Traders Pile Into Bitcoin Shorts as Fear Gripes Crypto Markets

The bears are out in force—Bitcoin’s short positions just hit a multi-month high as sentiment flips from greed to outright fear. Is this a temporary pullback or the start of something uglier?

Short sellers smell blood

With open interest tilting heavily toward shorts, the market’s pricing in a deeper correction. Never mind that institutions keep stacking BTC ETFs—retail traders are panicking like it’s 2021 all over again.

The irony? This exact scenario historically precedes violent upside squeezes. But try telling that to the leverage junkies getting liquidated on 100x positions.

Wall Street’s ’risk management’ teams will no doubt claim they saw this coming—right after they finish revising their price targets downward.

Most Traders Turn Bearish Despite Bitcoin’s Recent All-Time High

The pattern is mirrored on Binance, where short trades make up 54.05% of open interest, compared to 45.95% for longs.

This growing tilt toward shorts reflects mounting skepticism in the market, despite bitcoin reaching new highs.

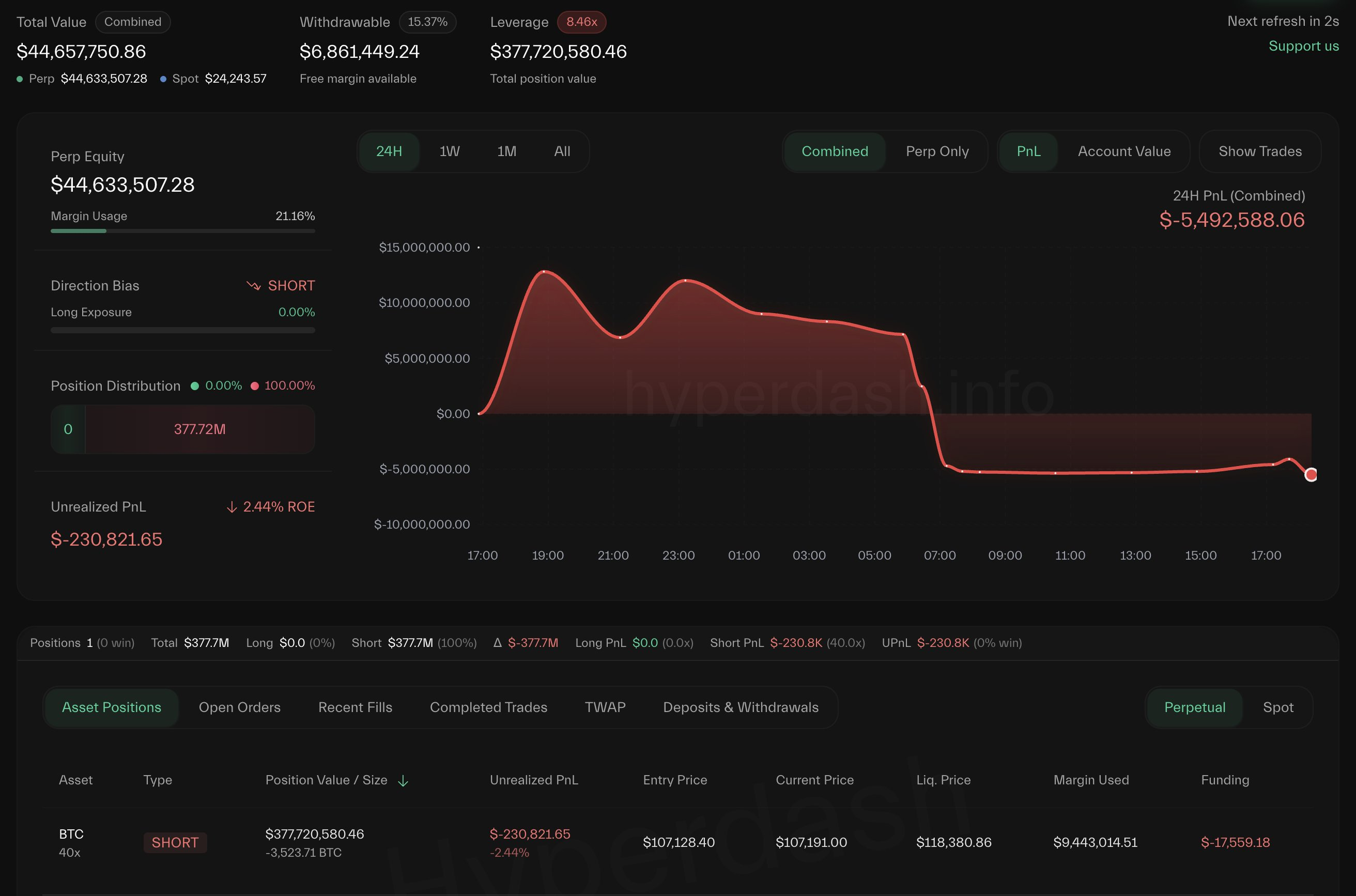

The sentiment shift is reinforced by the latest move from prominent crypto whale James Wynn, who reversed his bullish stance after a multi-million dollar loss.

Wynn had previously maintained an aggressively Leveraged 40x long position worth around $1.25 billion but exited after Bitcoin’s price dipped from $109,000 to roughly $107,107.

The trader closed his long exposure at a loss of $13.39 million, with liquidation unfolding in under an hour on May 25.

He has since opened a short position of 3,523 BTC—valued at approximately $377 million—at an entry price of $107,128. The new trade carries a liquidation threshold NEAR $118,380.

Market analysts have suggested that Wynn’s pivot reflects broader signs of exhaustion in the current bull cycle.

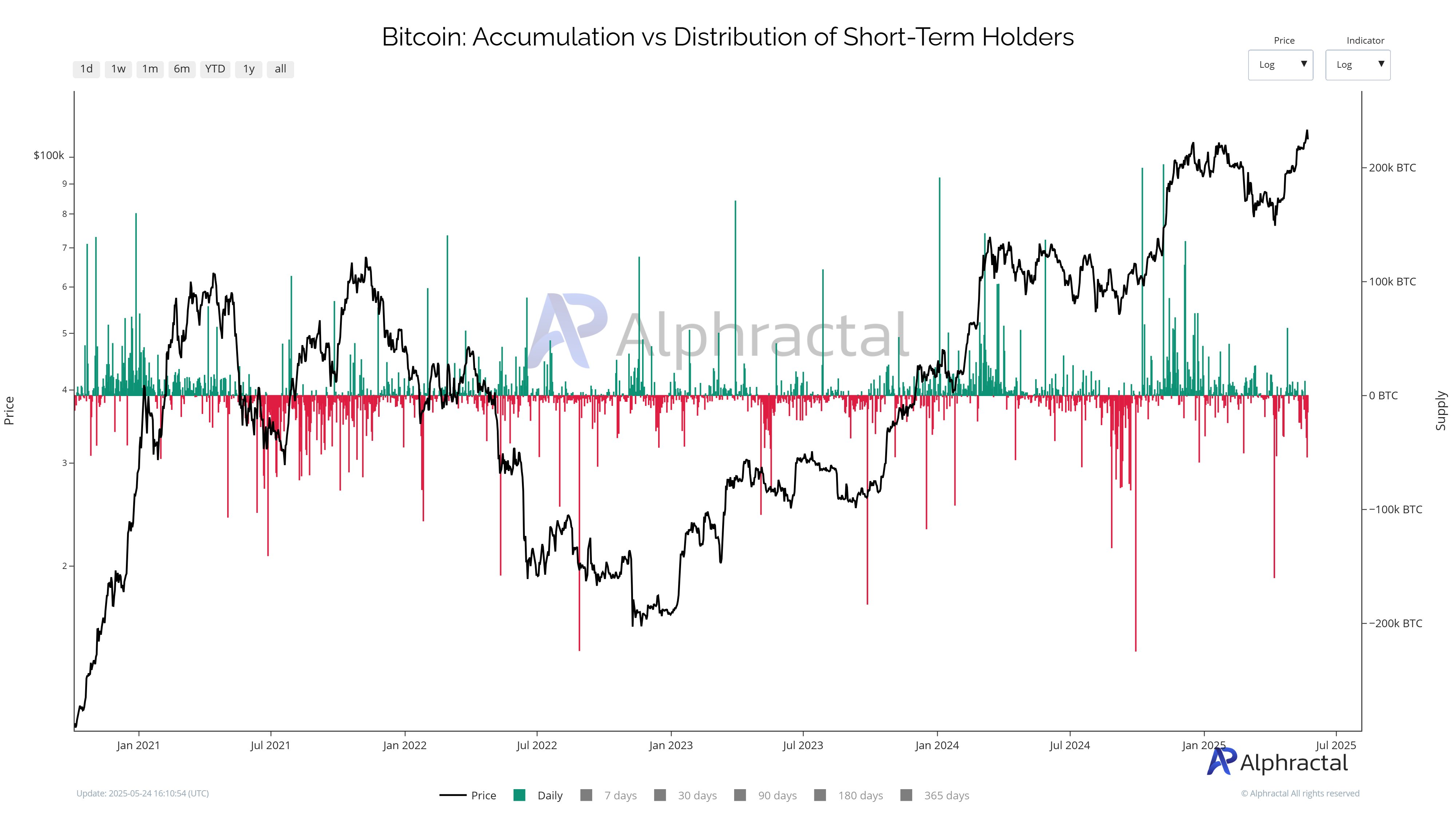

According to blockchain analytics firm Alhpractal, short-term holders (STHs) have begun distributing coins. Historically, a decline in STH supply often signals that Bitcoin is approaching a local top.

The firm noted that the Short-Term Holder Realized Price currently stands at $94,500, which is the last strong support before losses set in.

In contrast, long-term holders (LTHs) remain firm, with their realized price climbing to $33,000—highlighting a widening behavioral gap.

Alphractal stated that while Bitcoin previously hit record highs under similar conditions in 2021, it warned that the current cycle may be nearing exhaustion.

It added that several macro indicators and historical halving trends point to a possible correction after October 2025.