Bitcoin Eyes $110K as Fresh Money Fuels the Rally

New capital surges into crypto—just as the bulls predicted. Suddenly, six figures doesn’t seem so crazy.

Wall Street’s late to the party (again), but their checks still cash. Here’s how the math shakes out now.

Remember when $100K seemed outrageous? The market’s got a funny way of making yesterday’s moon shots look conservative.

Bitcoin Investors Remain Bullish

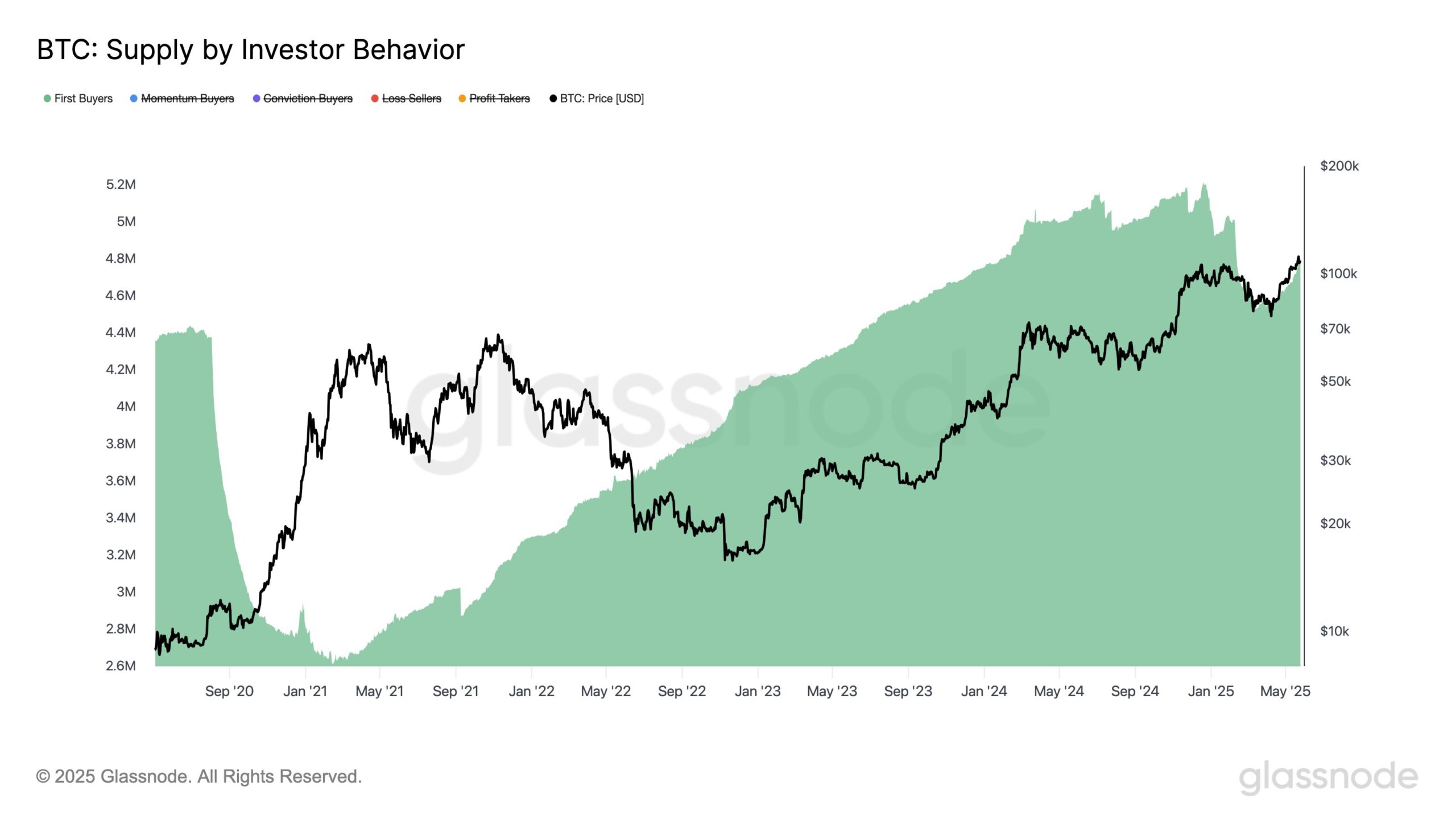

Supply by Investor Behavior shows an uptick in Bitcoin. BTC first-time buyers have a sharp rise from July to December 2024 and again from March to May 2025. Both periods align with significant price expansions, indicating fresh capital inflows are strengthening the market’s structure.

These new investor inflows suggest growing confidence in Bitcoin’s future. This influx of capital can sustain price growth by increasing demand, which, combined with limited supply, creates upward price pressure. Investors appear optimistic about Bitcoin’s long-term potential.

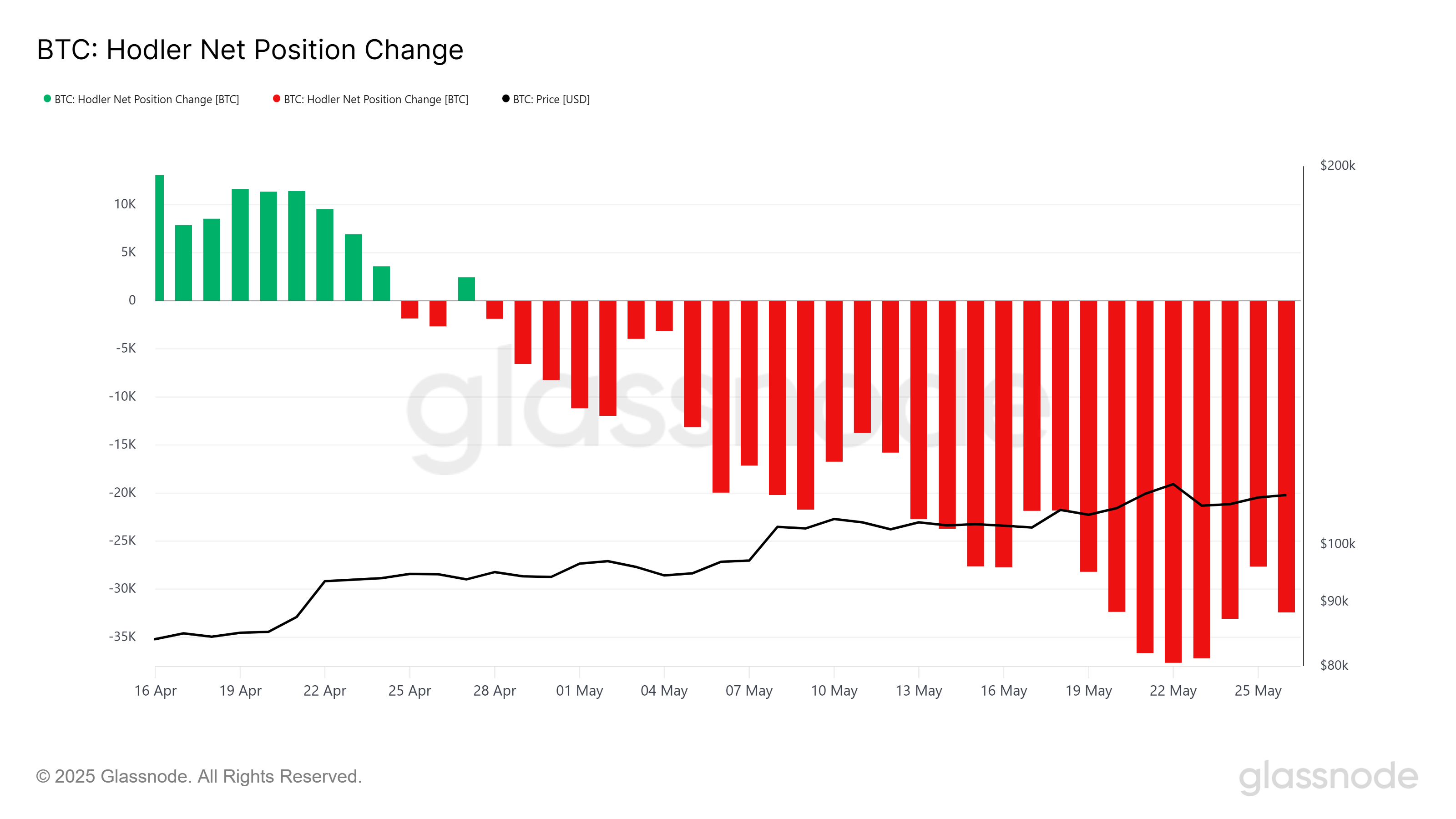

The HODLer Net Position Change highlights that long-term holders (LTHs) remain consistently bullish. LTHs are critical for price support, as they reduce the circulating supply by holding their coins. The presence of extended red bars in the indicator signals active accumulation, which keeps the price buoyant.

This steady accumulation by LTHs reflects a strong conviction, helping Bitcoin maintain resilience against short-term market fluctuations. The continued buying pressure from these holders provides a foundation for sustained price increases.

BTC Price Needs To Secure Support

Bitcoin’s price currently sits at $109,160, just below the key resistance level of $110,000. Flipping this psychological barrier into support is essential for Bitcoin’s continued rise. Securing this level WOULD restore bullish momentum and attract further buying interest.

If bitcoin holds above $110,000, the path to surpassing its all-time high of $111,980 looks clear. This breakout could fuel a rally toward $115,000 in the coming days, driven by renewed investor enthusiasm and favorable market conditions.

However, if LTH accumulation slows or is offset by selling pressure, Bitcoin could face downward pressure. A drop below $106,265 could push the price down to $105,000, invalidating the current bullish outlook and signaling caution for traders.