Crypto Whale James Wynn Drops $20M on PEPE—Because Memecoins Are Clearly the New Blue-Chips

Hyperliquid trader James Wynn just went all-in on frog-themed internet money—because nothing screams ’sophisticated investment strategy’ like a token named after a 4chan meme.

The $20 million PEPE position—equal parts audacious and absurd—highlights how crypto’s elite now treat memecoins like a high-stakes roulette table. Who needs fundamentals when you’ve got vibes?

Meanwhile, traditional investors weep into their spreadsheets.

Trader Gains Over $200,000 with 10x Leveraged PEPE Position

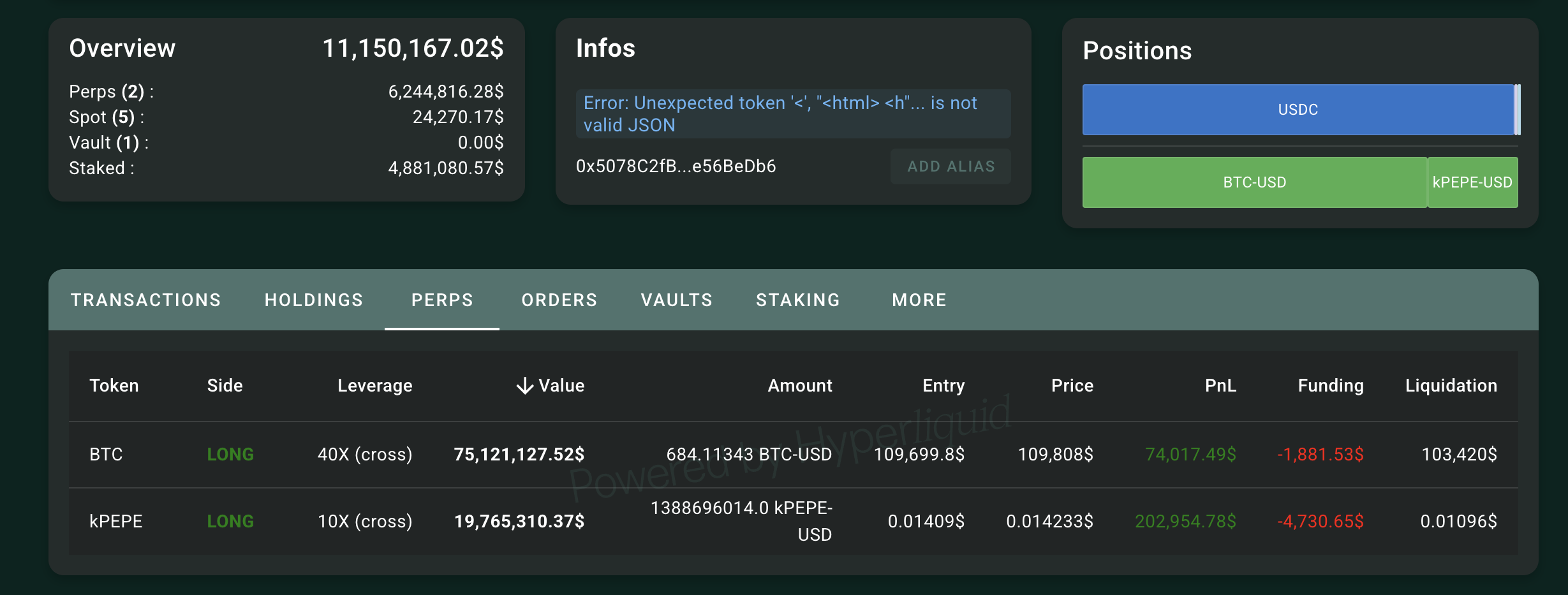

According to data from Wynn’s public address on Hypurrscan, the trade was initiated on the Hyperliquid platform at an entry price of $0.01409. The position is valued at approximately $19.7 million.

PEPE’s current price is slightly higher at $0.014233, resulting in an unrealized profit of about $202,954 for the whale.

Despite the profit, the trader is paying funding fees totaling $4,730. Moreover, the liquidation price is set at $0.01096. This essentially means that if the token’s price drops to this level, the position will be automatically closed to prevent further losses.

“I feel SAFE in Pepe. nfa. Dyor,” Wynn posted on X.

Wynn, who describes himself as a ‘high-risk leverage trader,’ also has a substantial long position in BTC with 40x leverage. This high-leverage position is valued at over $75 million.

The entry price is $109,699. Additionally, the current market price of $109,808 has resulted in an unrealized profit of $74,017. The liquidation level is set at $103,420.

Like his Pepe trade, Wynn is also paying notable funding fees here, totaling $1,881. This position demonstrates Wynn’s bullish stance on Bitcoin, although the high leverage carries significant risk. His trades have caught the attention of market watchers as well.

“James Wynn just opened a $75 million bitcoin long. Does he know something we don’t?” analyst Lark Davis wrote.

Notably, Wynn’s Bitcoin bet comes shortly after the trader lost $13.4 million on his short Bitcoin position.

“James Wynn closes 9,402.73 BTC ($1 billion) short position at a $13.4 million loss,” Whale Insider noted.

Another analyst, crypto Beast, also revealed that Wynn has lost $60 million in the last four days. Data from Lookonchain showed that over the past 75 days, Wynn has been actively trading on the Hyperliquid platform, executing 38 trades.

Of these, 17 trades were profitable, which translates to a win rate of approximately 45%. In addition, over this period, he paid the platform roughly $2.31 million in trading fees.