Robinhood Fuels MOODENG and MEW Frenzy with Listing—Prices Surge 20% Overnight

Retail traders pile in as the platform adds two new meme-worthy tokens—because nothing says ’financial innovation’ like speculative assets named after internet jokes.

MOODENG and MEW join Robinhood’s crypto roster, triggering a classic pump-and-hold pattern. Will the rally last? History suggests traders should enjoy the ride—and watch their stop-losses.

MOODENG Jumps from Robinhood Listing

Robinhood, a popular broker-dealer app, has been substantially expanding its crypto revenue recently. In the past, its listings have shown mixed results, occasionally failing to move an asset despite a general pattern of success.

Today, Robinhood abruptly announced the listing of two meme coins, MOODENG and MEW, sparking dramatic gains.

Of Robinhood’s two newest Solana-based meme coins, MOODENG had the faster gains. Earlier this month, it had a 612% weekly rally, a wave that proved durable.

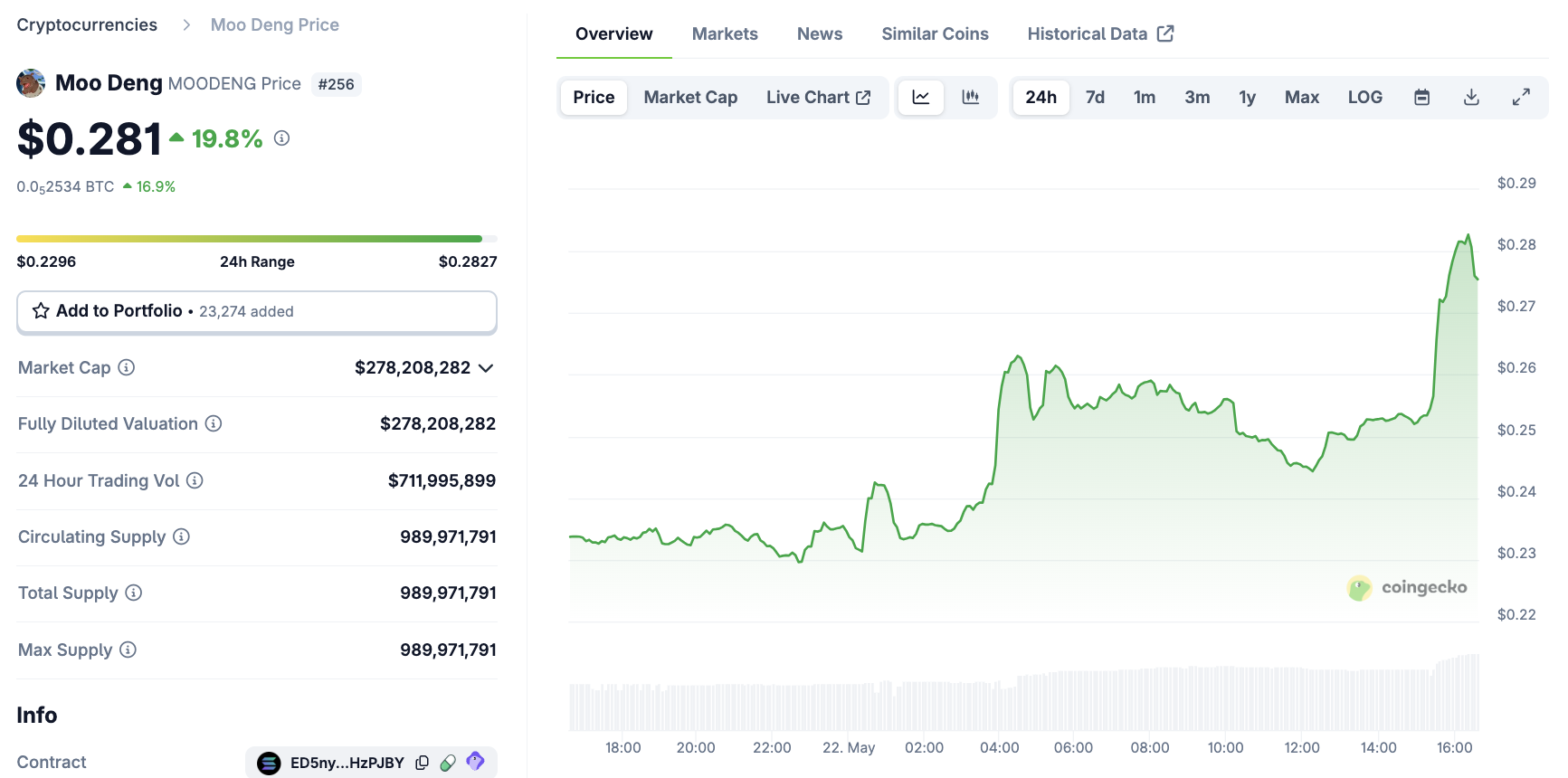

Throughout May, the meme coin has displayed remarkable growth, although it remains very far from its all-time high. After today’s listing, it spiked nearly 19%, although this growth quickly tapered off.

MEW, for its part, has been comparatively quiet since buyer exhaustion caused a price correction in late 2024. This meme coin ROSE approximately 17%, yet its value remains very far behind MOODENG.

Despite MOODENG’s massive gains, some prominent accounts alleged unspecified foul play in this Robinhood deal. Between one coin growing quickly and the other spending months in relative obscurity, Robinhood’s business decision didn’t make sense for some traders.

Nothing suspicious here

Moo Deng definitely didn’t pump 300% a week before this announcement because of this

People were definitely just a fan of the hippo this week

Absolutely nothing to see here pic.twitter.com/rzez0GKimb

MOODENG’s rise may have been dramatic, but there isn’t any concrete evidence of market manipulation on Robinhood’s part. As always, crypto investors should remain cautious of potential scams.

Robinhood is enjoying fresh success after the SEC closed its probe in February. There isn’t a good reason to alienate a loyal user base when things are looking up.