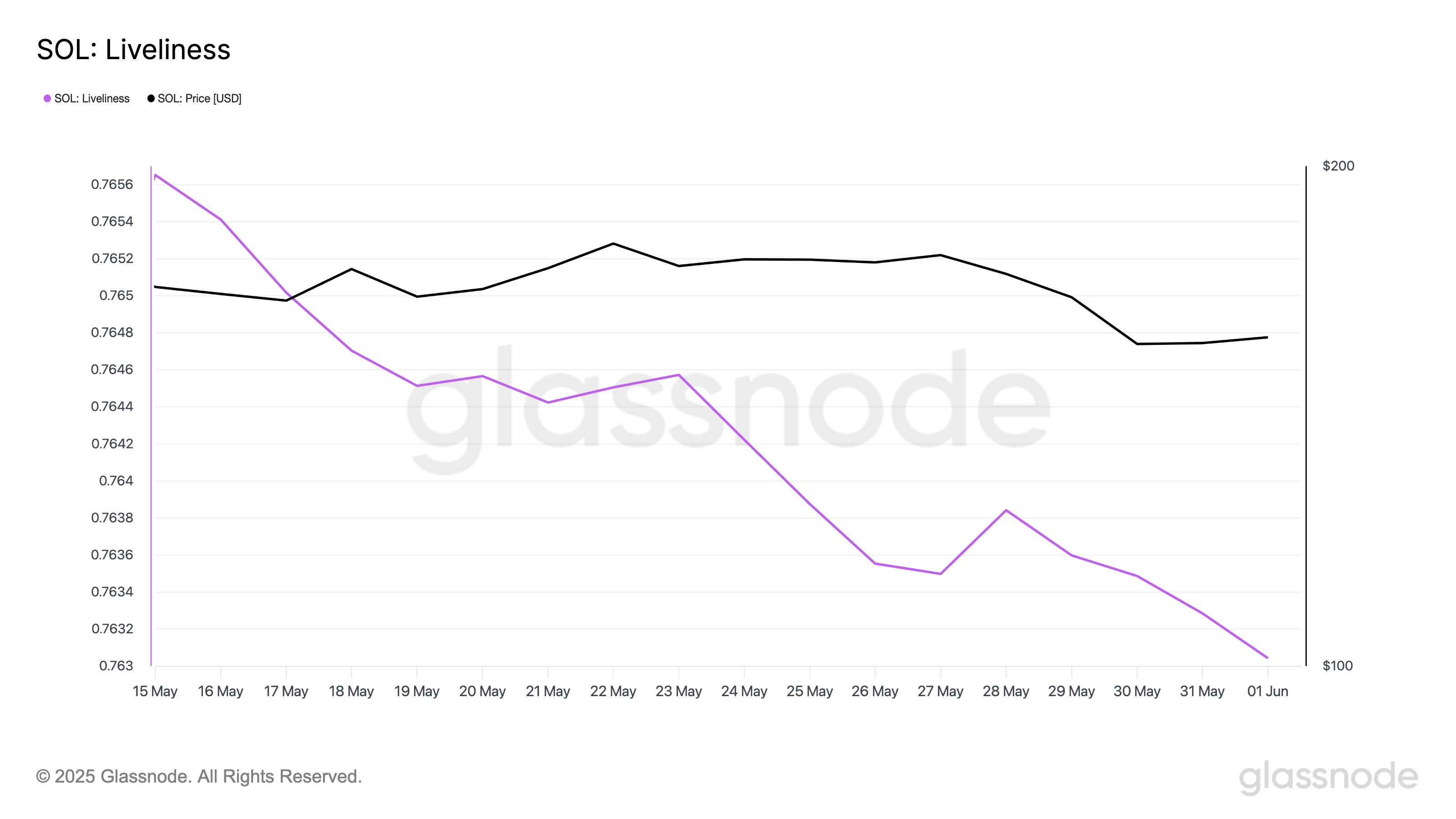

Solana’s Liveliness has dropped notably in recent days, indicating that Long-term holders (LTHs) view the recent price decline as a strategic buying opportunity. According to Glassnode, it currently stands at 0.76, its lowest in the past 14 days.

Liveliness measures the ratio of an asset’s coin days destroyed to the total coin days accumulated to track the activity of LTHs. When it climbs, it suggests that more dormant coins are being moved or sold, signaling increased profit-taking by long-term holders.

On the other hand, liveliness decreases when dormant wallets begin accumulating. This trend indicates that SOL’s LTHs are moving assets off exchanges, a bullish sign of accumulation.

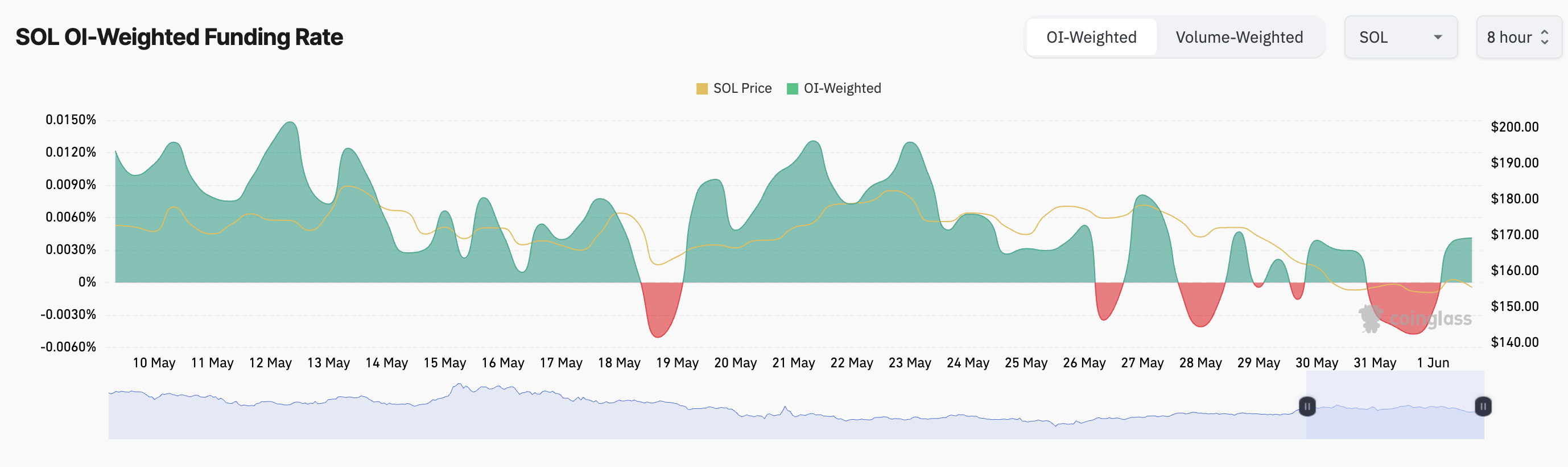

Further, the coin’s funding rate has flipped positive and is currently at 0.0041%. This indicates a preference for long positions among SOL futures traders.

The funding rate is a recurring fee paid between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price. When positive, long traders pay shorts, indicating that bullish sentiment dominates and more traders expect prices to rise.

SOL Could Surge to $195 if Support Holds

Solana’s price could rebound toward the $171.88 mark if its LTHs continue to double down on coin accumulation and broader market conditions stabilize. Should that price zone solidify as a support floor, it could further propel SOL toward the $195.55 level.

However, sellers could drive SOL down to $142.59 if bearish momentum intensifies.