Circle Nukes $57.5M USDC from LIBRA Meme Coin Devs in Mid-Lawsuit Freeze

Stablecoin giant Circle just pulled the plug on $57.5 million—because nothing says ’decentralization’ like a centralized freeze during legal drama.

When the meme coin team tried to play fast and loose with USDC, Circle hit back harder than a bear market. The lawsuit details remain under wraps, but the message is clear: play stupid games, win stupid prizes.

Bonus finance jab: At least they didn’t lose it all in a leveraged yield farm this time.

Circle Freezes LIBRA Assets

The LIBRA debacle from this February was a major scandal in the crypto industry, allegedly involving a sitting head of state. Although President Milei is personally under scrutiny, many LIBRA promoters are also facing charges.

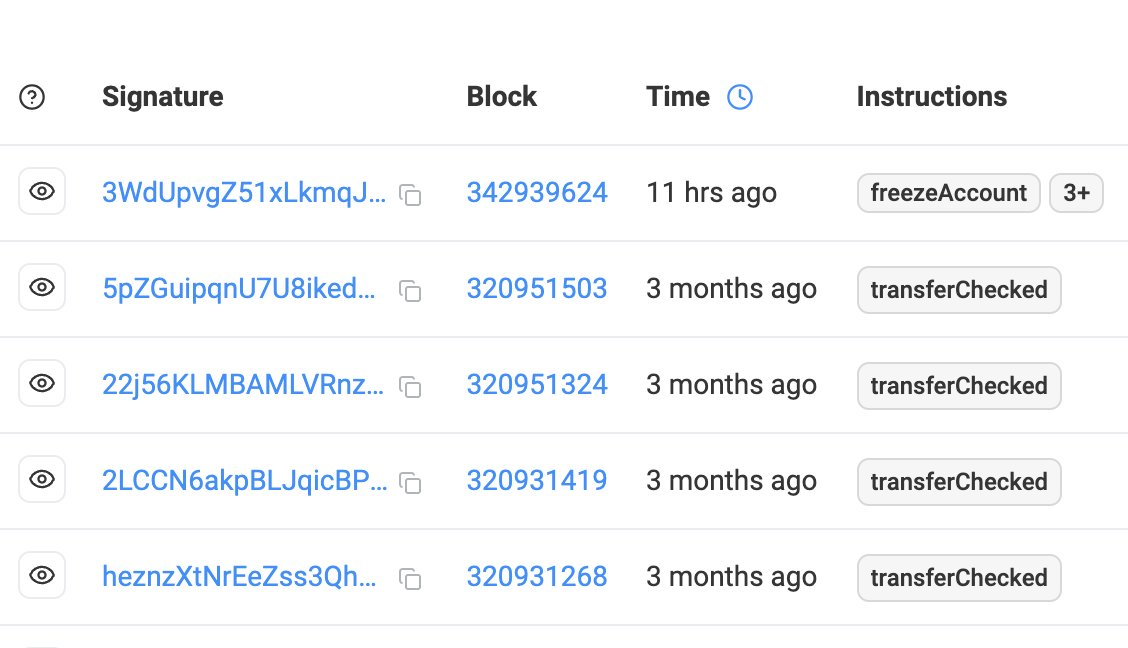

Earlier today, Circle froze $57.5 million in the LIBRA team’s USDC holdings, representing a significant escalation.

Circle, one of the biggest stablecoin issuers, has frozen user assets on many occasions other than LIBRA. And yet, at the moment, it’s unclear what caused the firm to take this drastic step.

Argentina’s legislature and judiciary are both investigating the scandal, leading some local journalists to conclude that this scrutiny forced Circle’s hand.

However, there is also a competing narrative that seems credible. Argentina’s charges against LIBRA promoters are very serious, but Circle is an American company.

It’s headquartered in New York City, where Burwick Law is filing a civil suit against non-Argentine LIBRA participants. Burwick’s suit recently moved to federal jurisdiction and is making more progress already:

UPDATE: Burwick Law’s international class action over the $Libra token on solana is progressing in the Southern District of New York.

We represent hundreds of Libra holders pursuing recovery from Ben Chow, Meteora, Julian Peh, Kip Protocol, Hayden Davis, CT Davis, Gideon…

In other words, this US-based federal suit may have encouraged Circle to freeze LIBRA promoters’ USDC. So far, Circle hasn’t made a statement, and none of the parties have officially taken credit for the move.

There isn’t any concrete evidence to confirm either theory yet.

Indeed, it’s very possible that both or neither of these legal battles moved Circle to act. Regardless of what happened, the outcome is the same: the noose is tightening for LIBRA’s promoters.

Whether Argentina’s top government officials will face criminal consequences or not, private crypto entrepreneurs have far fewer protections.