Hedera (HBAR) June 2025 Preview: Make-or-Break Month for the Enterprise Darling

Hedera’s hashgraph tech has long promised Wall Street-grade blockchain—now, June 2025 could be its proving ground. With enterprise adoption lagging behind hype, HBAR faces a critical inflection point.

The institutional adoption litmus test

Watch for Fortune 500 validators finally moving beyond pilot programs. Anything less than three major production deployments this month confirms the ’enterprise blockchain’ narrative as vaporware.

Regulatory chess moves

SEC scrutiny on proof-of-stake tokens could force HBAR’s governance council to pivot—just as traditional finance starts flirting with DLT solutions. Ironic timing, as always.

Price action: Speculation vs. utility

HBAR’s chart will reveal whether traders still believe the enterprise fairy tale. A 20%+ swing either way seems inevitable—because in crypto, fundamentals are optional but volatility is mandatory.

June either cements Hedera as the chain for suits or exposes it as another slide deck warrior. Place your bets—the hashgraph doesn’t lie (but white papers sometimes do).

HBAR Futures Volume Falls Below $100 Million – What Does it Mean?

HBAR futures volume has dropped to $96.5 million and has remained under the $100 million mark for the past five consecutive days, marking a sharp contrast to the elevated levels seen earlier this year.

Back on March 1, futures volume peaked at $1.3 billion, but since then, both volume and open interest have steadily declined.

HBAR futures allow traders to speculate on the token’s future price, and their activity often reflects broader sentiment and risk appetite from both retail and institutional participants.

The recent drop points to waning speculative interest, potentially signaling caution or lack of conviction in Hedera’s short-term price direction.

With the 7-day EMA of HBAR futures volume now at its lowest in three months, the data suggests current price action may be increasingly driven by spot demand rather than Leveraged positioning.

This shift in market structure could mean reduced volatility and a more organic price trend in the NEAR term. However, without a rebound in derivatives activity, any upward moves may lack the momentum typically provided by aggressive speculative inflows.

Hedera Lags Behind BTC Rally—Will It Catch Up in June?

Historically, HBAR price has shown a strong positive correlation with Bitcoin (BTC), often amplifying the broader market’s moves.

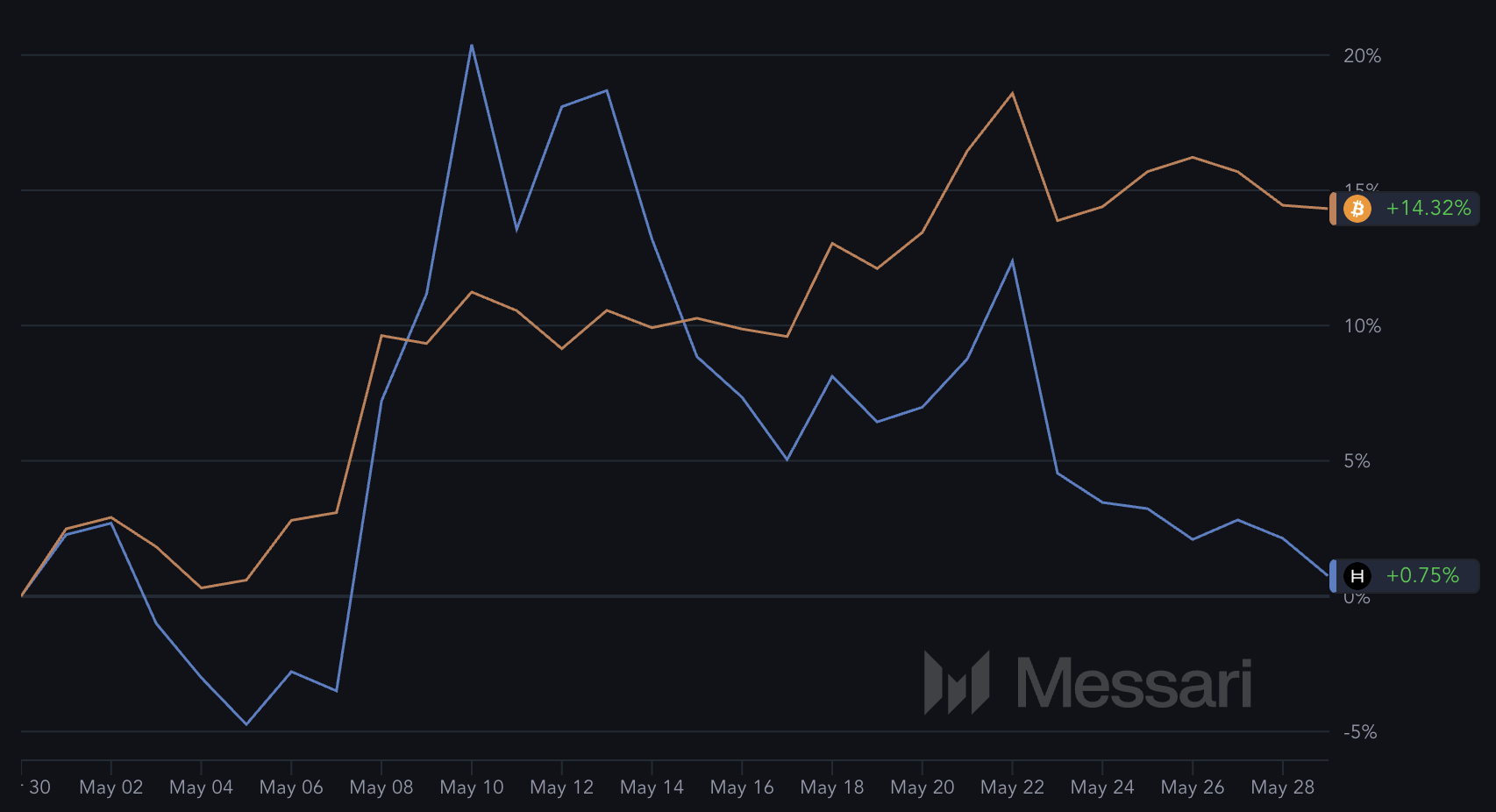

However, over the past 30 days, that relationship appears to have weakened—BTC is up 14.3%, while HBAR has gained just 0.75% over the same period.

This divergence suggests that HBAR has not yet responded to the recent bullish momentum in the crypto market, despite typically being a higher-beta asset.

In previous cycles, HBAR has often outperformed BTC during rallies but also faced steeper declines during broader market corrections, reflecting its sensitivity to shifts in sentiment.

If Bitcoin reaches new highs in June, HBAR could be well-positioned for a sharper move upward, as it did during past surges.

HBAR Approaches $0.18 Support as Bearish EMA Setup Persists

HBAR’s EMA structure remains bearish, with short-term exponential moving averages still positioned below long-term ones—a classic sign of ongoing downward momentum.

The token has been trading below the $0.20 mark for the past six days, reflecting sustained pressure and a lack of bullish follow-through.

This setup reinforces the cautious sentiment surrounding HBAR as it hovers near key technical levels.

Currently, HBAR is approaching the critical support at $0.18, and losing this level WOULD mark its first break below that threshold since May 8.

However, if the market turns and momentum improves in June, HBAR could break back above $0.20, with room to rally toward $0.25—an area it hasn’t touched since early March.