Atlanta Fed’s Rosy GDP Outlook Sparks Crypto Speculation—Time to Buy the Rumor?

The Atlanta Fed just doubled down on bullish US GDP projections—and crypto traders are already front-running the narrative. Could this be the macro tailwind digital assets need?

When traditional finance gets optimistic, risk appetite follows. Bitcoin’s historical correlation with liquidity cycles suggests Fed-fueled growth often spills into crypto markets. But will this time be different?

Remember: Wall Street’s ’goldilocks’ scenarios have a habit of curdling. One strong jobs report away from the Fed pivoting back to hawkish mode—and taking crypto’s liquidity lifeline with it.

Is the US GDP Going to Grow?

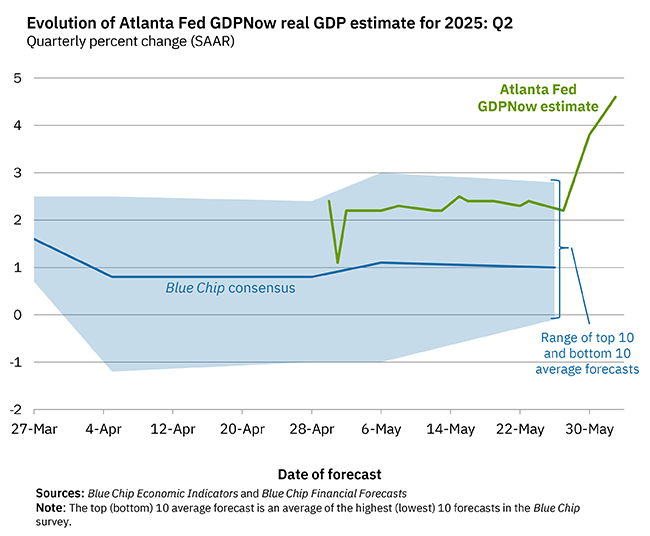

Just a few weeks ago, the markets were receiving a deluge of recession indicators. The Atlanta Fed estimated negative GDP growth in February, and other federal institutions repeated these concerns in April.

However, new trade agreements have turned these estimates around, and Atlanta is now predicting 4.6% US GDP growth:

If these US GDP predictions are accurate, it’d be hugely bullish for crypto. Bitcoin has been less volatile than usual lately, encouraging massive firms to invest in it as “digital gold.”

More economic growth WOULD firmly push back recession fears, potentially leading investors to invest in riskier assets, especially crypto.

US GDP growth estimates are back on the rise:

As trade deals are being reached and tariffs are being delayed, Q2 GDP growth is now seen at +2.8%.

On May 1st, Q2 GDP growth of just +0.4% was expected, per @Kalshi.

Meanwhile, the Atlanta Fed’s GDPNow forecast for real GDP growth… pic.twitter.com/mApCCV1Kn5

However, the Atlanta Fed’s prediction might be a simple overcorrection. Months ago, it predicted the beginning of a recession. Have the fundamentals underpinning US GDP really changed that much since?

An end to US-China tariffs pumped the market, but TRUMP is considering new sanctions to replace them. He is also reigniting tariffs against the EU, which are set to take effect soon.

All that is to say, a resumed trade war would put the US GDP right back where it was a few weeks ago. Some economists are continuing to predict a major stock market collapse, but it’s hard to be sure of anything.

Case in point, the judiciary is trying to undermine Trump’s authority to levy tariffs, adding yet another wild card to this hectic situation.

If things continue as normal, the US GDP is allegedly set to usher in a bullish moment. However, any number of tertiary factors could introduce new chaos.

No matter what happens, bitcoin has a long track record as a hedge against inflation or other negative developments. Crypto will find a way to succeed either way, but its 3-month prospects are very uncertain.