$5.23 Billion Torrent Fuels Bitcoin ETF Frenzy in May

Wall Street’s latest gold rush? Bitcoin ETFs just gulped $5.23B in a single month—proving even traditional finance can’t resist crypto’s siren song.

When suits start chasing volatility, you know we’re in a new era. Guess those ’risky asset’ warnings didn’t age well.

BTC ETF Inflows Surge 76% in May

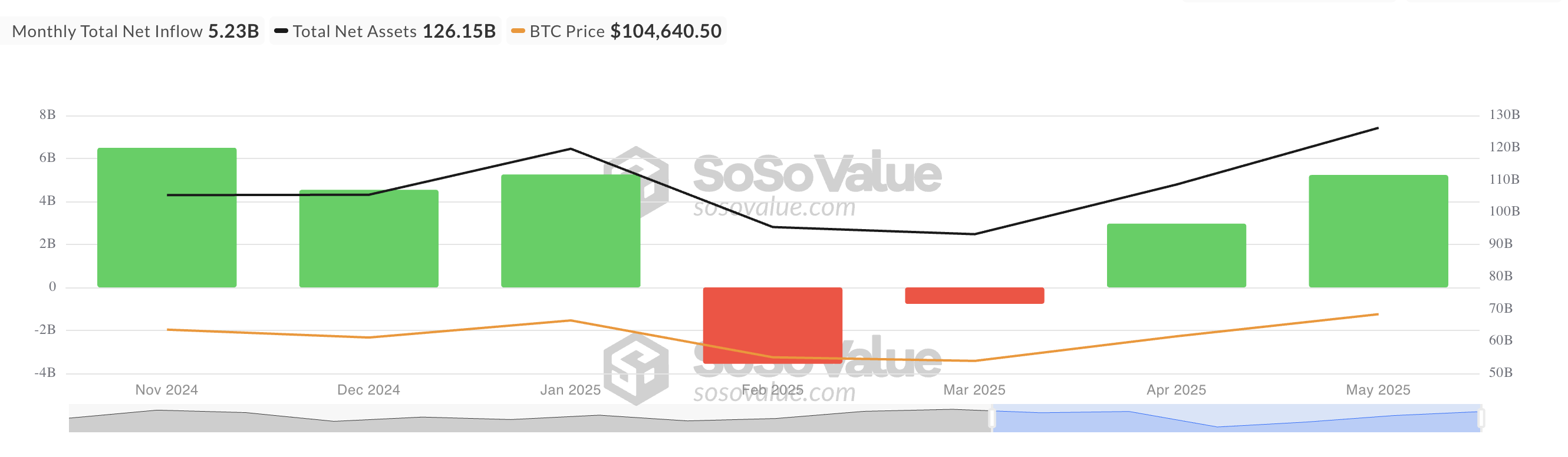

According to data from SosoValue, BTC ETFs saw a resurgence in demand in May, with net inflows totaling $5.23 billion. This marked a 76% surge from April’s $2.97 billion figure and represented the largest monthly influx since January.

The surge in demand coincided with BTC’s rally to a new all-time high of $111,968 during the month under review. This milestone, driven by sustained retail momentum and growing interest from institutional players, injected fresh Optimism into the broader market.

So, as the price of BTC climbed, ETF products became an increasingly attractive vehicle for large investors seeking exposure to digital assets.

Sustained institutional participation like this often brings price stability and reduced volatility, potentially setting the stage for further BTC rallies in June.

BTC Market Sees Mixed Signals

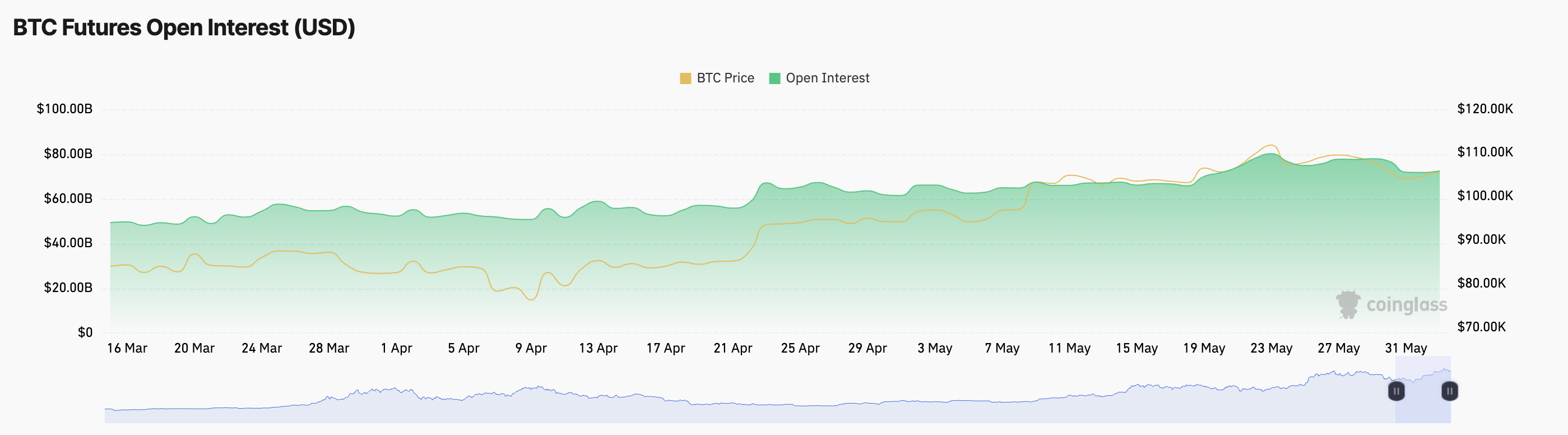

Amid today’s slight rebound in trading activity, BTC is up by a modest 1% and currently trades at $105,216. Its rising futures open interest confirms the surge in the demand for the king coin. This stands at $72.47 billion at press time, climbing 1% over the past day.

Open interest refers to the total number of active derivative contracts, such as futures or options, that have not been settled. A rise in open interest indicates increased market participation and capital inflows.

This signals a gradually strengthening momentum in the BTC market and shows conviction in its price trend.

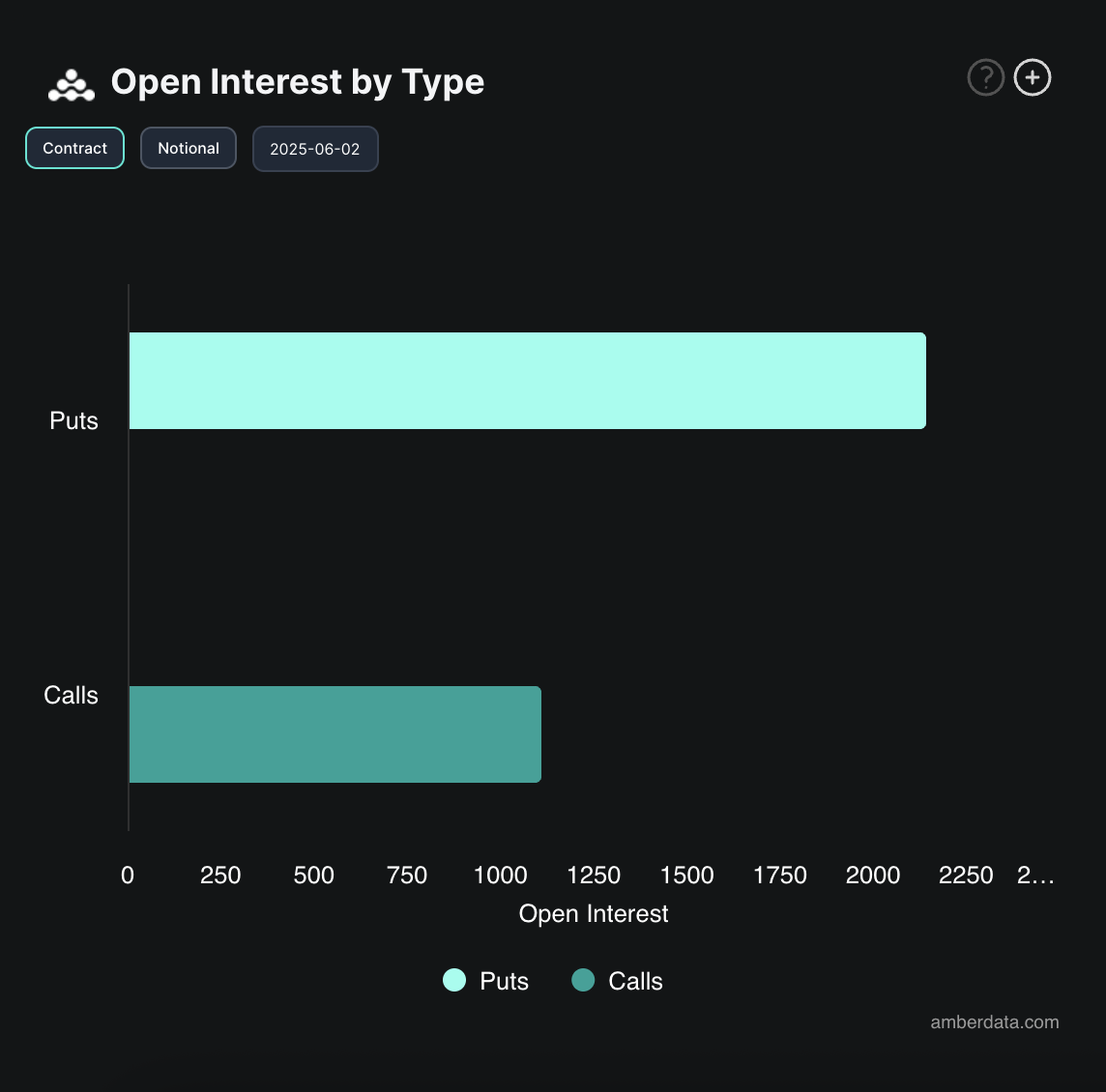

However, readings from the coin’s options market show signs of bearish hedging. According to Deribit, today is marked by a significant demand for put contracts, indicating that many traders are preparing for potential downside, even as the underlying asset trends higher.

This highlights a split in market sentiment: strong long-term fundamentals overshadowed by lingering short-term uncertainty.