Ethereum Whale Dumps $570M in Two Days – Is ETH’s Rally in Trouble?

A single Ethereum holder just liquidated over half a billion dollars worth of ETH in 48 hours—triggering alarm bells across crypto markets. Was this a strategic exit or just another whale playing hot potato with retail investors’ dreams?

The move comes as Ethereum struggles to reclaim its all-time highs, leaving traders wondering if this is the start of a deeper correction or just a blip before the next leg up. Meanwhile, Wall Street ’experts’ still can’t decide if crypto is a scam or the future of finance—classic.

With the sell-off’s dust still settling, all eyes are on whether ETH can shake off this pressure or if the whale’s timing was as perfect as their anonymous wallet.

Ethereum Investors Secure Their Profits

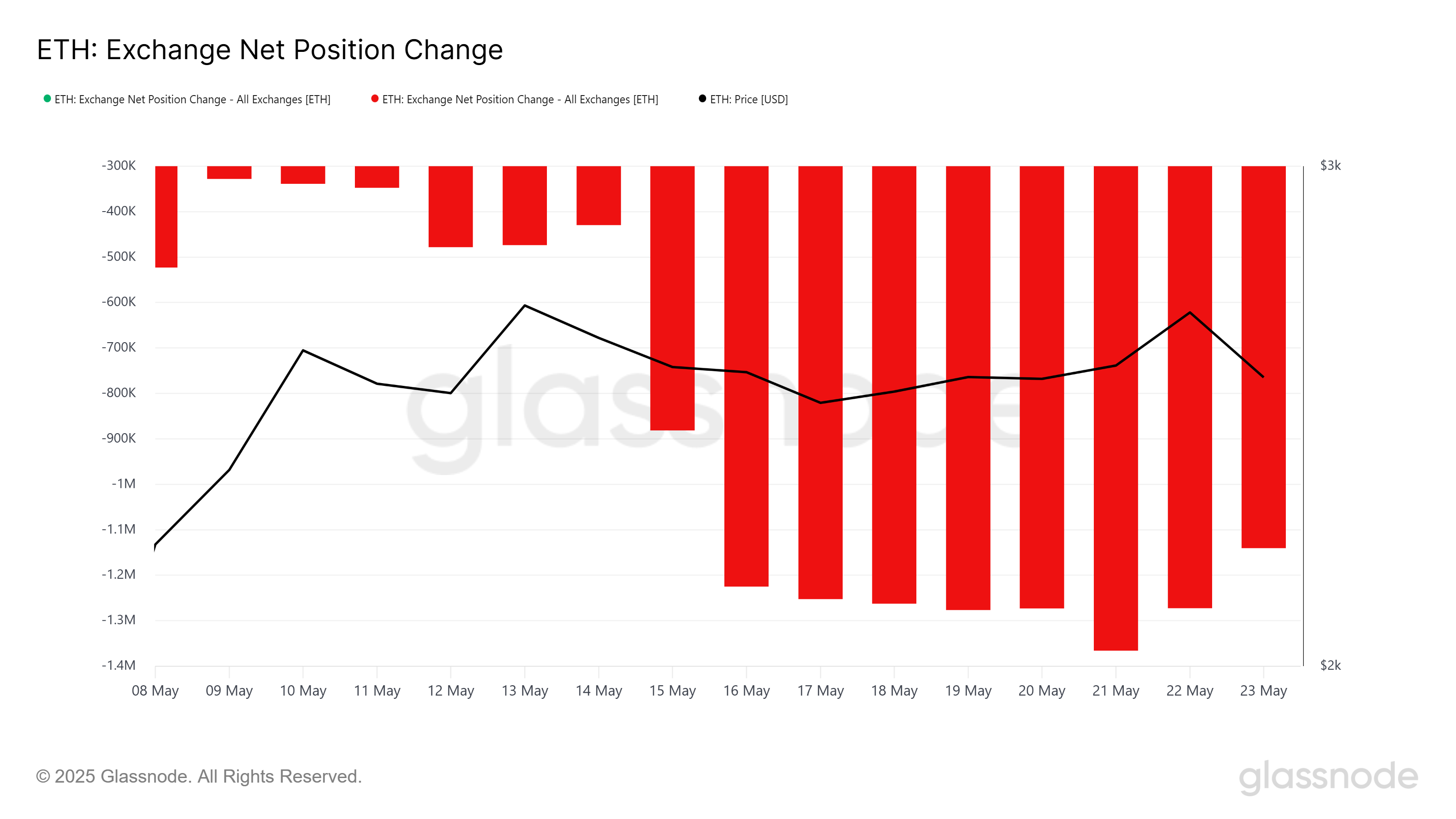

Recent data indicates significant selling pressure on Ethereum. Over the last 48 hours, investors have sold more than 225,779 ETH tokens. This volume translates to a supply worth approximately $576 million, reflecting a rapid pace of offloading.

Such extensive selling indicates reduced investor confidence. Many appear to be securing profits amid doubts about further price appreciation. This behavior often signals a shift toward risk aversion in the short term.

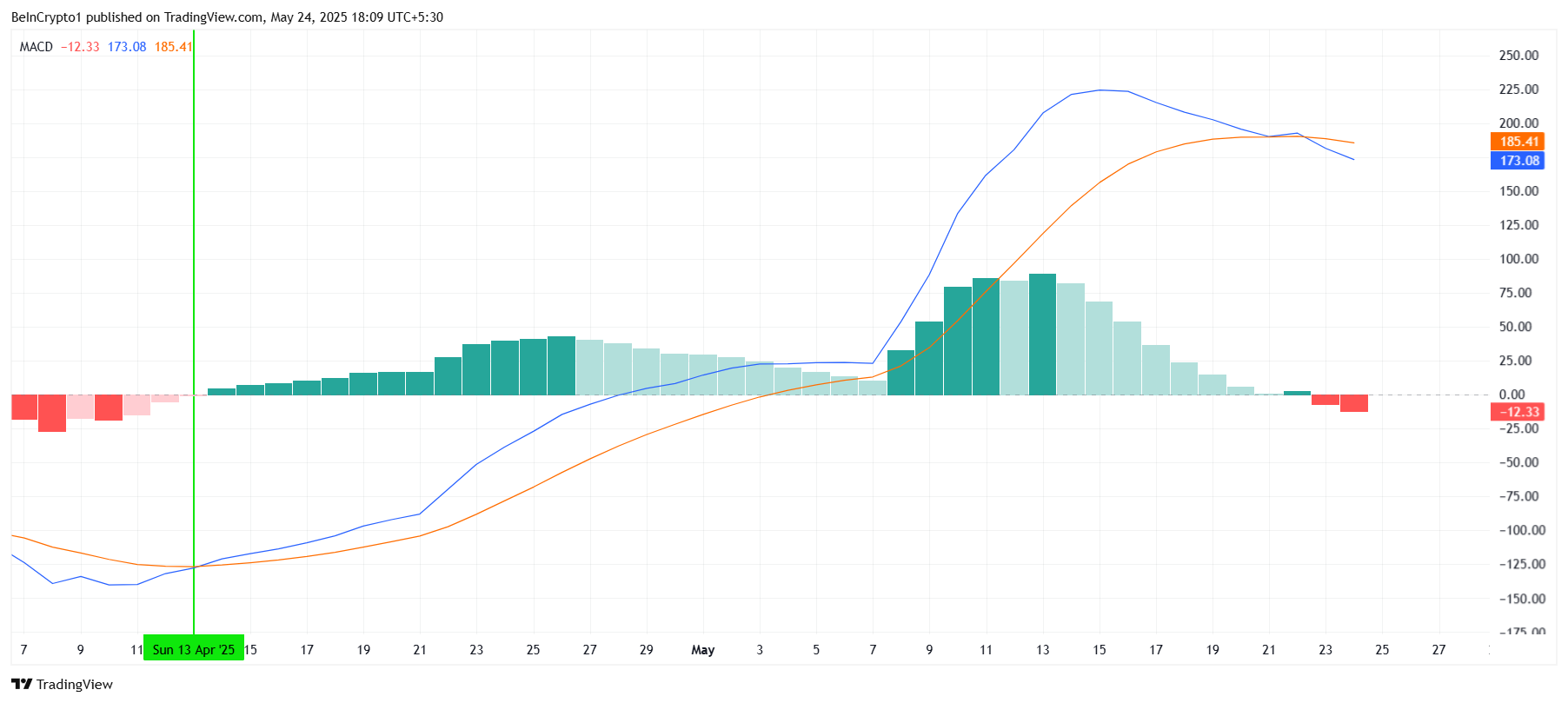

Technical indicators add to the bearish sentiment surrounding Ethereum. The Moving Average Convergence Divergence (MACD) shows a bearish crossover after nearly seven weeks of bullish momentum. This change often precedes a price decline or increased volatility.

Losing bullish momentum weakens Ethereum’s price support. Without fresh buying interest, ETH may face further downward pressure as traders adjust positions in response to technical signals.

ETH Price is Stuck

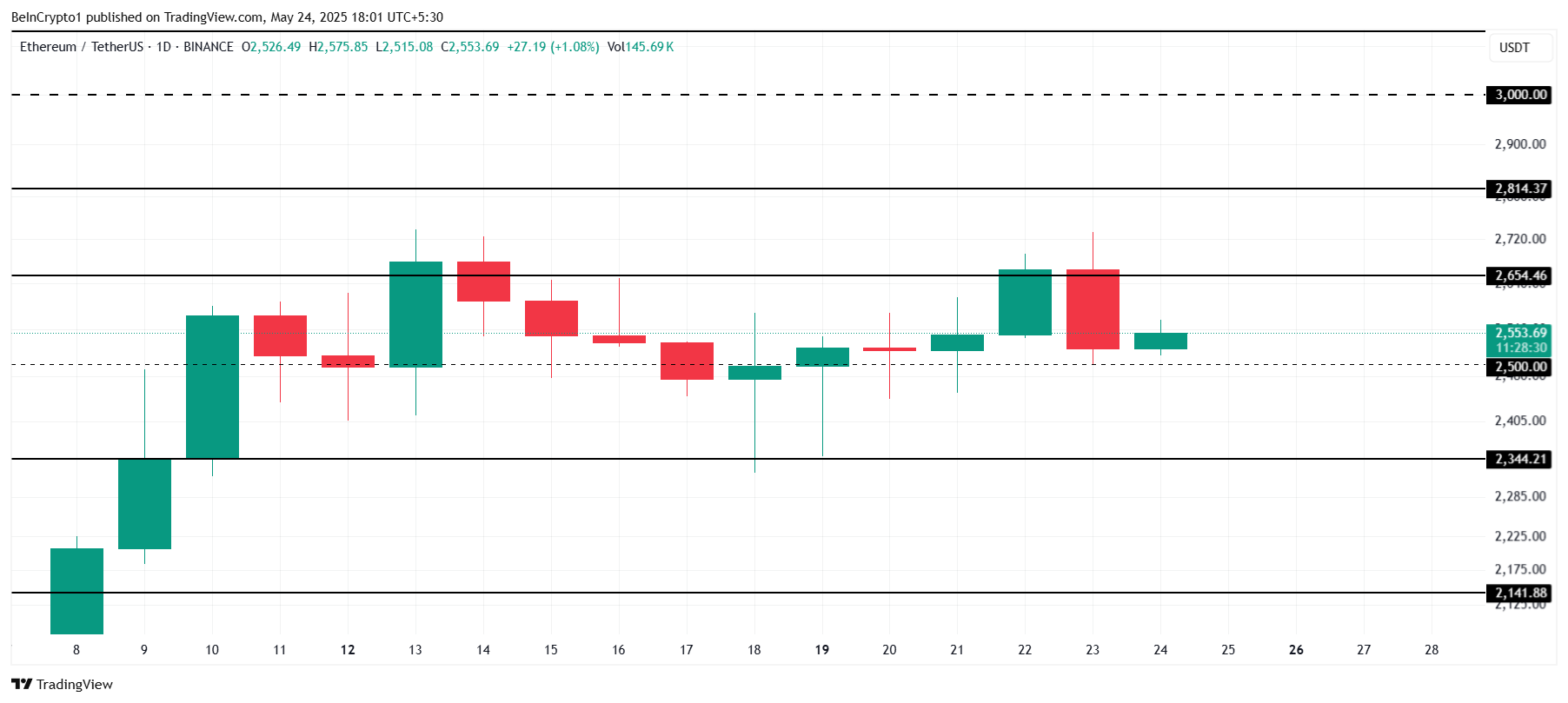

Ethereum is currently trading NEAR $2,553, maintaining a critical support level of around $2,500. The altcoin king has hovered above this threshold for some time, but its ability to hold this level is being tested.

If bearish pressures continue, Ethereum could break below $2,500 and move lower toward the next support at $2,344. However, if buying interest returns, ETH may consolidate between $2,500 and the resistance level of $2,654 for a period.

For the short-term bearish outlook to change, Ethereum must breach the resistance near $2,654. A sustained move beyond this point could push the price up toward $2,814, reigniting investor Optimism and supporting further gains.