Liquidation Data Suggests Bitcoin Primed for $109K Rebound—Traders Hold Breath

Bitcoin’s latest liquidation metrics reveal a powder keg of pent-up demand—and the fuse might just lead back to $109,000.

After weeks of sideways action, derivatives data shows shorts getting squeezed harder than a Wall Street intern during earnings season. The market’s coiled tighter than a spring, with cascading liquidations historically preceding violent rallies.

Will this time be different? The charts say no—but then again, so did the guys who shorted BTC at $20K.

BTC Liquidity Clusters Signal Surge Toward $109,000

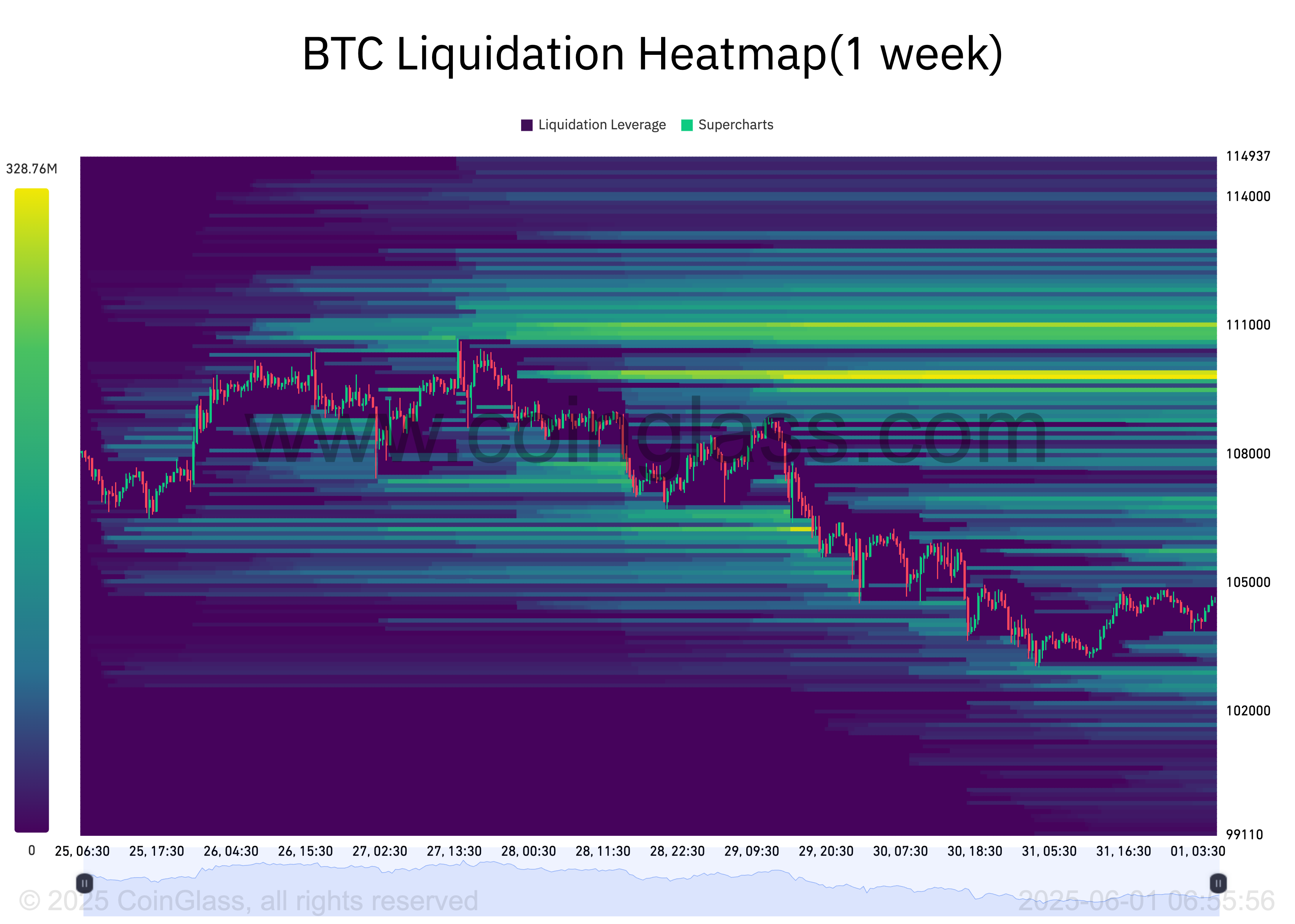

An assessment of BTC’s liquidation heatmap shows a notable concentration of liquidity around the $109,933 price zone.

Liquidation heatmaps identify price levels where large clusters of Leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones (yellow) representing larger liquidation potential.

Usually, these cluster zones act as magnets for price action, as the market tends to MOVE toward these areas to trigger liquidations and open fresh positions.

Therefore, for BTC, the convergence of a high volume of liquidity at the $109,933 price level indicates a strong trader interest in buying or closing short positions at that price. It creates room for a surge toward the $109,000 mark.

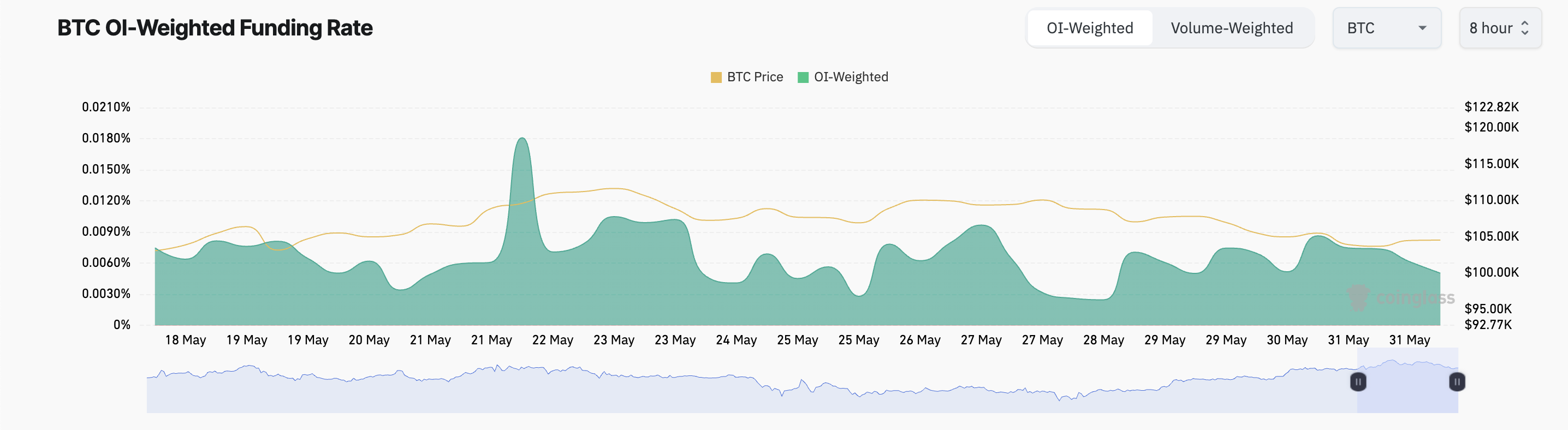

Further, the coin’s funding rate has remained positive despite its recent price pullback. At press time, this stands at 0.005%, per Coinglass.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep the contract price aligned with the spot price. When the funding rate is positive, there is a higher demand for long positions.

This means more traders continue to bet on BTC’s price going up, even in the face of strengthening bearish momentum.

BTC Price Teeters Between $103,000 Support and $109,000 Liquidity Zone

BTC has posted a modest 1% gain in the past 24 hours, bouncing off the $103,952 support level. If demand soars, this support floor could hold firm and push prices above the psychological barrier at $105,000, potentially targeting $106,307.

A clean break above this zone may open the door to the $109,000 price area dense with leveraged positions.

However, increased profit-taking could drag BTC back below $103,952, with a further decline toward $102,590 likely.