Celestia’s TIA Token Tumbles Another 10%—When Will the Bleeding Stop?

Another brutal week for Celestia as its native token extends a three-month freefall. TIA’s latest 10% nosedive leaves traders scrambling—is this a buying opportunity or a sinking ship?

Subheader: The Bearish Streak No One Wanted

Three months of red candles, zero signs of reversal. Even crypto’s usual ‘buy the dip’ crowd is staying sidelined. Meanwhile, Wall Street analysts nod sagely and mutter ‘told you so’—classic.

Subheader: What’s Next for TIA?

Technical charts scream oversold, but fundamentals? Radio silence. Until Celestia shows real adoption—not just hype—this could be another ‘hold my bag’ moment for retail investors.

Closing thought: Another day, another crypto asset proving that gravity still works—especially when VCs start dumping.

Celestia Finds Support From Investors

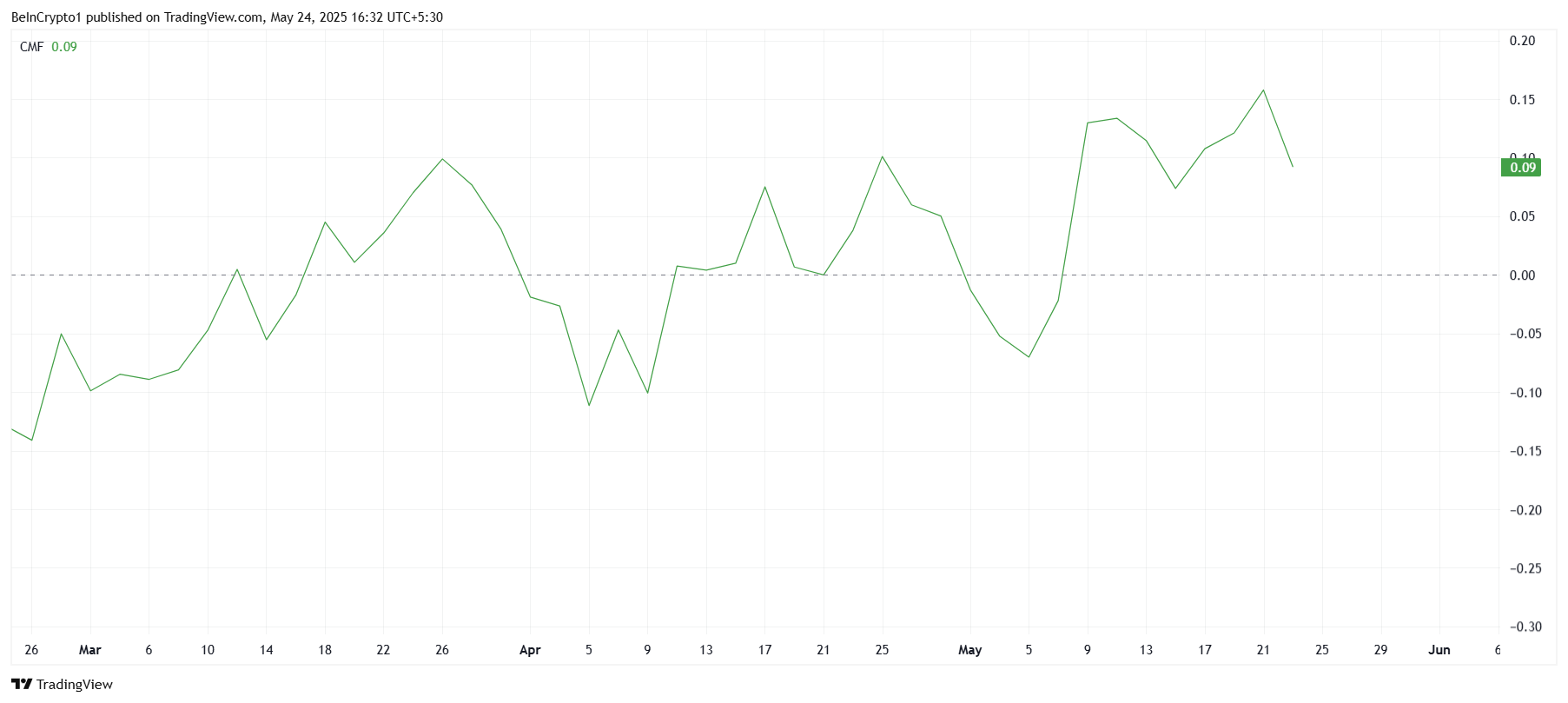

The Chaikin Money FLOW (CMF) indicator has shown a modest increase recently but remains just below zero. This implies that while capital inflows are present, overall investor confidence is tentative.

Buyers seem to be attracted by TIA’s relatively low price, yet the momentum isn’t strong enough to decisively break the downtrend.

The CMF’s failure to climb above zero signals lingering caution and suggests that traders are only cautiously entering positions. This tentative interest may result in heightened volatility unless broader market support emerges.

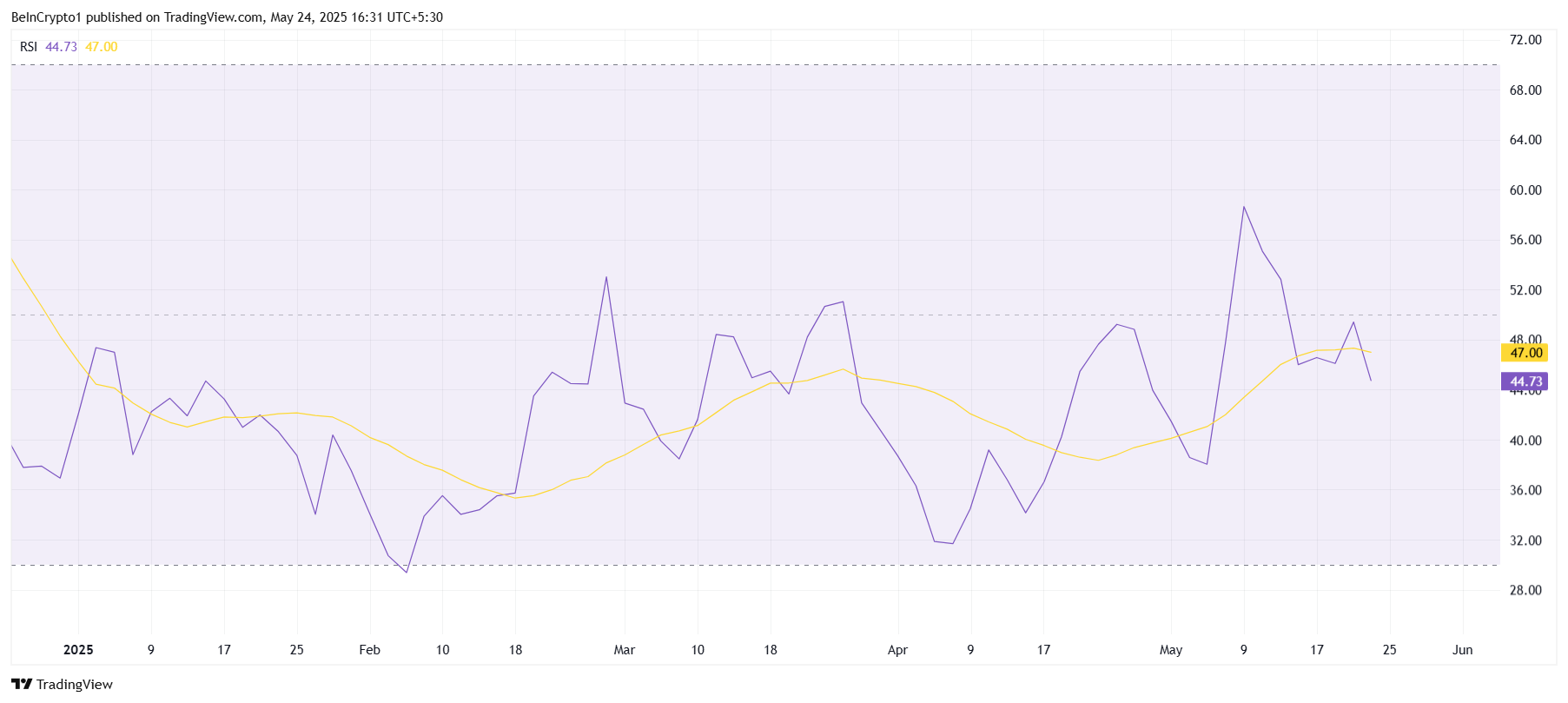

The Relative Strength Index (RSI) spiked briefly into bullish territory but has since retreated below the neutral 50 level. This pattern points to fragile bullish momentum, likely hampered by selling pressure or external market uncertainties.

The drop below 50 reinforces the notion that TIA’s price recovery is precarious. Without renewed buying strength, it faces difficulty overcoming resistance and may continue to languish in subdued trading ranges.

TIA Price Aims To Jump

Currently trading around $2.54, TIA is testing a critical support level at $2.53. This level is pivotal for stabilizing price action and preventing further losses, especially after failing to surpass the $3.00 resistance during its prolonged downtrend.

A significant upward breakout appears unlikely for now. However, if support at $2.53 holds, TIA might consolidate, potentially building momentum to retest the $3.00 resistance after breaching $2.73.

Conversely, a decisive break below $2.53 could intensify bearish pressure, pushing the price down toward $2.27. Such a move WOULD invalidate short-term bullish prospects and increase downside risks.