Trump’s EU Tariff Bombshell Triggers Crypto Bloodbath—Traders Scramble as Markets Nosedive

Digital asset markets got a brutal reality check this week as geopolitical tensions sent shockwaves through speculative portfolios. Former President Trump’s threat of sweeping EU tariffs ignited a risk-off stampede—with crypto taking the hardest hits.

Bitcoin shed 8% in 24 hours while altcoins got crushed even harder. The sell-off exposed crypto’s lingering sensitivity to macro shocks—despite all the ’decoupling’ talk from true believers.

Market makers quickly pulled liquidity, creating cascading liquidations. One hedge fund manager quipped: ’Turns out digital gold still tarnishes when traditional markets sneeze.’

The correction serves as a stark reminder: in global finance, even ’disruptive’ assets still dance to old-school political tunes. Especially when that music comes from Mar-a-Lago.

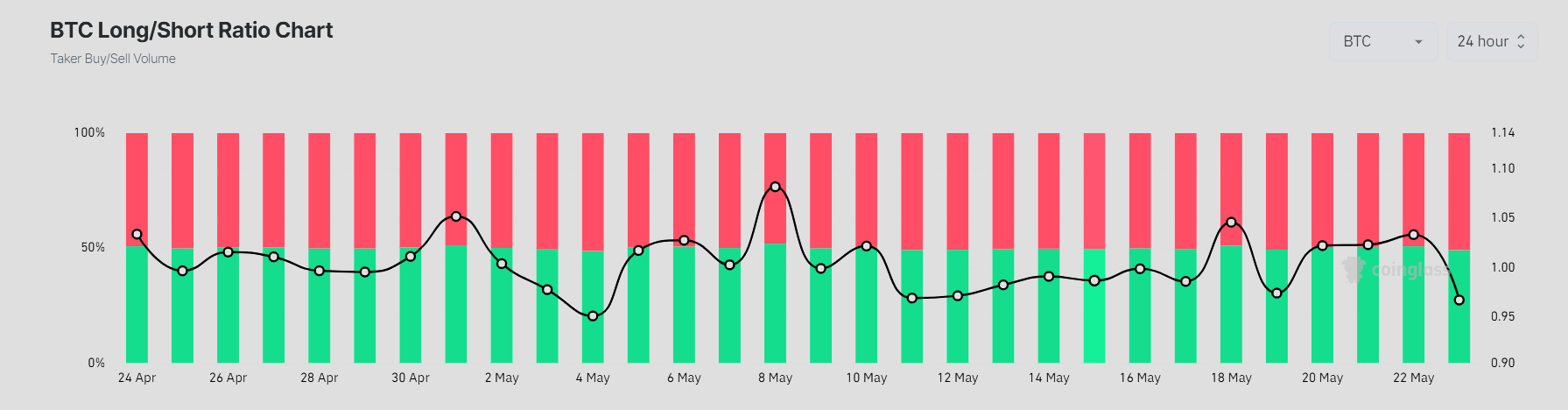

Long-Short Ratio Shows Market Confusion

Bitcoin dropped to $108,000 following the announcement, down from a session high of $111,000. It has since recovered to around $109,000 but remains under pressure. The overall crypto market is down 4% over the past 24 hours.

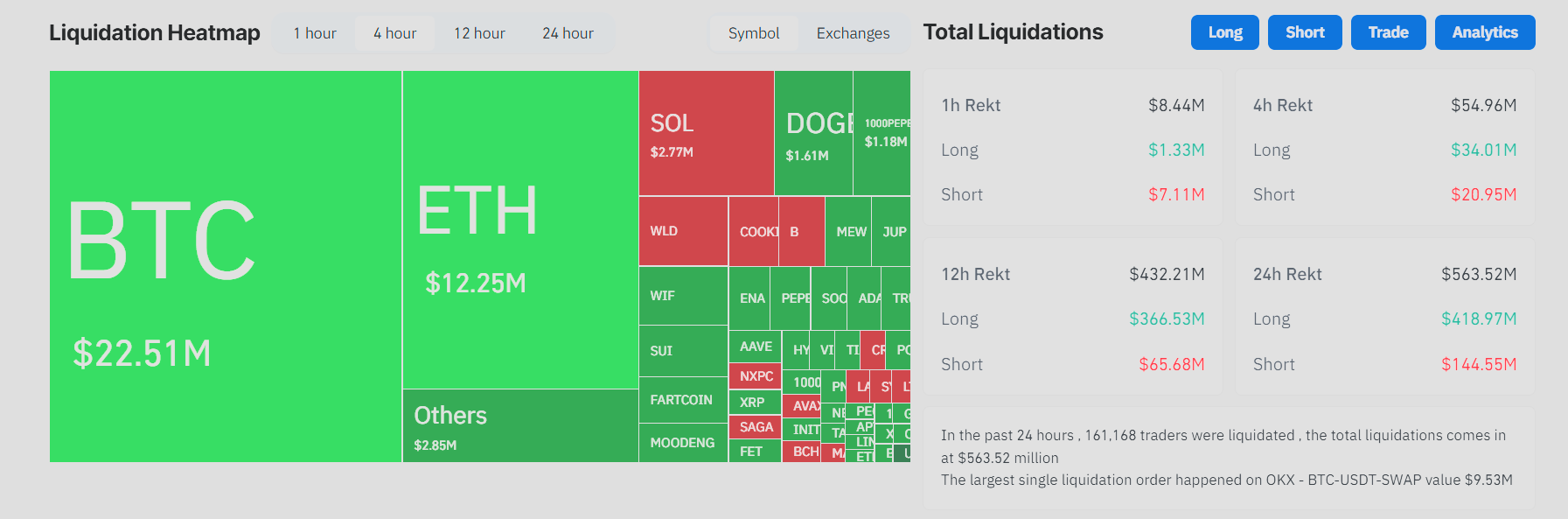

Data from Coinglass shows $64.13 million in crypto liquidations over the last four hours. Long positions accounted for $34.05 million, while short positions made up $30.09 million.

Bitcoin alone saw $24.4 million in liquidations, with ethereum at $15.16 million.

Meanwhile, Bitcoin’s long-short ratio remains almost equal, which shows a short-term uncertainty in the market’s direction. Yesterday, Bitcoin long positions dominated the charts at 54%.

Solana, XRP, and several altcoins also experienced sharp volatility, reflecting heightened volatility across the board.

Most altcoins saw a greater wipeout in long positions, suggesting retail traders were caught off guard by the sudden policy shift.

Rising concern over macro volatility

The US-China trade deal earlier this month provided a much-needed boost to the crypto market. It was an indication that the macroeconomic uncertainty might be priced in. However, Trump’s EU threats have injected renewed concerns.

Analysts warn that the tariff announcement could be the start of broader economic disruption. European stock indices fell sharply, and US tech shares also faced selling pressure.

The trade war is back:

After a brief pause, Trump just threatened 50% tariffs on the EU beginning June 1st and 25% tariffs on Apple.

In 5 days, the S&P 500 has erased -$1.5 trillion of market cap.

What’s next? Here’s why you NEED to watch the bond market.

(a thread) pic.twitter.com/8np3sevfA7

In crypto, the liquidation heatmap reflects a market caught between downward fear and upward retracement attempts.

The situation is fluid. If the tariff threat escalates into a full trade dispute, risk assets, including cryptocurrencies, may face additional headwinds. Traders are watching closely for any EU response or signs of negotiation.

In the past 24 hours, 162,419 traders were liquidated, totaling $567.65 million. While crypto has often acted as a hedge during traditional market stress, today’s moves show it is not immune to global policy shocks.

Volatility may persist as geopolitical uncertainty mounts.